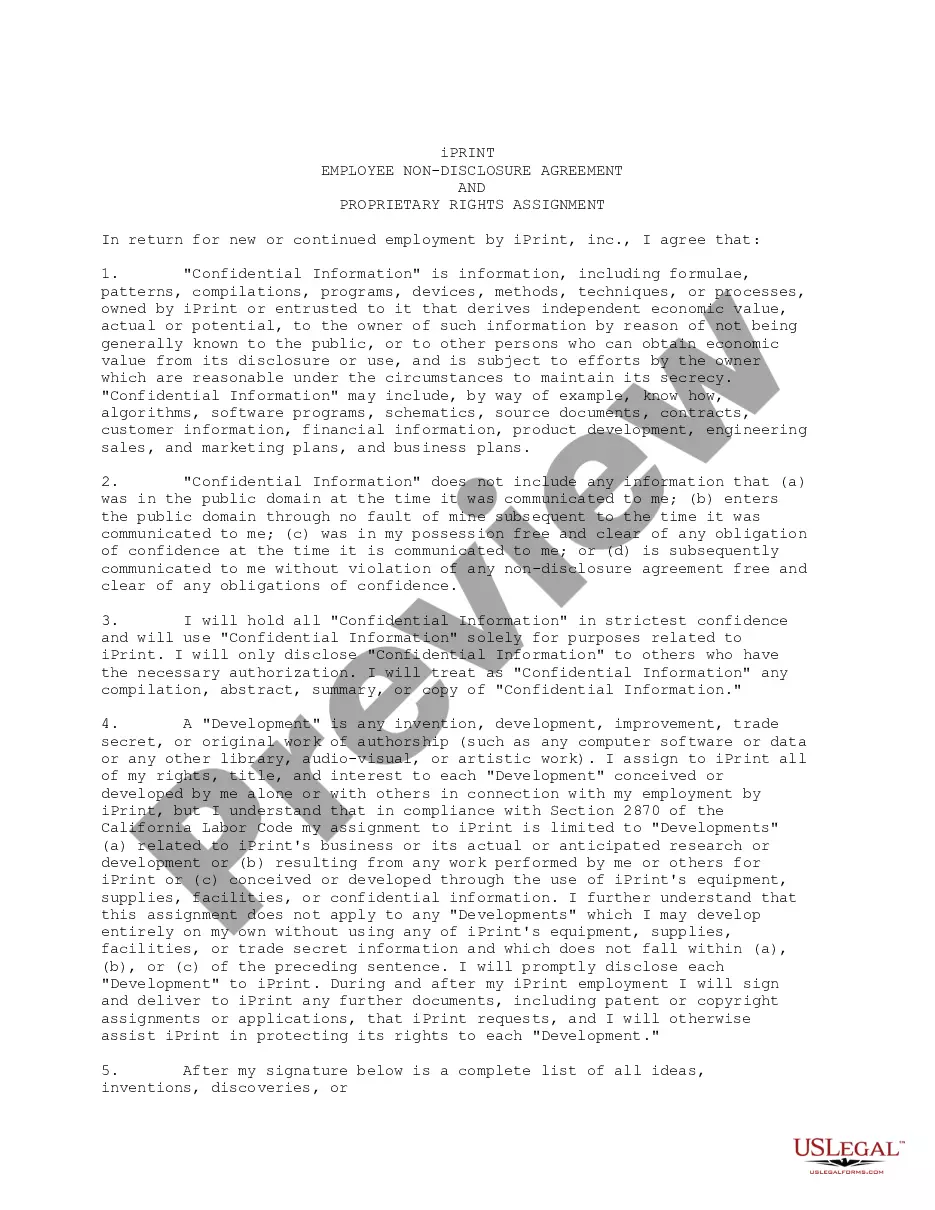

Colorado Approval of Savings Plan for Employees is a beneficial program offered to employees that allows them to save for their future financial needs. This plan has been established to help employees secure their retirement by taking advantage of tax incentives and employer contributions. One of the primary types of Colorado Approval of Savings Plan for Employees is the Colorado Employee Retirement Plan (CORP). This plan is designed to provide retirement benefits to all eligible state government employees. CORP offers various investment options and allows employees to contribute a portion of their salary toward their retirement fund. The contributions are often matched by the employer, providing a substantial boost to the employee's savings. Another type of Colorado Approval of Savings Plan for Employees is the Colorado ERA (Public Employees' Retirement Association) Defined Benefit Plan. This plan covers public employees, including teachers and state government workers. It offers a guaranteed retirement income based on years of service and final average salary. In addition to these major plans, there are various other Colorado Approval of Savings Plan for Employees offered by different employers in the private sector. These plans include 401(k) plans, 403(b) plans, and Simple IRA plans, which allow employees to contribute a portion of their salary into an investment account for retirement. Employers often match a percentage of the employee's contributions, further enhancing the savings potential. Colorado Approval of Savings Plan for Employees is an excellent tool for employees to secure their financial future. Taking advantage of these plans enables employees to save money on a tax-deferred basis while benefiting from employer contributions. It is essential for employees to carefully evaluate the different options available and choose a plan that aligns with their long-term financial goals. In summary, the Colorado Approval of Savings Plan for Employees encompasses various retirement benefit programs such as CORP, Colorado ERA Defined Benefit Plan, and employer-sponsored plans like 401(k), 403(b), and Simple IRA. These plans offer a structured approach to retirement savings, encouraging employees to save for a financially secure future.

Colorado Approval of savings plan for employees

Description

How to fill out Colorado Approval Of Savings Plan For Employees?

US Legal Forms - one of many most significant libraries of lawful kinds in America - gives an array of lawful file templates you can acquire or produce. Making use of the internet site, you can get a huge number of kinds for company and personal reasons, sorted by types, states, or keywords.You can get the newest types of kinds like the Colorado Approval of savings plan for employees in seconds.

If you already have a registration, log in and acquire Colorado Approval of savings plan for employees through the US Legal Forms catalogue. The Obtain key will appear on each and every kind you perspective. You gain access to all earlier delivered electronically kinds inside the My Forms tab of your respective accounts.

If you want to use US Legal Forms the first time, listed below are basic recommendations to get you started off:

- Ensure you have chosen the best kind to your metropolis/county. Click on the Preview key to examine the form`s content. Browse the kind information to actually have chosen the correct kind.

- If the kind doesn`t suit your specifications, make use of the Lookup area at the top of the display screen to discover the one which does.

- When you are satisfied with the shape, affirm your option by visiting the Acquire now key. Then, select the pricing program you prefer and give your references to register to have an accounts.

- Method the deal. Make use of your charge card or PayPal accounts to accomplish the deal.

- Pick the structure and acquire the shape on your own system.

- Make changes. Fill out, change and produce and indication the delivered electronically Colorado Approval of savings plan for employees.

Every web template you put into your account does not have an expiry particular date and is the one you have permanently. So, if you would like acquire or produce yet another backup, just visit the My Forms segment and click on about the kind you need.

Obtain access to the Colorado Approval of savings plan for employees with US Legal Forms, by far the most comprehensive catalogue of lawful file templates. Use a huge number of skilled and status-specific templates that meet up with your company or personal requires and specifications.

Form popularity

FAQ

Yes. Under Colorado law, Colorado employers will be required to offer their employees some sort of retirement savings. This can be a traditional pension, a 401(k) plan, a 403(b) plan, a SEP Plan, a SIMPLE IRA plan, a governmental deferred compensation plan ? or an account from Colorado SecureSavings.

As the name implies, it's an employee benefit designed to help you save for retirement. You choose how much of your paycheck to put into your plan account each pay period. And you decide how your money is invested by selecting from the investment options your employer offers.

Yes. Employees can opt out or re-enroll at any time. If they choose to opt out before the 30-day notification period, their account won't be activated. However, if they opt out after 30 days, the employer will receive a notification to stop payroll deductions, and the employee can withdraw any deductions already made.

Colorado SecureSavings was created by law to meet this urgent need. Once enrolled in Colorado SecureSavings, employees can contribute to a Roth Individual Retirement Account (IRA) directly from their paychecks and access tools to help them reach their financial goals.

Employers who sponsor a qualified retirement savings plan on their own are exempt from SecureSavings. They can certify their exemption online using the access code provided to them by the state.

Employers with one or more employees must participate in CalSavers if they do not already have a workplace retirement plan. The following deadlines to register are based on the size of the business. CalSavers deadlines by business size.

Only workers with a verifiable Individual Tax Identification Number (ITIN) or Social Security number (SSN) can participate in the program. If a worker's information cannot be verified, the worker will not be enrolled, and an account will not be established for him or her.