Colorado Proposal to approve adoption of stock purchase assistance plan

Description

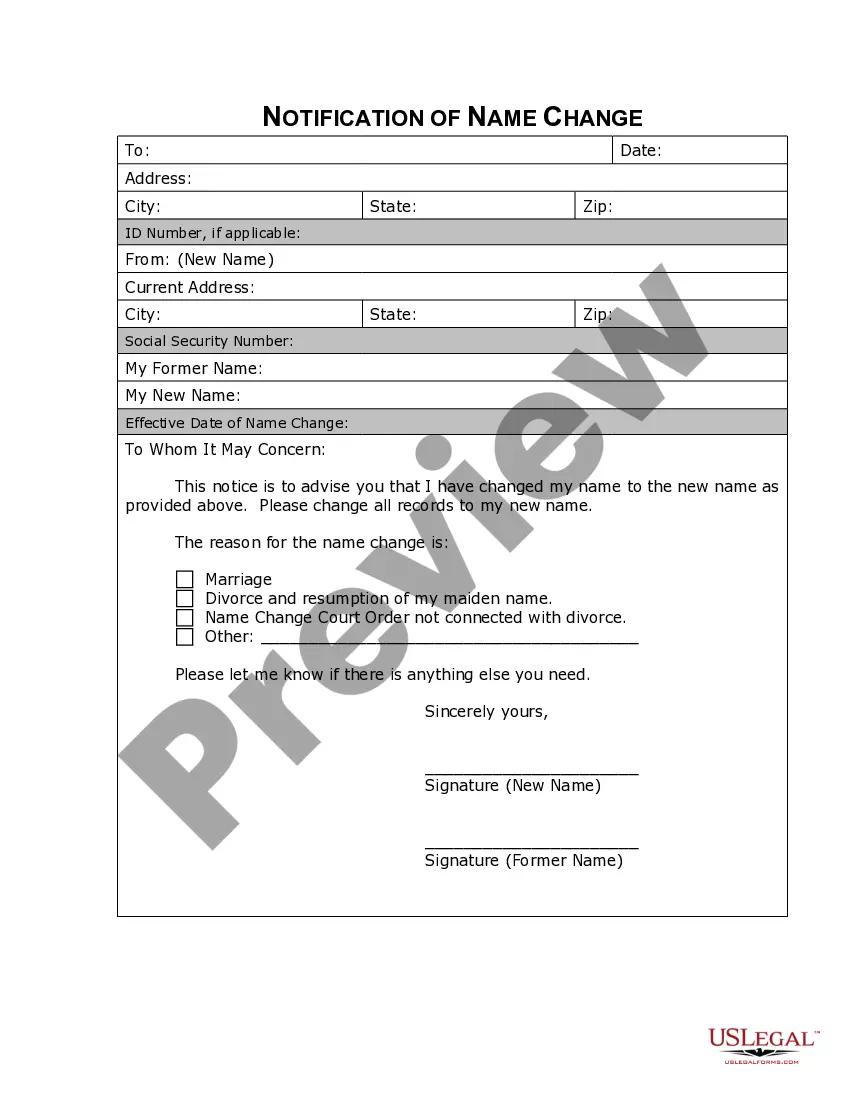

How to fill out Proposal To Approve Adoption Of Stock Purchase Assistance Plan?

Are you currently inside a place that you require documents for either enterprise or individual functions virtually every working day? There are a variety of legal papers layouts accessible on the Internet, but finding versions you can rely isn`t easy. US Legal Forms gives thousands of develop layouts, just like the Colorado Proposal to approve adoption of stock purchase assistance plan, which are written to meet state and federal specifications.

If you are already informed about US Legal Forms web site and also have an account, merely log in. Afterward, it is possible to download the Colorado Proposal to approve adoption of stock purchase assistance plan format.

Unless you have an account and wish to start using US Legal Forms, adopt these measures:

- Discover the develop you will need and ensure it is to the appropriate city/area.

- Take advantage of the Review switch to analyze the form.

- Read the description to actually have selected the correct develop.

- In case the develop isn`t what you`re looking for, utilize the Research field to get the develop that suits you and specifications.

- If you discover the appropriate develop, click Acquire now.

- Opt for the pricing prepare you need, complete the required information to create your money, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file formatting and download your backup.

Find all the papers layouts you might have bought in the My Forms food selection. You can obtain a more backup of Colorado Proposal to approve adoption of stock purchase assistance plan at any time, if possible. Just select the required develop to download or print the papers format.

Use US Legal Forms, by far the most extensive variety of legal forms, to save time as well as prevent errors. The service gives appropriately manufactured legal papers layouts that can be used for a selection of functions. Make an account on US Legal Forms and commence producing your way of life easier.

Form popularity

FAQ

The most common subsidy is a monthly cash benefit, usually $300 to $1,000 or more per month, per child. There is also a federal tax credit of thousands of dollars that is available as an incentive to adopt special needs children.

The most common subsidy is a monthly cash benefit, usually $300 to $1,000 or more per month, per child. There is also a federal tax credit of thousands of dollars that is available as an incentive to adopt special needs children. There are additional state and federal programs that may apply.