Colorado Amended and Restated Certificate of Incorporation of CMI Corporation

Description

How to fill out Amended And Restated Certificate Of Incorporation Of CMI Corporation?

If you have to full, download, or print out legitimate file layouts, use US Legal Forms, the largest variety of legitimate kinds, that can be found on the Internet. Utilize the site`s simple and practical lookup to get the documents you require. Different layouts for organization and personal purposes are sorted by classes and states, or keywords. Use US Legal Forms to get the Colorado Amended and Restated Certificate of Incorporation of CMI Corporation with a number of mouse clicks.

Should you be previously a US Legal Forms consumer, log in to your profile and click on the Download button to obtain the Colorado Amended and Restated Certificate of Incorporation of CMI Corporation. You may also gain access to kinds you in the past saved from the My Forms tab of your own profile.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for your correct town/land.

- Step 2. Use the Review choice to examine the form`s articles. Never neglect to read the description.

- Step 3. Should you be unsatisfied with all the develop, use the Lookup industry on top of the display screen to discover other versions in the legitimate develop format.

- Step 4. After you have identified the form you require, go through the Acquire now button. Select the pricing strategy you favor and add your references to sign up for the profile.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal profile to finish the deal.

- Step 6. Pick the format in the legitimate develop and download it on your own system.

- Step 7. Complete, change and print out or indicator the Colorado Amended and Restated Certificate of Incorporation of CMI Corporation.

Every single legitimate file format you get is your own permanently. You have acces to each and every develop you saved with your acccount. Click on the My Forms segment and choose a develop to print out or download again.

Compete and download, and print out the Colorado Amended and Restated Certificate of Incorporation of CMI Corporation with US Legal Forms. There are millions of skilled and express-particular kinds you can utilize for your organization or personal needs.

Form popularity

FAQ

Converting a Single-Member LLC to a Multi-Member LLC If your LLC already has an employer identification number (EIN), you have to file Form 8832 with the IRS to elect partnership taxation and provide the names of the new members.

How do I amend my Colorado LLC operating agreement to add a member? Hold a meeting of all members. Draft a resolution (to add a member) Vote on the resolution. Pass the resolution (if a majority vote in favor) Keep the member resolution with your records.

The process of adding a member to a Colorado LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

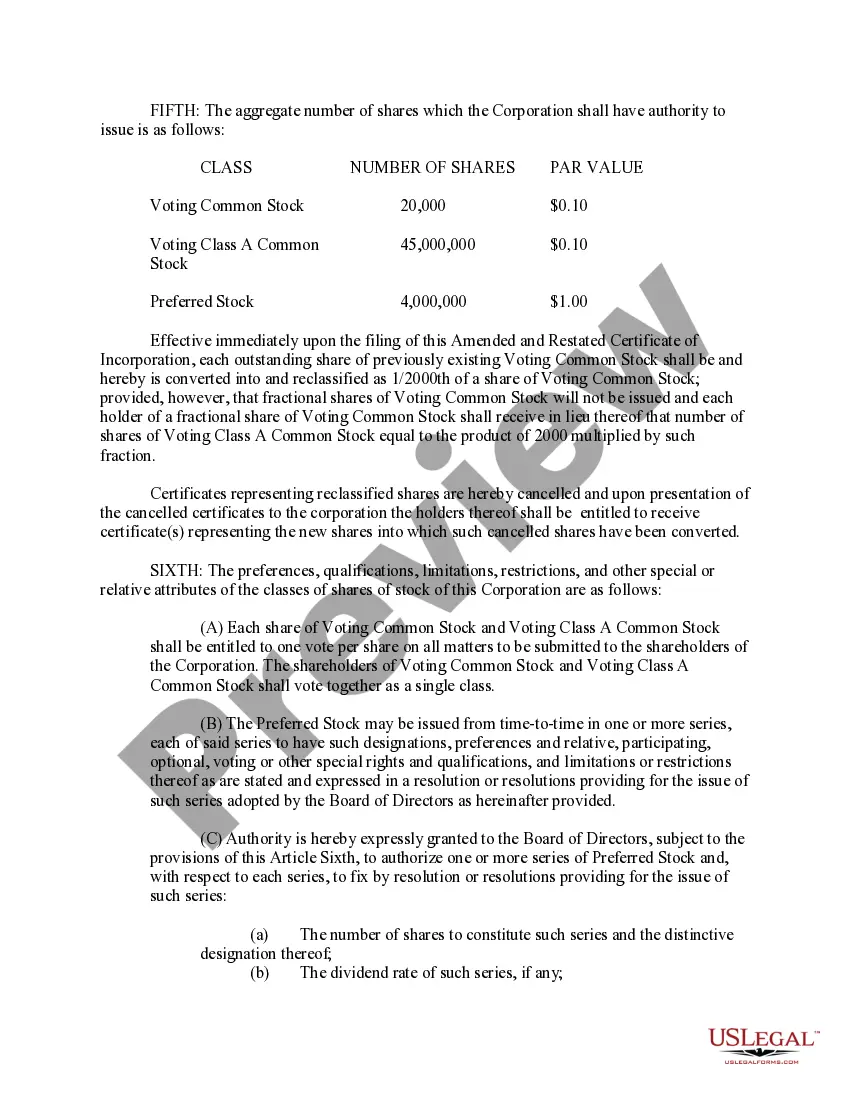

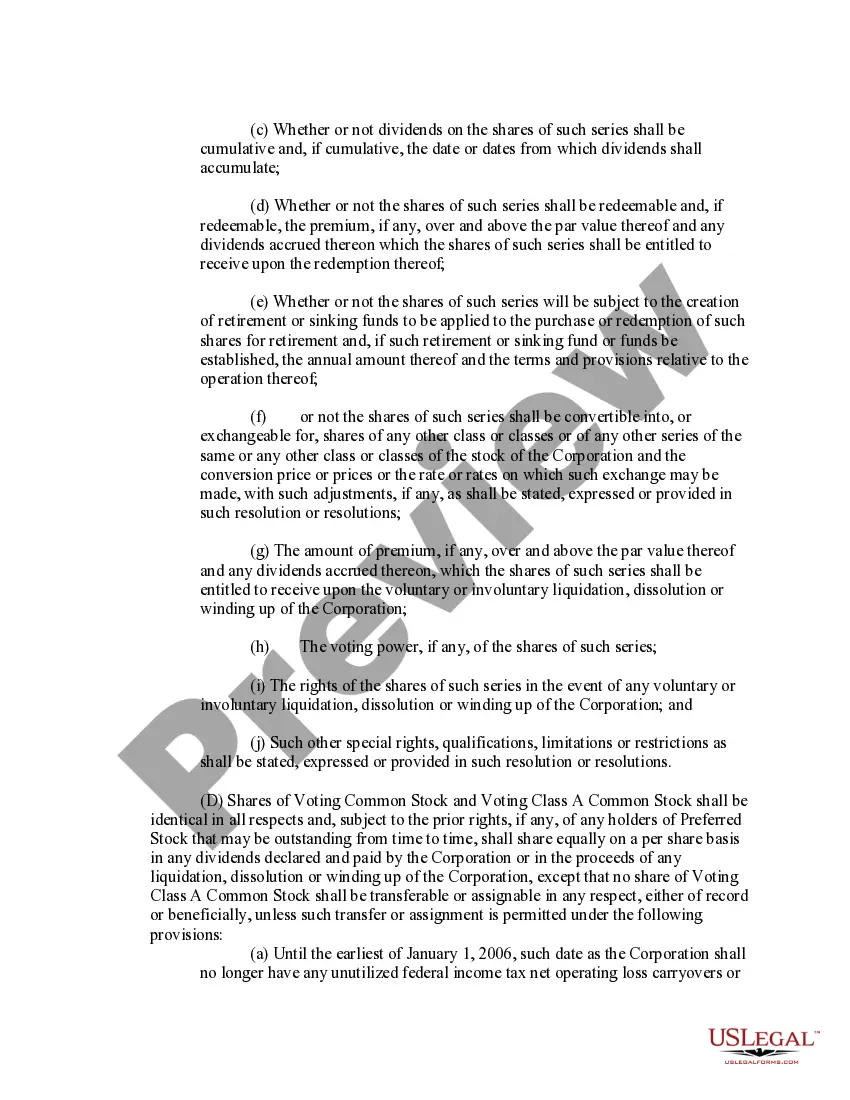

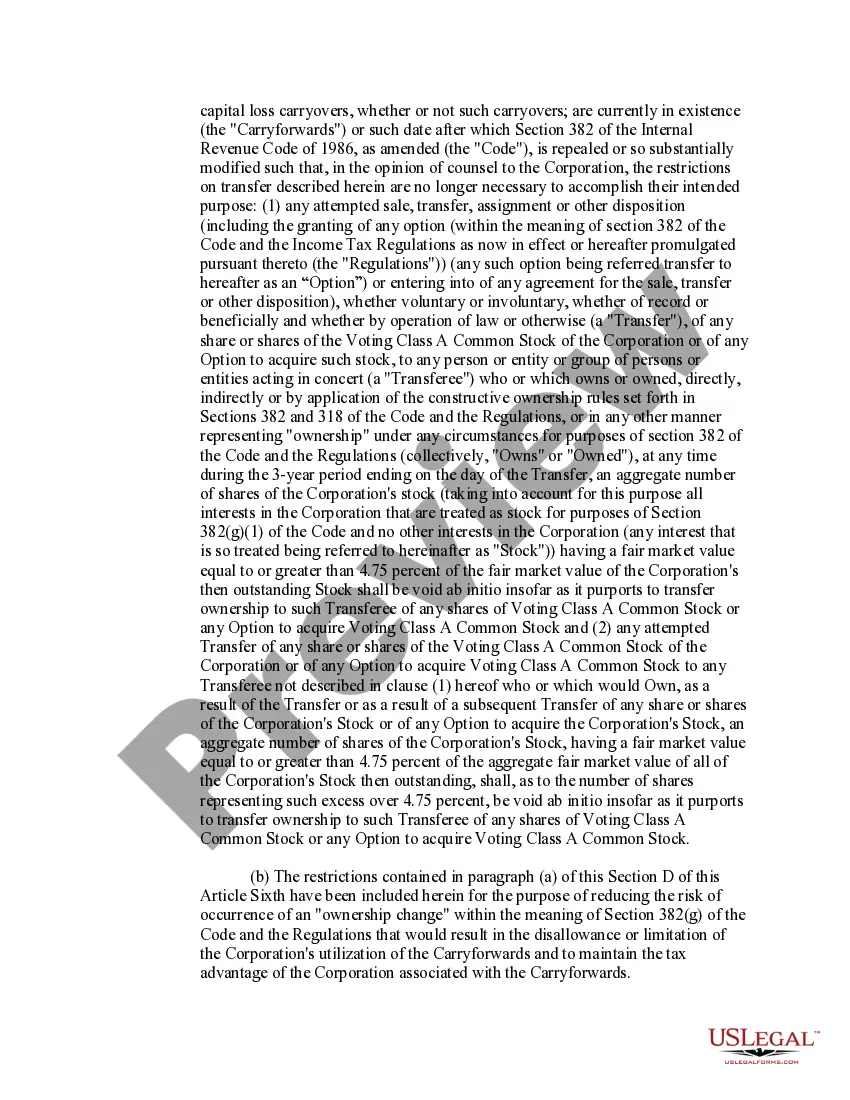

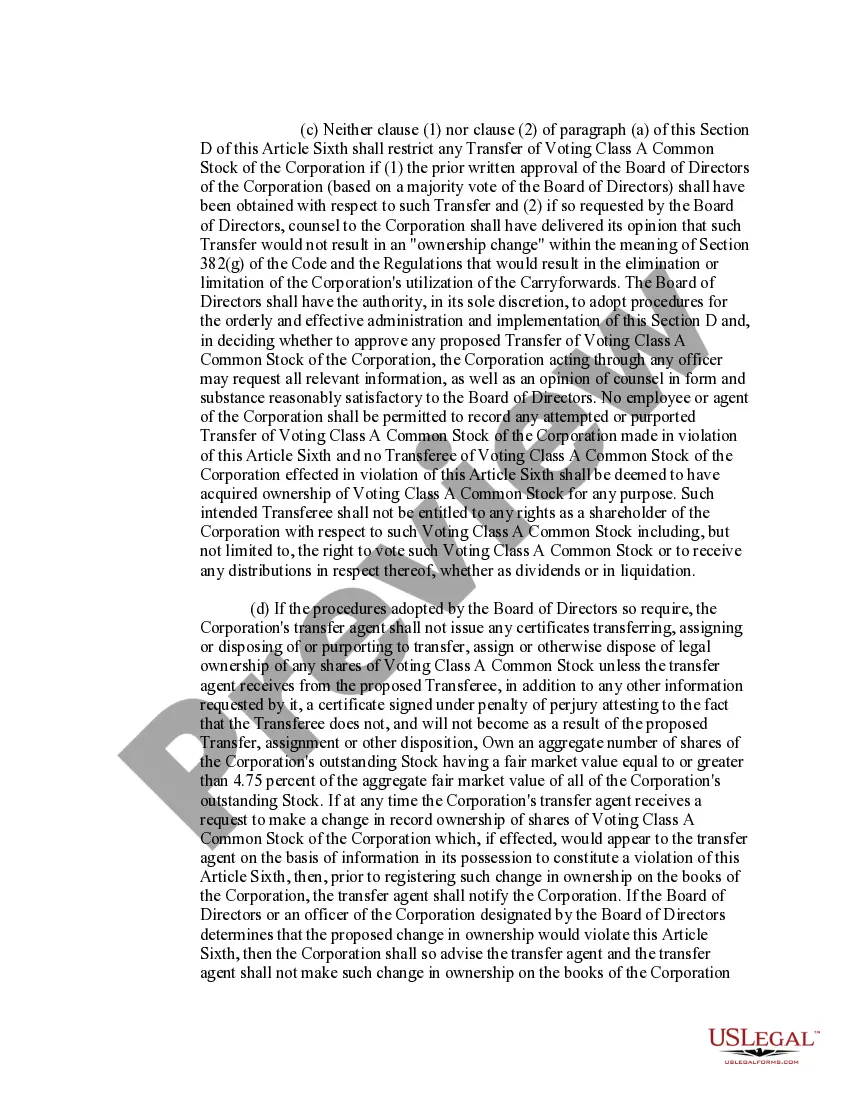

An Amended and Restated Certificate of Incorporation is a legal document filed with the Secretary of State that restates, integrates, and adjusts the startup's initial Articles of Incorporation (i.e. the company's Charter).

Colorado LLCs have to file a completed Articles of Amendment form with the Secretary of State. You can do this online. All you have to do is input the name of your company and confirm that you are authorized to make changes to your LLC's records. You also need to include $25 for the filing fee.

To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail. The member in question of removal may need to get compensated for his share of membership interests.