Colorado Proxy Statement and Prospectus of USX Corporation

Description

How to fill out Proxy Statement And Prospectus Of USX Corporation?

Are you currently inside a position the place you need to have files for both business or individual purposes virtually every working day? There are a lot of lawful papers web templates available on the net, but discovering versions you can depend on is not straightforward. US Legal Forms delivers a huge number of kind web templates, like the Colorado Proxy Statement and Prospectus of USX Corporation, which are published to fulfill state and federal specifications.

If you are currently informed about US Legal Forms site and possess a free account, basically log in. Following that, you are able to download the Colorado Proxy Statement and Prospectus of USX Corporation design.

If you do not provide an account and need to begin using US Legal Forms, abide by these steps:

- Obtain the kind you will need and make sure it is for the right metropolis/county.

- Use the Preview switch to examine the form.

- Read the description to actually have chosen the proper kind.

- If the kind is not what you`re looking for, utilize the Research area to discover the kind that fits your needs and specifications.

- Once you find the right kind, click Acquire now.

- Select the rates program you want, fill out the required information to generate your bank account, and purchase the transaction with your PayPal or credit card.

- Select a practical document file format and download your duplicate.

Get all the papers web templates you have bought in the My Forms menus. You can get a extra duplicate of Colorado Proxy Statement and Prospectus of USX Corporation whenever, if possible. Just click the essential kind to download or print the papers design.

Use US Legal Forms, one of the most substantial variety of lawful forms, to conserve time as well as stay away from faults. The assistance delivers appropriately created lawful papers web templates which you can use for a variety of purposes. Make a free account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

Rule 14a-4(f)61 forbids any person conducting a proxy solicitation to deliver a form of proxy, often referred to as a "proxy card," to a security holder unless it is accompanied or preceded by a proxy statement.

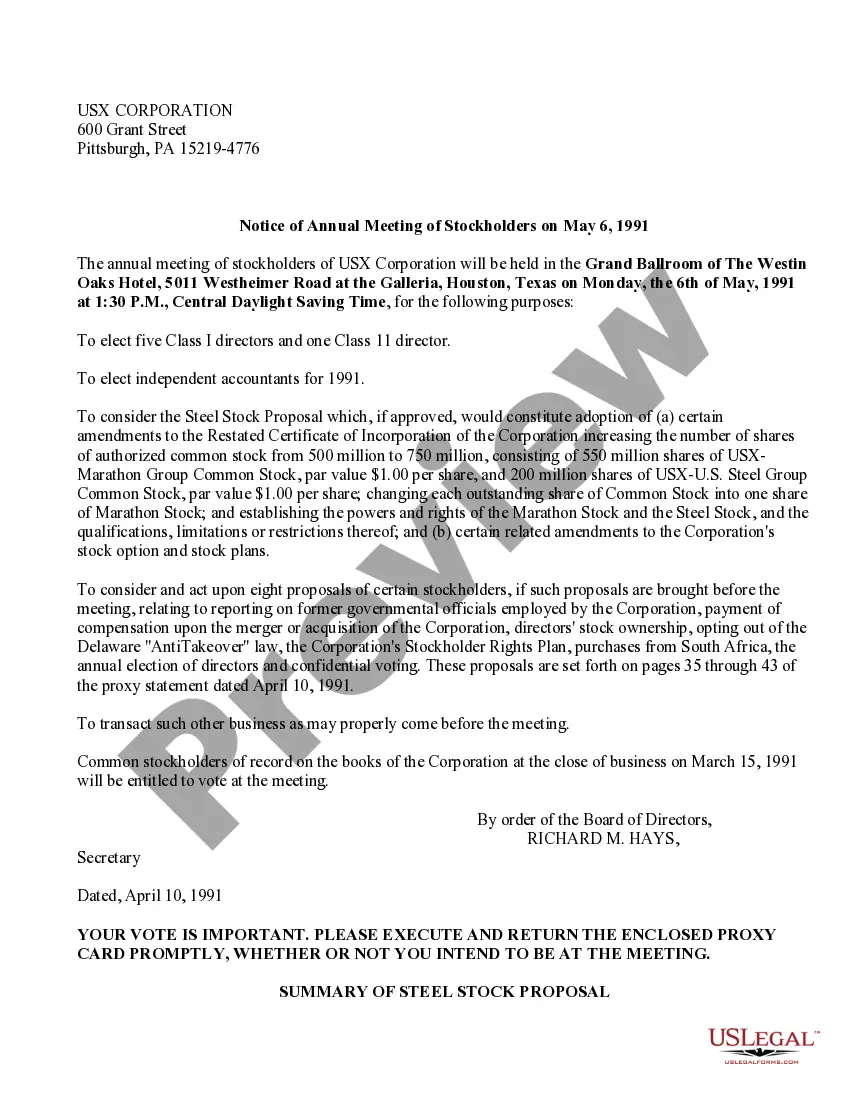

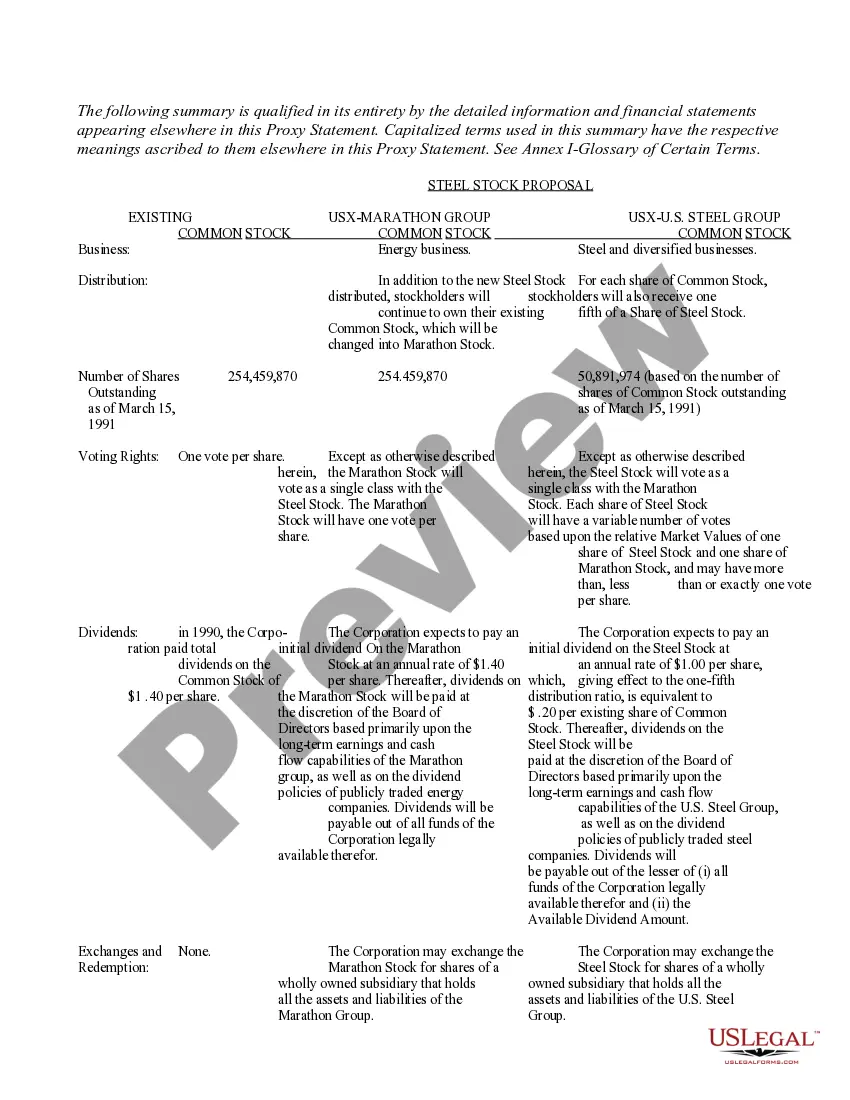

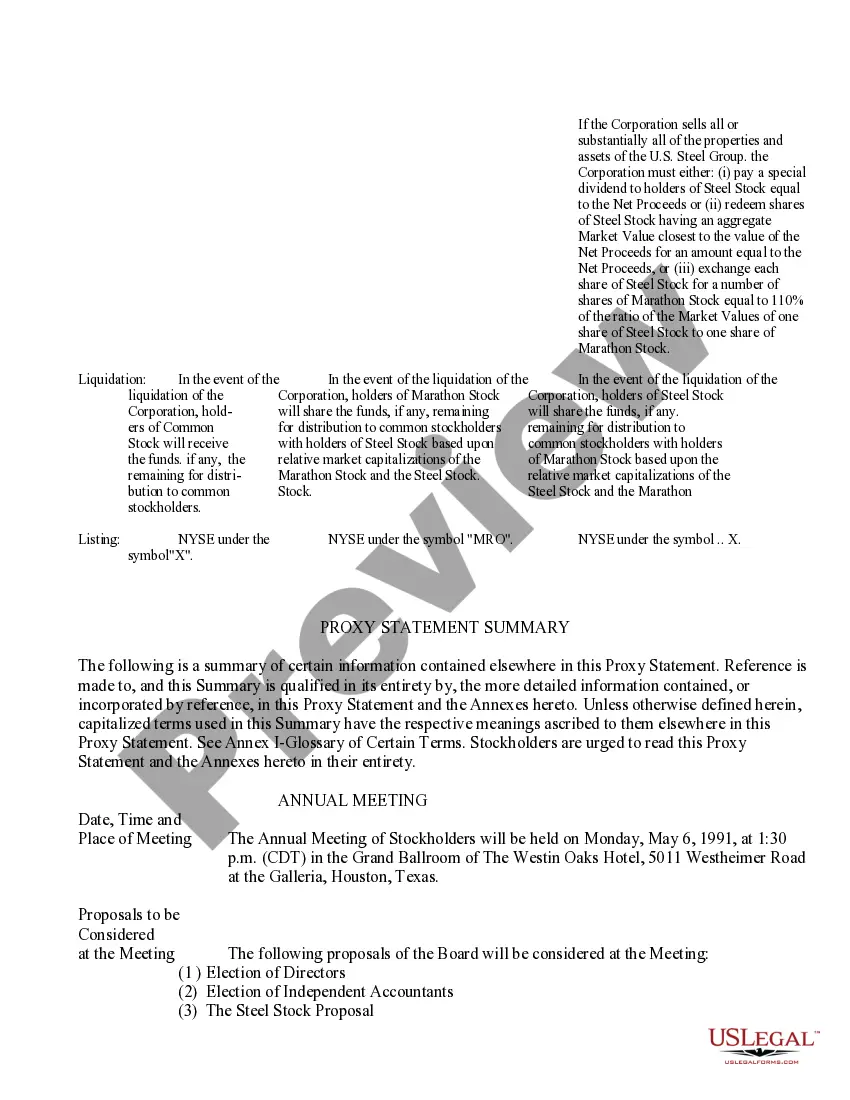

A proxy statement is a document filed by public-traded companies before annual or special shareholder meetings to give shareholders the necessary information to make informed votes on board business.

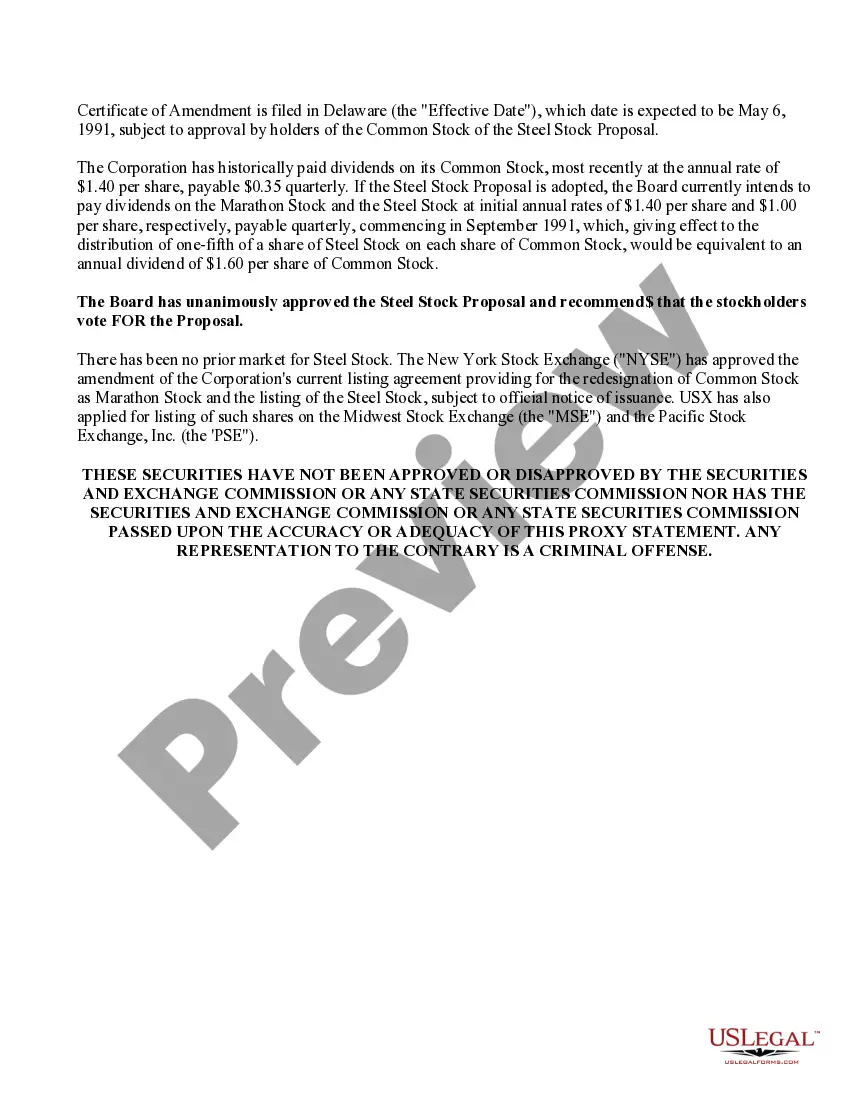

SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934.

"In the annual proxy statement, a company must disclose information concerning the amount and type of compensation paid to its chief executive officer, chief financial officer and the three other most highly compensated executive officers A company also must disclose the criteria used in reaching executive compensation ...

SEC Proxy Filing Requirements Companies should file the proxy card together with the proxy statement and separately file the Notice of Internet Availability of Proxy Materials as additional proxy soliciting materials. Submit annual report on EDGAR.

Proxy Statement Details Description of the merger agreement. Background and reasons for the merger. The recommendation of the board of directors with respect to the merger. Fairness opinion of the financial advisor, which summarizes whether the price being paid or received in the merger is fair.

State laws require public companies to hold a meeting of shareholders every year, and the Securities and Exchange Commission (SEC) requires publicly traded companies to file proxy statements ahead of annual shareholders' meetings and special meetings.

Proxy materials (also known as the proxy statement) are documents provided by public corporations in order that shareholders can understand how to vote at shareholder meetings, and make informed decisions about how to delegate their votes to a proxy.