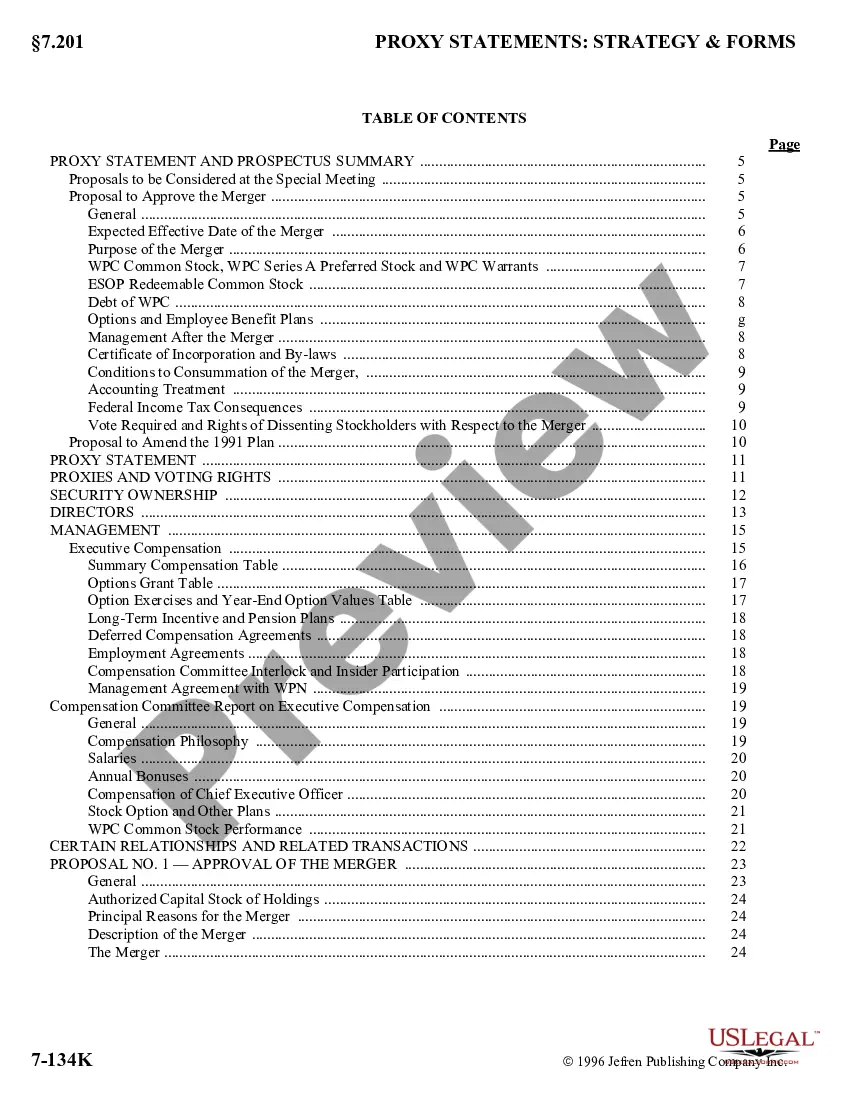

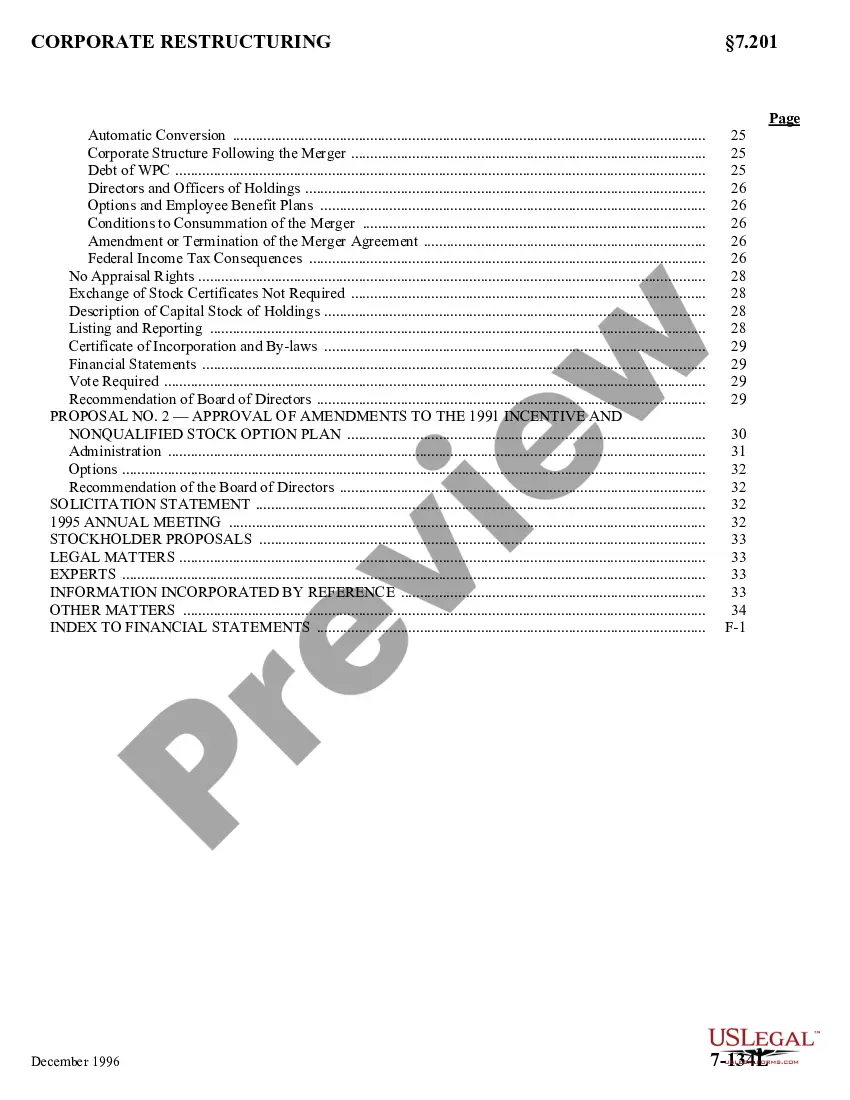

Colorado Proxy Statement and Prospectus with exhibits for WHX Corp.

Description

How to fill out Proxy Statement And Prospectus With Exhibits For WHX Corp.?

It is possible to devote time on the web searching for the authorized record web template that suits the state and federal specifications you need. US Legal Forms gives thousands of authorized kinds that are examined by pros. It is simple to download or produce the Colorado Proxy Statement and Prospectus with exhibits for WHX Corp. from the service.

If you currently have a US Legal Forms profile, you are able to log in and click the Down load option. Following that, you are able to comprehensive, edit, produce, or indicator the Colorado Proxy Statement and Prospectus with exhibits for WHX Corp.. Each and every authorized record web template you acquire is your own permanently. To have one more copy for any obtained kind, proceed to the My Forms tab and click the related option.

Should you use the US Legal Forms internet site the very first time, adhere to the basic recommendations beneath:

- Initially, make certain you have selected the proper record web template for your state/town that you pick. Browse the kind explanation to make sure you have chosen the proper kind. If readily available, take advantage of the Preview option to look throughout the record web template at the same time.

- If you want to locate one more model of the kind, take advantage of the Look for industry to get the web template that meets your requirements and specifications.

- Once you have located the web template you desire, simply click Buy now to carry on.

- Pick the pricing strategy you desire, enter your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can use your charge card or PayPal profile to pay for the authorized kind.

- Pick the format of the record and download it in your system.

- Make alterations in your record if possible. It is possible to comprehensive, edit and indicator and produce Colorado Proxy Statement and Prospectus with exhibits for WHX Corp..

Down load and produce thousands of record themes utilizing the US Legal Forms site, that provides the biggest selection of authorized kinds. Use professional and status-particular themes to tackle your organization or personal requirements.

Form popularity

FAQ

Proxy statements are documents that the Securities and Exchange Commission requires companies to give to shareholders so they can weigh in on important company issues. Proxy statements offer shareholders information about changes on the board and other important decisions the board needs to make.

Proxy statements are documents that the Securities and Exchange Commission requires companies to give to shareholders so they can weigh in on important company issues. Proxy statements offer shareholders information about changes on the board and other important decisions the board needs to make.

Proxy materials are filed to shareholders before annual meetings to disclose important information and give them a chance to vote on basic issues.

Proxy | Business English a written document that officially gives someone the authority to do something for another person, for example by voting at a meeting for them: A creditor may give a proxy to any person of full age requiring him or her to vote for or against any specified resolution.

NetNut is a proxy service provider that offers a variety of proxy types, including residential and datacenter proxies. They have a large network of IP addresses in over 195 countries, and they offer a variety of features that make them a good choice for a variety of use cases.

State laws require public companies to hold a meeting of shareholders every year, and the Securities and Exchange Commission (SEC) requires publicly traded companies to file proxy statements ahead of annual shareholders' meetings and special meetings.