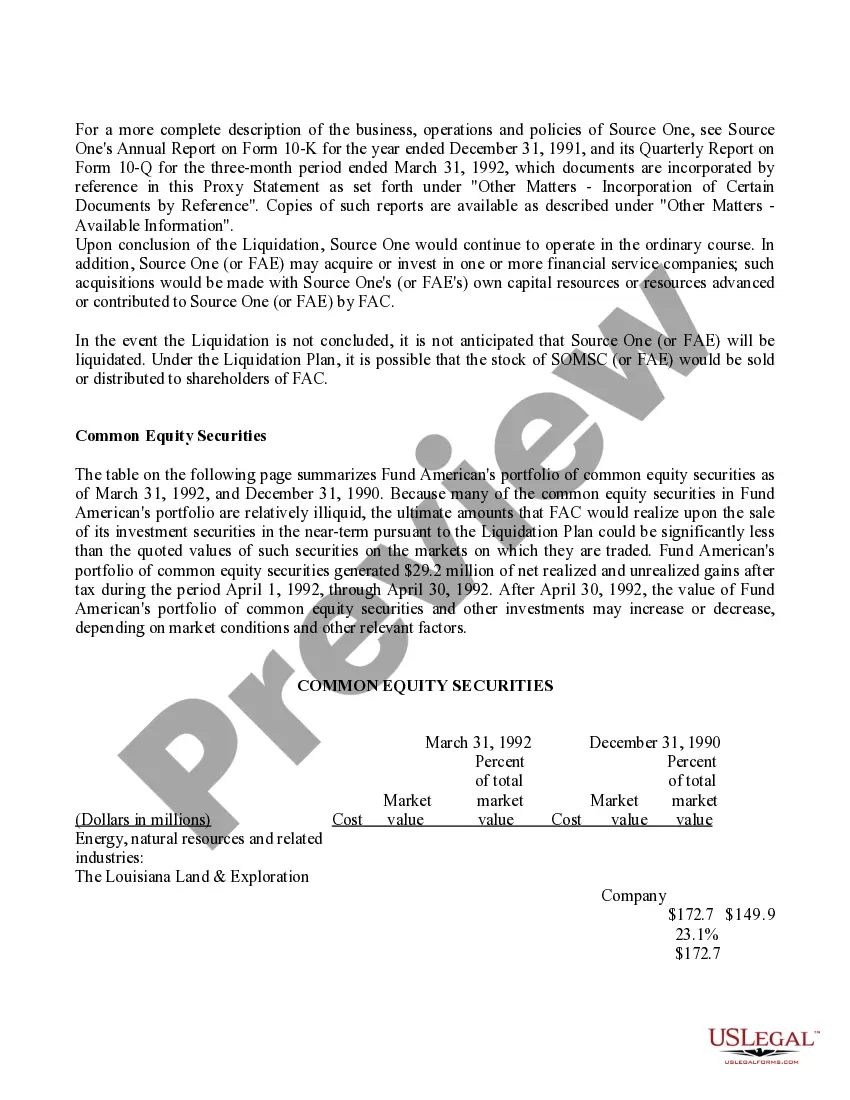

Colorado Proposal — Conclusion of the Liquidation with Exhibit Description: The Colorado Proposal — Conclusion of the Liquidation with exhibit is a comprehensive document that outlines the final stages of the liquidation process in the state of Colorado. This proposal serves as a legally binding agreement between the liquidator and the concerned parties involved in the liquidation. The main purpose of this proposal is to provide all the necessary details and final actions required to conclude the liquidation process successfully. It encompasses various crucial aspects, including the distribution of remaining assets, resolution of pending claims, and the overall termination of the business entity. Keywords: Colorado, proposal, conclusion, liquidation, exhibit, agreement, liquidator, concerned parties, process, distribution, remaining assets, pending claims, termination, business entity. Types of Colorado Proposal — Conclusion of the Liquidation with Exhibit: 1. Corporate Liquidation Proposal — Conclusion with Exhibit: This specific type of proposal is tailor-made for corporations undergoing liquidation in Colorado. It includes detailed provisions for the distribution of corporate assets, resolution of outstanding claims, and the final termination of the corporate entity. 2. Limited Liability Company (LLC) Liquidation Proposal — Conclusion with Exhibit: Designed specifically for LCS going through liquidation in Colorado, this proposal outlines the process of distributing remaining assets among the LLC members, resolving pending claims, and officially dissolving the LLC. 3. Partnership Liquidation Proposal — Conclusion with Exhibit: Geared towards partnerships undergoing liquidation in Colorado, this proposal encompasses specific clauses pertaining to the distribution of partnership assets, the settlement of outstanding obligations, and the dissolution of the partnership. 4. Sole Proprietorship Liquidation Proposal — Conclusion with Exhibit: This type of proposal is tailored for sole proprietors liquidating their business in Colorado. It details the process of asset distribution, settlement of debts and obligations, and the official closure of the sole proprietorship. 5. Non-Profit Organization Liquidation Proposal — Conclusion with Exhibit: Specifically designed for non-profit organizations in Colorado, this proposal provides an outline of the final steps involved in the liquidation process. It includes provisions for the distribution of any remaining funds or assets, the resolution of any pending obligations or legal matters, and the official dissolution of the organization. In conclusion, the Colorado Proposal — Conclusion of the Liquidation with exhibit is a crucial document that ensures the orderly and legal conclusion of the liquidation process. It covers different types of entities such as corporations, LCS, partnerships, sole proprietorship, and non-profit organizations, each having specific requirements and considerations during the liquidation process.

Colorado Proposal - Conclusion of the Liquidation with exhibit

Description

How to fill out Colorado Proposal - Conclusion Of The Liquidation With Exhibit?

If you want to full, acquire, or print out legitimate record themes, use US Legal Forms, the largest collection of legitimate types, that can be found on-line. Make use of the site`s easy and convenient lookup to discover the paperwork you require. Numerous themes for business and person reasons are categorized by types and claims, or keywords and phrases. Use US Legal Forms to discover the Colorado Proposal - Conclusion of the Liquidation with exhibit in just a handful of clicks.

Should you be presently a US Legal Forms buyer, log in in your account and then click the Obtain button to get the Colorado Proposal - Conclusion of the Liquidation with exhibit. You can even access types you earlier saved within the My Forms tab of your own account.

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the form for your right area/region.

- Step 2. Make use of the Review solution to look through the form`s content. Don`t overlook to learn the information.

- Step 3. Should you be not happy with the develop, utilize the Look for industry on top of the display to locate other variations of the legitimate develop design.

- Step 4. Once you have found the form you require, click on the Acquire now button. Choose the costs strategy you prefer and add your credentials to register on an account.

- Step 5. Process the transaction. You can utilize your bank card or PayPal account to perform the transaction.

- Step 6. Pick the file format of the legitimate develop and acquire it in your gadget.

- Step 7. Full, edit and print out or signal the Colorado Proposal - Conclusion of the Liquidation with exhibit.

Each legitimate record design you acquire is your own property eternally. You have acces to each and every develop you saved inside your acccount. Click on the My Forms portion and select a develop to print out or acquire once again.

Be competitive and acquire, and print out the Colorado Proposal - Conclusion of the Liquidation with exhibit with US Legal Forms. There are many specialist and condition-certain types you can use for your personal business or person demands.