Title: Understanding Colorado Complaints Regarding Action by Bank to Recover on Note After Application of Security Proceeds Introduction: In Colorado, complaints may arise when a bank or financial institution seeks to recover on a note even after applying security proceeds. This article aims to provide a detailed description of such complaints and their variations, highlighting the relevant keywords associated with each type. 1. Colorado Complaint — Bank's Failure to Adequately Apply Security Proceeds: This type of complaint revolves around a bank's alleged failure to appropriately apply the security proceeds towards the outstanding note balance. Keyword: Security proceeds, inadequate application, outstanding balance, bank's responsibility. 2. Colorado Complaint — Discrepancies in Security Proceeds Application: Here, the complainant argues that the bank has applied the security proceeds unfairly or erroneously, leading to an imbalance in the outstanding note amount. Keyword: Unfair application, erroneous application, discrepancy, imbalance. 3. Colorado Complaint — Incomplete Satisfaction of Note After Security Proceeds Application: This complaint centers on the contention that the bank did not fully satisfy the note's outstanding balance despite the application of security proceeds. Keyword: Incomplete satisfaction, unpaid balance, unresolved note. 4. Colorado Complaint — Damages Incurred due to Bank's Negligence in Security Proceeds Application: When a complainant believes that the bank caused financial harm due to negligent handling or misapplication of security proceeds, this type of complaint may arise. Keyword: Negligence, misapplication, financial harm, damages. 5. Colorado Complaint — Bank's Refusal to Release Security Interest Upon Appropriate Application of Security Proceeds: In this scenario, the complainant argues that the bank has unreasonably or wrongfully retained its security interest, despite the appropriate application of security proceeds, leading to ongoing disputes. Keyword: Refusal to release, wrongful retention, ongoing dispute, security interest. Conclusion: Understanding the various types of complaints related to banks seeking to recover on a note after applying security proceeds plays a vital role in navigating the legal landscape in Colorado. Whether it involves insufficient security proceeds application, discrepancies, incomplete satisfaction, negligence, or refusal to release security interests, knowing the precise nature of the complaint helps aggrieved parties seek appropriate legal remedies.

Colorado Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds

Description

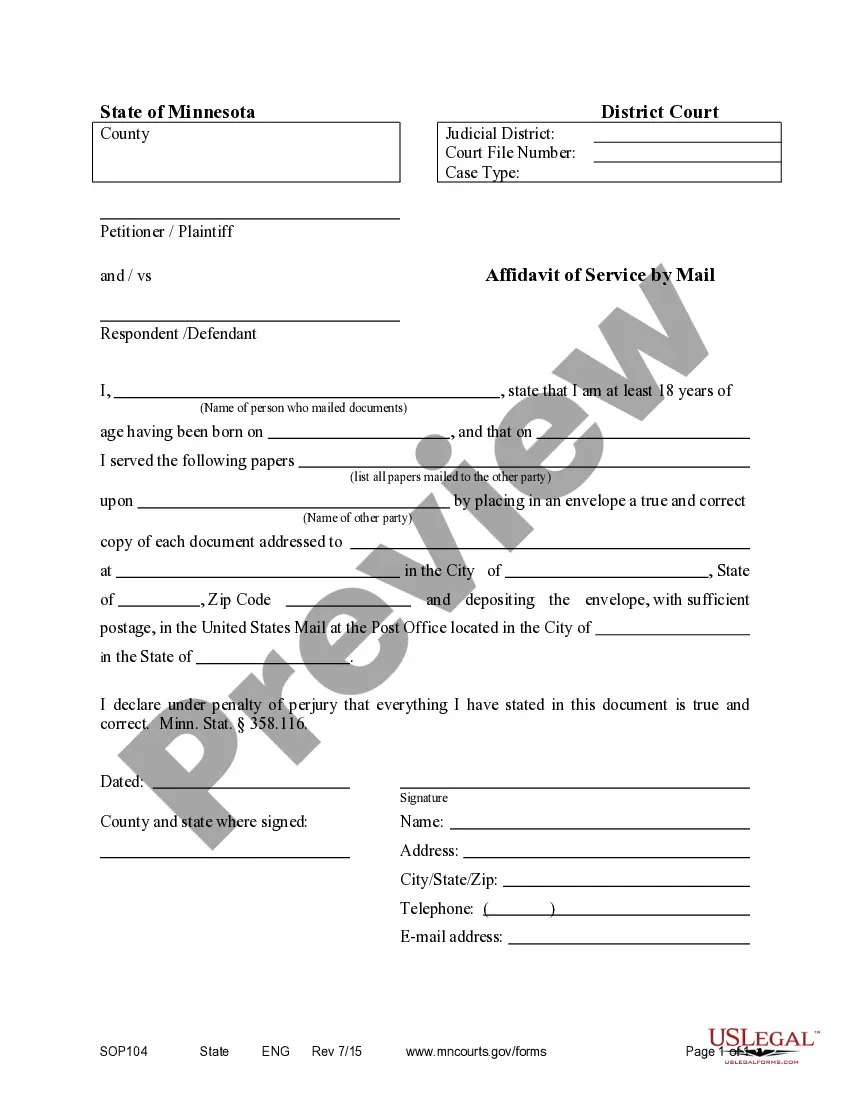

How to fill out Colorado Complaint Regarding Action By Bank To Recover On Note After Application Of Security Proceeds?

US Legal Forms - one of several greatest libraries of legitimate forms in the States - gives a wide array of legitimate papers web templates it is possible to download or produce. Using the internet site, you can find thousands of forms for enterprise and personal purposes, categorized by groups, says, or search phrases.You can find the newest variations of forms much like the Colorado Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds in seconds.

If you already possess a registration, log in and download Colorado Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds from the US Legal Forms library. The Acquire button will appear on each and every type you look at. You get access to all earlier delivered electronically forms inside the My Forms tab of the account.

If you would like use US Legal Forms the very first time, here are easy guidelines to obtain started:

- Make sure you have chosen the proper type for your metropolis/region. Click on the Preview button to check the form`s content material. Read the type description to actually have selected the appropriate type.

- If the type doesn`t satisfy your needs, make use of the Research area on top of the screen to obtain the one who does.

- If you are content with the shape, confirm your choice by simply clicking the Get now button. Then, select the rates strategy you want and offer your accreditations to sign up for the account.

- Approach the transaction. Make use of your charge card or PayPal account to finish the transaction.

- Select the file format and download the shape on the system.

- Make adjustments. Fill up, change and produce and indication the delivered electronically Colorado Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds.

Each design you included with your bank account does not have an expiration date and is your own permanently. So, if you wish to download or produce one more version, just visit the My Forms section and click on the type you will need.

Get access to the Colorado Complaint regarding Action by Bank to Recover on Note After Application of Security Proceeds with US Legal Forms, probably the most comprehensive library of legitimate papers web templates. Use thousands of expert and condition-distinct web templates that fulfill your business or personal needs and needs.

Form popularity

FAQ

You can submit your complaint or inquiry online at the FDIC Information and Support Center at . Alternatively, you can submit a complaint via mail to the Consumer Response Unit at 1100 Walnut Street, Box#11, Kansas City, MO 64106.

The regulatory agencies primarily responsible for supervising the internal operations of commercial banks and administering the state and federal banking laws applicable to commercial banks in the United States include the Federal Reserve System, the Office of the Comptroller of the Currency (OCC), the FDIC and the ...

Where can I complain if I have a problem with my Bank? You can raise your grievance on the Digital Complaint Management System (CMS) Portal: .

If you have determined the Division regulates the institution you wish to file a complaint against, your complaints must be submitted via the Complaint Form posted on this page. Note that you will not fill out the Complaint Form online. Instead, you must download the file to your own device and edit that version.

The OCC charters, regulates, and supervises all national banks and federal savings associations as well as federal branches and agencies of foreign banks. The OCC is an independent bureau of the U.S. Department of the Treasury.

The FDIC National Center for Consumer and Depositor Assistance is responsible for investigating all types of consumer complaints about FDIC-supervised institutions and responding to consumer inquiries about consumer laws and regulations.

How can I file a complaint with the Federal Reserve Board (FRB)? If your problem concerns a state-chartered bank that is a member of the Federal Reserve System, contact the Federal Reserve Consumer Help unit. You may also contact the relevant state attorneys general or state banking department.

File banking and credit complaints with the Consumer Financial Protection Bureau. If contacting your bank directly does not help, visit the Consumer Financial Protection Bureau (CFPB) complaint page to: See which specific banking and credit services and products you can complain about through the CFPB.