Colorado Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank

Description

How to fill out Escrow Agreement Public Offering Between Lorelei Corporation And Chase Manhattan Bank?

US Legal Forms - among the largest libraries of legitimate types in the States - offers a wide range of legitimate file templates it is possible to obtain or print. While using website, you can get a huge number of types for company and person functions, sorted by categories, suggests, or search phrases.You can find the most recent versions of types like the Colorado Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank within minutes.

If you currently have a membership, log in and obtain Colorado Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank in the US Legal Forms collection. The Acquire button can look on each develop you see. You have access to all earlier downloaded types inside the My Forms tab of the accounts.

If you wish to use US Legal Forms initially, listed below are straightforward guidelines to obtain started off:

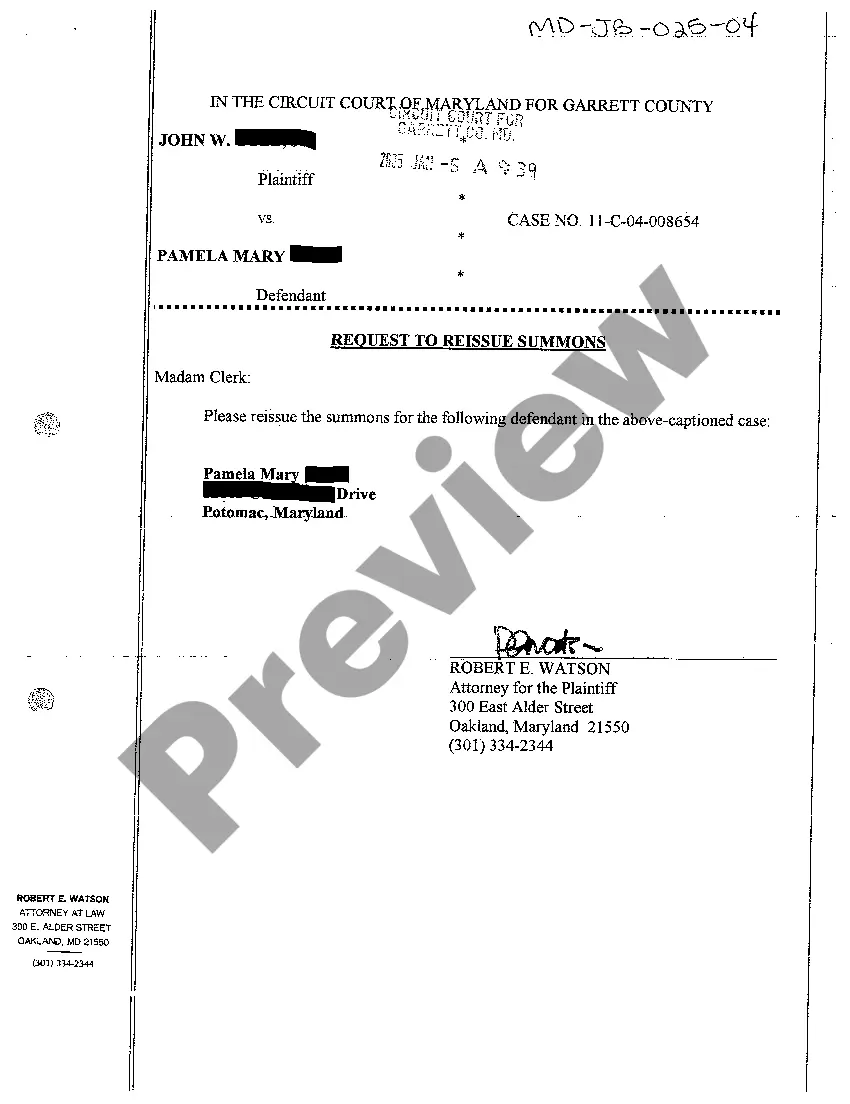

- Be sure to have picked out the correct develop to your metropolis/county. Select the Preview button to examine the form`s information. See the develop information to ensure that you have selected the correct develop.

- If the develop doesn`t satisfy your needs, make use of the Search area near the top of the monitor to get the one who does.

- If you are pleased with the form, verify your option by simply clicking the Get now button. Then, choose the prices program you want and provide your qualifications to register to have an accounts.

- Procedure the transaction. Make use of credit card or PayPal accounts to accomplish the transaction.

- Find the file format and obtain the form on the gadget.

- Make alterations. Complete, change and print and indication the downloaded Colorado Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank.

Each design you put into your bank account lacks an expiration day and it is your own for a long time. So, if you want to obtain or print yet another copy, just go to the My Forms segment and click on about the develop you will need.

Obtain access to the Colorado Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank with US Legal Forms, the most substantial collection of legitimate file templates. Use a huge number of expert and state-certain templates that meet up with your organization or person requires and needs.

Form popularity

FAQ

In some areas of Northern California, separate sets of unilateral escrow instructions are prepared, usually waiting until the transaction is ready to close.

"In escrow" is often used in real estate transactions whereby property, cash, and the title are held in escrow until predetermined conditions are met. Escrow is often associated with real estate transactions, but it can apply to any situation where funds will pass from one party to another.

To be in escrow means the seller and buyer of a home have agreed to a set of purchase terms, and both the seller and buyer are completing the due diligence process of the home sale. A house under contract meaning can be thought of the same thing.

Properly drawn and executed escrow instructions become an enforceable contract/agreement. An escrow is termed ?completed? or ?perfected? when each of the terms of the instructions have been met or performed (satisfied or waived).

The escrow instructions define the events and conditions that must take place and the manner in which the escrow agent shall deliver or release to the beneficiary of the escrow the assets, documents, and/or money held in escrow. The escrow instructions are commonly contemplated by the escrow agreement.

The escrow agreement is a contract entered by two or more parties under which an escrow agent is appointed to hold in escrow certain assets, documents, and/or money deposited by such parties until a contractual condition is fulfilled.