Colorado Plan of Merger between two corporations

Description

How to fill out Plan Of Merger Between Two Corporations?

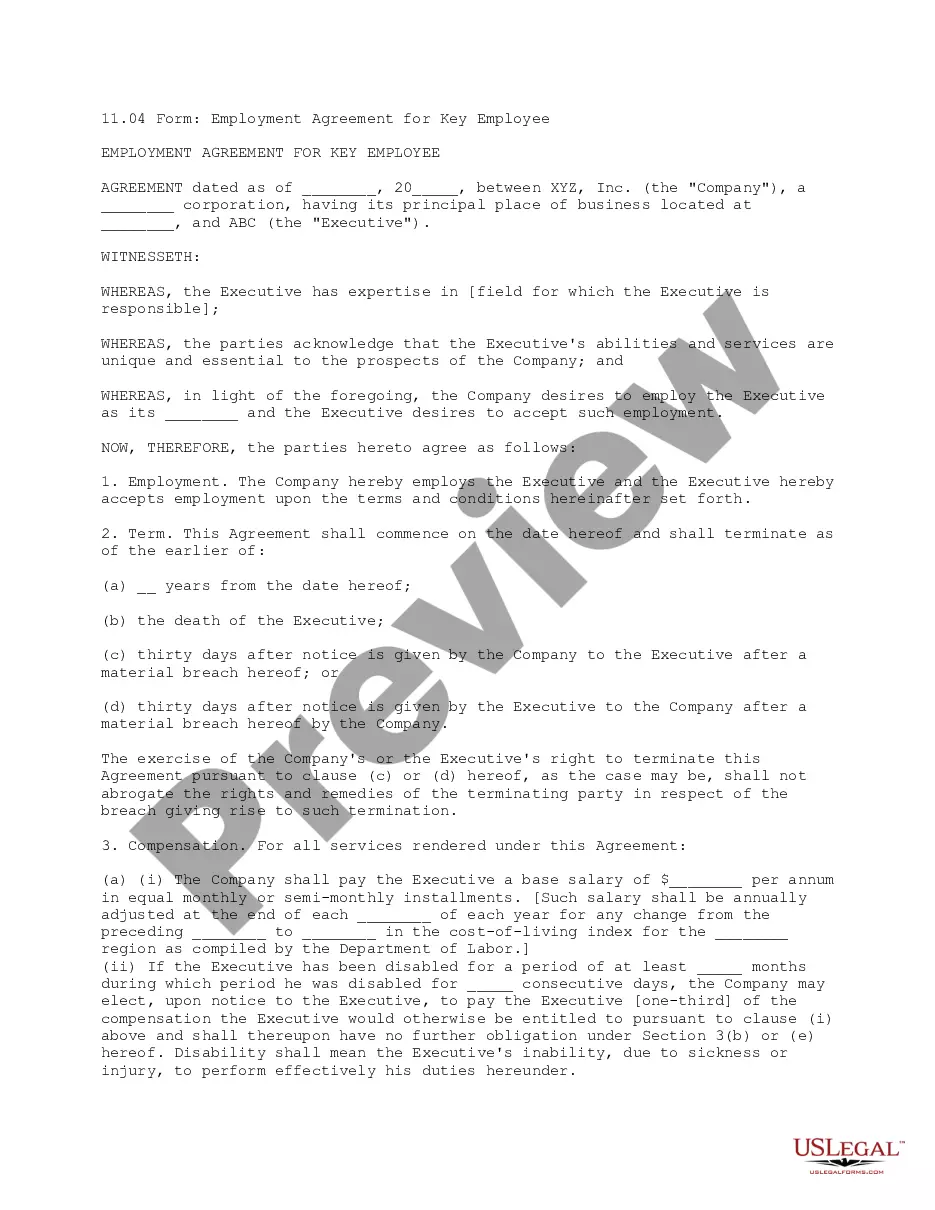

Choosing the right lawful document design can be a have a problem. Obviously, there are plenty of themes accessible on the Internet, but how can you discover the lawful type you want? Utilize the US Legal Forms internet site. The services provides thousands of themes, including the Colorado Plan of Merger between two corporations, which can be used for enterprise and personal needs. All the forms are inspected by professionals and meet up with federal and state needs.

When you are presently signed up, log in in your account and click the Download key to obtain the Colorado Plan of Merger between two corporations. Utilize your account to look throughout the lawful forms you may have ordered previously. Check out the My Forms tab of the account and have another duplicate from the document you want.

When you are a new consumer of US Legal Forms, allow me to share easy directions that you should stick to:

- Very first, be sure you have selected the correct type to your city/state. You can look over the form making use of the Review key and browse the form explanation to make certain it is the best for you.

- When the type will not meet up with your requirements, make use of the Seach discipline to obtain the correct type.

- When you are sure that the form would work, go through the Buy now key to obtain the type.

- Select the costs program you want and enter in the needed details. Build your account and pay for the transaction using your PayPal account or charge card.

- Opt for the submit file format and acquire the lawful document design in your product.

- Complete, change and printing and indication the received Colorado Plan of Merger between two corporations.

US Legal Forms is the largest collection of lawful forms in which you can see a variety of document themes. Utilize the company to acquire skillfully-produced documents that stick to condition needs.

Form popularity

FAQ

A merger is a business deal where two existing, independent companies combine to form a new, singular legal entity. Mergers are voluntary. Typically, both companies are of a similar size and scope and both stand to gain from the transaction. Mergers happen for a variety of reasons.

Merging two private limited companies as equal partners is a delicate process to manage ? indeed, true mergers are relatively uncommon, as more often one company tends to be the junior partner.

If you already own multiple companies, you can choose to merge them into a single entity. Another option is to purchase an existing business owned by another individual or organization and join it with your own business.

Small Business Merger Guidelines Compare and analyze the corporate structures. Determine the leadership of the new company. Compare the company cultures. Determine the branding of the new company. Analyze all financial positions. Determine operating costs. Do your due diligence. Conduct a valuation of all companies. 10 Steps to Make Your Small Business Merger Successful dealroom.net ? blog ? steps-to-successful-small-bu... dealroom.net ? blog ? steps-to-successful-small-bu...

A merger, or acquisition, is when two companies combine to form one to take advantage of synergies. A merger typically occurs when one company purchases another company by buying a certain amount of its stock in exchange for its own stock. What You Should Know About Corporate Mergers - Investopedia investopedia.com ? basics ? themerger investopedia.com ? basics ? themerger

Mergers combine two separate businesses into a single new legal entity. True mergers are uncommon because it's rare for two equal companies to mutually benefit from combining resources and staff, including their CEOs. Unlike mergers, acquisitions do not result in the formation of a new company. Merge and acquire businesses | U.S. Small Business Administration sba.gov ? grow-your-business ? merge-acqu... sba.gov ? grow-your-business ? merge-acqu...

Mergers are a way for companies to expand their reach, expand into new segments, or gain market share. A merger is the voluntary fusion of two companies on broadly equal terms into one new legal entity. The five major types of mergers are conglomerate, congeneric, market extension, horizontal, and vertical.