Colorado Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P.

Description

How to fill out Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. And First Trust Advisors, L.P.?

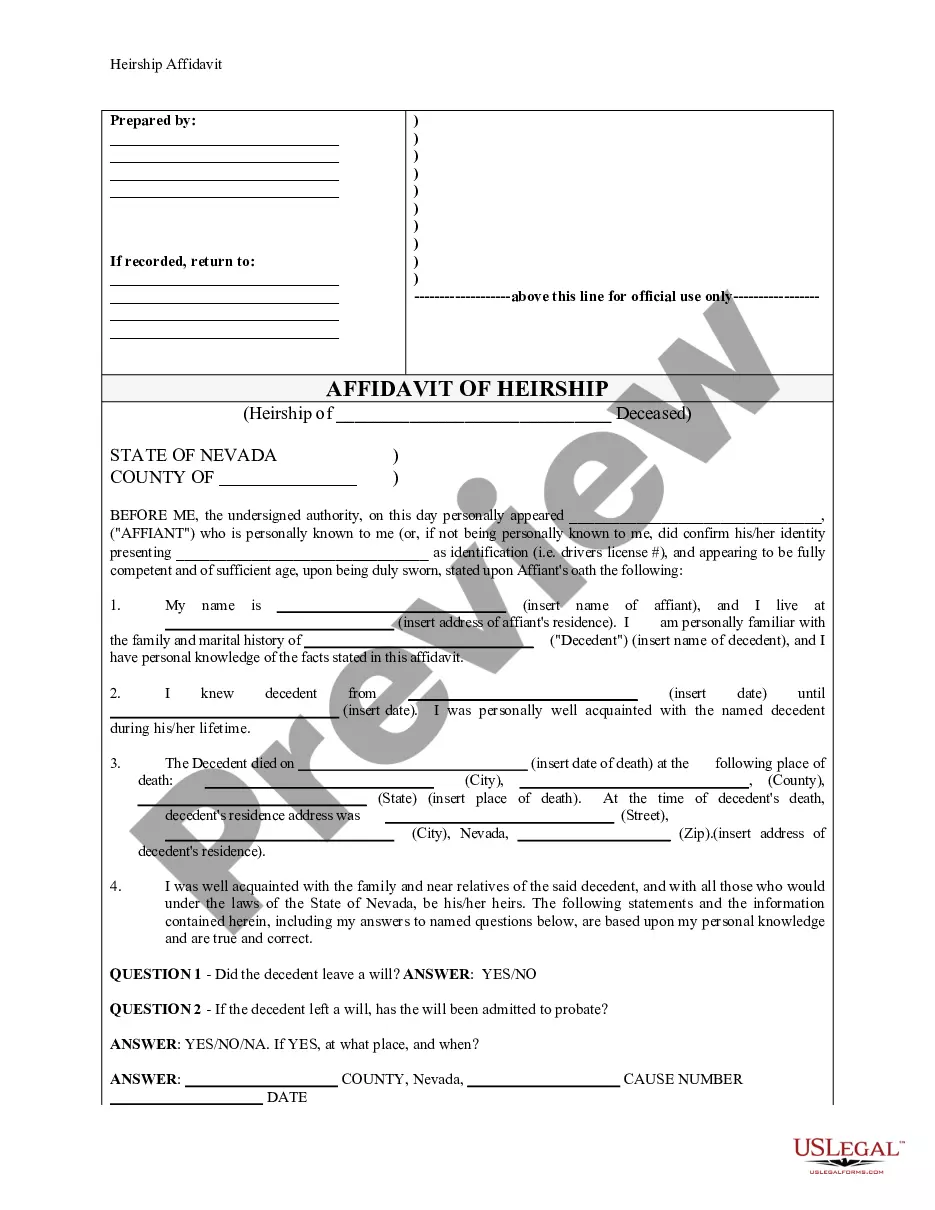

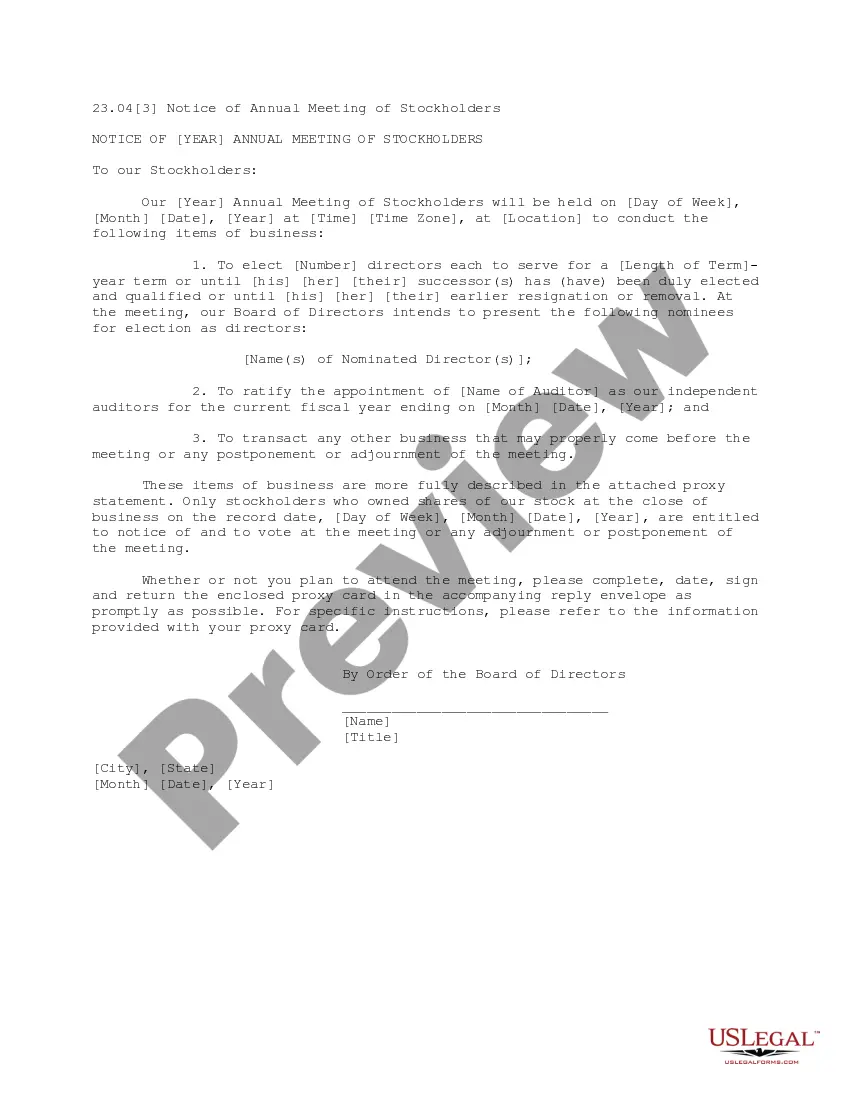

You may devote several hours on the Internet looking for the legitimate record template which fits the federal and state specifications you need. US Legal Forms provides 1000s of legitimate kinds which can be evaluated by pros. You can easily obtain or print the Colorado Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P. from your service.

If you currently have a US Legal Forms bank account, you can log in and then click the Down load switch. Afterward, you can total, revise, print, or signal the Colorado Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P.. Every legitimate record template you buy is your own eternally. To obtain an additional backup of any purchased develop, check out the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms internet site the very first time, follow the easy recommendations listed below:

- Initial, be sure that you have selected the proper record template to the area/city of your choosing. Look at the develop explanation to ensure you have picked out the correct develop. If offered, utilize the Review switch to search from the record template also.

- If you want to locate an additional variation of your develop, utilize the Research discipline to find the template that fits your needs and specifications.

- Upon having located the template you need, just click Get now to move forward.

- Pick the pricing plan you need, enter your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You should use your bank card or PayPal bank account to cover the legitimate develop.

- Pick the structure of your record and obtain it for your gadget.

- Make modifications for your record if possible. You may total, revise and signal and print Colorado Trust Agreement Nike Securities, L.P., The Chase Manhattan Bank, BISYS Fund Services Ohio, Inc. and First Trust Advisors, L.P..

Down load and print 1000s of record themes using the US Legal Forms Internet site, that offers the biggest variety of legitimate kinds. Use skilled and status-specific themes to take on your business or person requirements.