A Colorado Sub-Advisory Agreement refers to the contractual arrangement between the BNY Hamilton International Equity fund and IndyCar, a subsidiary of Crédit Agricole, for the purpose of appointing IndyCar as a sub-advisor to manage a segment or portion of the fund's investments in the state of Colorado, USA. This partnership allows the BNY Hamilton International Equity fund to leverage IndyCar's expertise and resources, ensuring efficient management of investments in the region. Through the Colorado Sub-Advisory Agreement, BNY Hamilton International Equity fund empowers IndyCar with the authority to make investment decisions, manage assets, and conduct day-to-day portfolio management activities within the specified Colorado segment. This arrangement offers a specialized approach to managing investments, considering the unique characteristics and opportunities presented by the Colorado market. By utilizing the sub-advisory services of IndyCar, the BNY Hamilton International Equity fund gains access to Crédit Agricole's vast global network, research capabilities, and market insights. IndyCar, as a subsidiary of Crédit Agricole, brings substantial experience and knowledge of the Colorado market, enabling the fund to capitalize on local investment opportunities. Types of Colorado Sub-Advisory Agreements could include: 1. Full Discretion Agreement: Under this agreement, IndyCar is granted full discretion overinvestment decisions within the Colorado segment. They have the authority to execute trades, allocate assets, and manage the portfolio without prior approval from the BNY Hamilton International Equity fund. 2. Limited Discretion Agreement: In this scenario, IndyCar has limited discretion and needs to seek approval from the BNY Hamilton International Equity fund for certain investment decisions or asset allocations within the Colorado segment. The precise scope and thresholds for IndyCar's autonomy would be outlined in the agreement. 3. Performance-based Agreement: This type of agreement entails IndyCar's compensation being tied to performance metrics, such as achieving specified investment objectives or outperforming benchmark indices within the Colorado segment. The agreement could include a performance fee structure that rewards successful outcomes. 4. Fixed Fee Agreement: Under this agreement, IndyCar receives a fixed fee from the BNY Hamilton International Equity fund for their sub-advisory services in managing the Colorado segment. The fee is predetermined and not contingent on investment performance. Overall, the Colorado Sub-Advisory Agreement between BNY Hamilton International Equity fund and IndyCar aims to enhance the fund's investment capabilities in Colorado, leveraging the expertise and resources of IndyCar, a subsidiary of Crédit Agricole. The agreement may vary in terms of discretion, compensation structure, and objectives, based on the specific needs and preferences of both parties.

Colorado Sub-Advisory Agreement between BNY Hamilton International Equity fund and Indocam, a subsidiary of Credit Agricole

Description

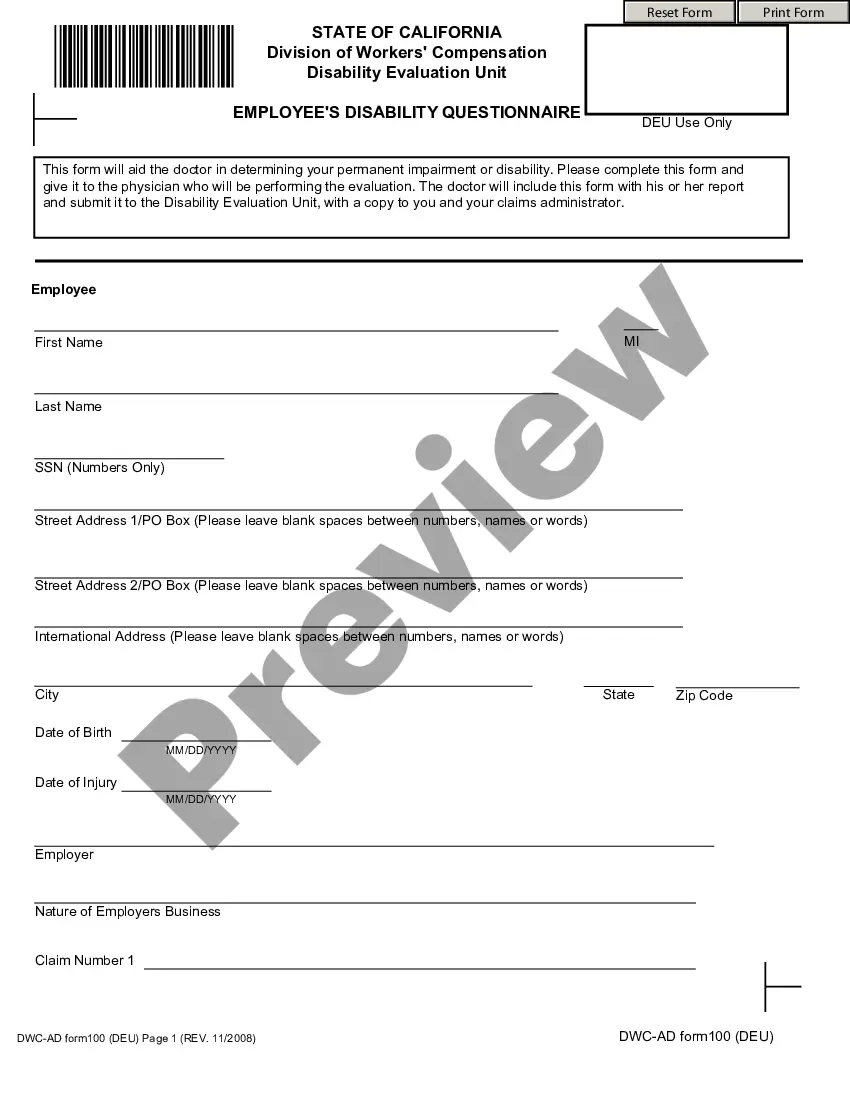

How to fill out Colorado Sub-Advisory Agreement Between BNY Hamilton International Equity Fund And Indocam, A Subsidiary Of Credit Agricole?

Discovering the right lawful document web template can be a have a problem. Needless to say, there are tons of templates available on the Internet, but how do you get the lawful type you require? Use the US Legal Forms internet site. The services delivers a large number of templates, for example the Colorado Sub-Advisory Agreement between BNY Hamilton International Equity fund and Indocam, a subsidiary of Credit Agricole, which you can use for company and private needs. All the kinds are inspected by pros and meet up with state and federal demands.

In case you are already listed, log in to your profile and click the Acquire switch to have the Colorado Sub-Advisory Agreement between BNY Hamilton International Equity fund and Indocam, a subsidiary of Credit Agricole. Make use of your profile to look through the lawful kinds you may have bought earlier. Go to the My Forms tab of your own profile and obtain another backup from the document you require.

In case you are a brand new customer of US Legal Forms, allow me to share simple recommendations for you to adhere to:

- Initially, make certain you have selected the right type to your town/area. You are able to look over the shape while using Preview switch and look at the shape outline to guarantee it is the right one for you.

- In the event the type does not meet up with your preferences, utilize the Seach discipline to obtain the correct type.

- Once you are certain that the shape would work, click on the Get now switch to have the type.

- Pick the costs program you want and enter in the required information and facts. Make your profile and buy your order making use of your PayPal profile or charge card.

- Select the data file file format and obtain the lawful document web template to your system.

- Total, edit and produce and signal the attained Colorado Sub-Advisory Agreement between BNY Hamilton International Equity fund and Indocam, a subsidiary of Credit Agricole.

US Legal Forms is the largest library of lawful kinds in which you can see various document templates. Use the service to obtain appropriately-manufactured paperwork that adhere to state demands.