Colorado Pooling and Servicing Agreement is a legal contract that governs the pooling and servicing of mortgage loans between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One. This agreement outlines the various terms, conditions, and obligations that these entities must adhere to in order to effectively manage and administer a portfolio of mortgage loans. The Colorado Pooling and Servicing Agreement is tailored to meet the specific requirements and regulations set forth in the state of Colorado. It ensures compliance with state laws, guidelines, and provisions, and helps facilitate the smooth operation of the mortgage-backed securities (MBS) market in Colorado. Some key components covered in the Colorado Pooling and Servicing Agreement include: 1. Pooling of Mortgage Loans: The agreement addresses the process of pooling various mortgage loans originated and acquired by Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One. It outlines the criteria for selecting eligible loans, including loan types, underwriting standards, and documentation requirements. 2. Servicing: The agreement specifies the roles and responsibilities of the services involved in managing the mortgage loans. It covers the payment and collection of principal and interest on the loans, administration of escrow accounts, handling of delinquent loans, and maintenance of complete and accurate records. 3. Distribution of Cash Flows: The agreement establishes the rules for the distribution of principal and interest payments received from the mortgage loans. It outlines the priority of cash flow allocation, reserve requirements, and guidelines for the calculation and payment of servicing fees to the respective parties involved. 4. Reporting and Disclosure: The agreement requires regular reporting and disclosure to ensure transparency and compliance. It lays out the information that must be provided by the services to investors, including loan performance data, financial statements, and any material changes or events that may impact the MBS portfolio. It is important to note that while the Colorado Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One is a general term, there may be variations or specific types of agreements based on the unique nature of each transaction or portfolio. These may include variations such as Master Pooling and Servicing Agreements, Supplemental Pooling and Servicing Agreements, or Transaction-specific Pooling and Servicing Agreements, each serving a different purpose and addressing specific aspects of the MBS transactions. In conclusion, the Colorado Pooling and Servicing Agreement plays a vital role in regulating the pooling and servicing of mortgage loans between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A., and Bank One. By establishing clear guidelines and obligations, this agreement helps ensure the efficient and compliant management of the mortgage-backed securities market in Colorado.

Colorado Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One

Description

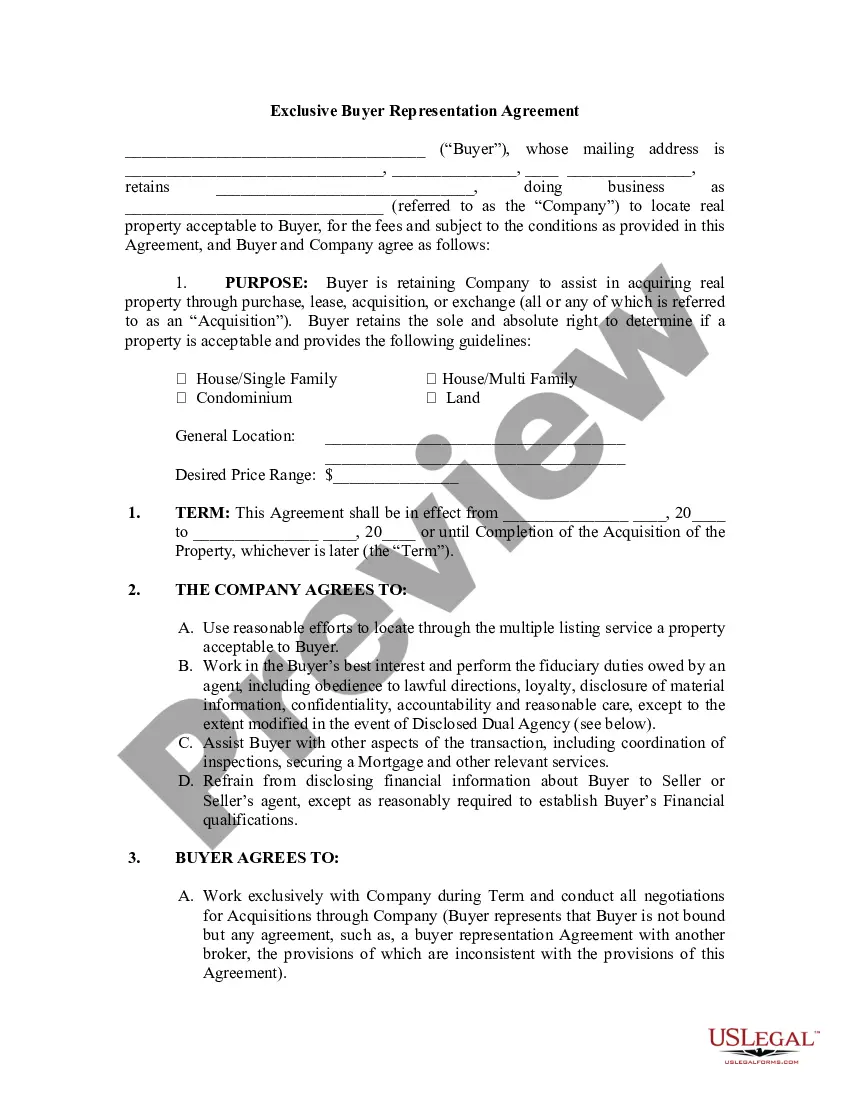

How to fill out Colorado Pooling And Servicing Agreement Between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. And Bank One?

US Legal Forms - one of the most significant libraries of authorized varieties in America - provides a wide array of authorized papers layouts it is possible to obtain or print. While using site, you will get a huge number of varieties for business and specific purposes, categorized by categories, states, or keywords and phrases.You can find the newest versions of varieties just like the Colorado Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One in seconds.

If you have a monthly subscription, log in and obtain Colorado Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One in the US Legal Forms collection. The Obtain option will show up on every form you perspective. You gain access to all previously downloaded varieties from the My Forms tab of the profile.

If you would like use US Legal Forms initially, listed here are basic directions to obtain started off:

- Ensure you have selected the correct form for the city/county. Select the Review option to examine the form`s articles. Read the form description to ensure that you have chosen the proper form.

- When the form doesn`t suit your demands, utilize the Research discipline towards the top of the display screen to get the one which does.

- In case you are pleased with the shape, validate your selection by simply clicking the Acquire now option. Then, choose the costs program you want and provide your references to sign up to have an profile.

- Method the financial transaction. Make use of charge card or PayPal profile to finish the financial transaction.

- Pick the format and obtain the shape on your gadget.

- Make changes. Complete, modify and print and sign the downloaded Colorado Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One.

Each and every web template you included with your account does not have an expiration date and is the one you have permanently. So, in order to obtain or print another duplicate, just go to the My Forms area and click on the form you require.

Get access to the Colorado Pooling and Servicing Agreement between Credit Suisse First Boston Mortgage Securities Corp., Washington Mutual Bank F.A. and Bank One with US Legal Forms, by far the most substantial collection of authorized papers layouts. Use a huge number of expert and condition-certain layouts that meet up with your company or specific requires and demands.