Colorado Borrower Security Agreement regarding the extension of credit facilities

Description

How to fill out Borrower Security Agreement Regarding The Extension Of Credit Facilities?

Are you currently within a situation in which you need to have files for possibly business or individual reasons almost every day time? There are tons of legal record templates available on the Internet, but discovering types you can depend on isn`t effortless. US Legal Forms provides a large number of form templates, much like the Colorado Borrower Security Agreement regarding the extension of credit facilities, that happen to be created to satisfy federal and state requirements.

When you are already familiar with US Legal Forms web site and get your account, simply log in. After that, you may down load the Colorado Borrower Security Agreement regarding the extension of credit facilities web template.

Unless you come with an bank account and would like to begin using US Legal Forms, adopt these measures:

- Obtain the form you need and ensure it is for the proper city/county.

- Utilize the Preview option to check the shape.

- See the information to ensure that you have chosen the appropriate form.

- In case the form isn`t what you are looking for, make use of the Lookup industry to obtain the form that suits you and requirements.

- Whenever you obtain the proper form, click on Buy now.

- Pick the rates program you desire, fill out the desired information and facts to create your account, and pay for the transaction making use of your PayPal or bank card.

- Decide on a convenient data file structure and down load your copy.

Locate each of the record templates you possess bought in the My Forms food list. You can get a extra copy of Colorado Borrower Security Agreement regarding the extension of credit facilities whenever, if necessary. Just select the needed form to down load or produce the record web template.

Use US Legal Forms, one of the most substantial variety of legal forms, to save time and steer clear of mistakes. The assistance provides appropriately created legal record templates that can be used for a range of reasons. Generate your account on US Legal Forms and begin generating your life easier.

Form popularity

FAQ

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

Also, extend someone credit. Allow a purchase on credit; also, permit someone to owe money. For example, The store is closing your charge account; they won't extend credit to you any more, or The normal procedure is to extend you credit for three months, and after that we charge interest.

(q) Extend credit and extension of credit mean the granting of credit in any form (including, but not limited to, credit granted in addition to any existing credit or credit limit; credit granted pursuant to an open-end credit plan; the refinancing or other renewal of credit, including the issuance of a new credit card ...

Regulation O regulates the credit extensions that member banks can offer to their "insiders." Regulation O requires that banks report any extensions provided to insiders in their quarterly reports. Regulation O defines bank insiders as directors or trustees of a bank, executive officers, or principal shareholders.

Section 1003.2(d) defines a closed-end mortgage loan as an extension of credit that is secured by a lien on a dwelling and that is not an open-end line of credit under § 1003.2(o).

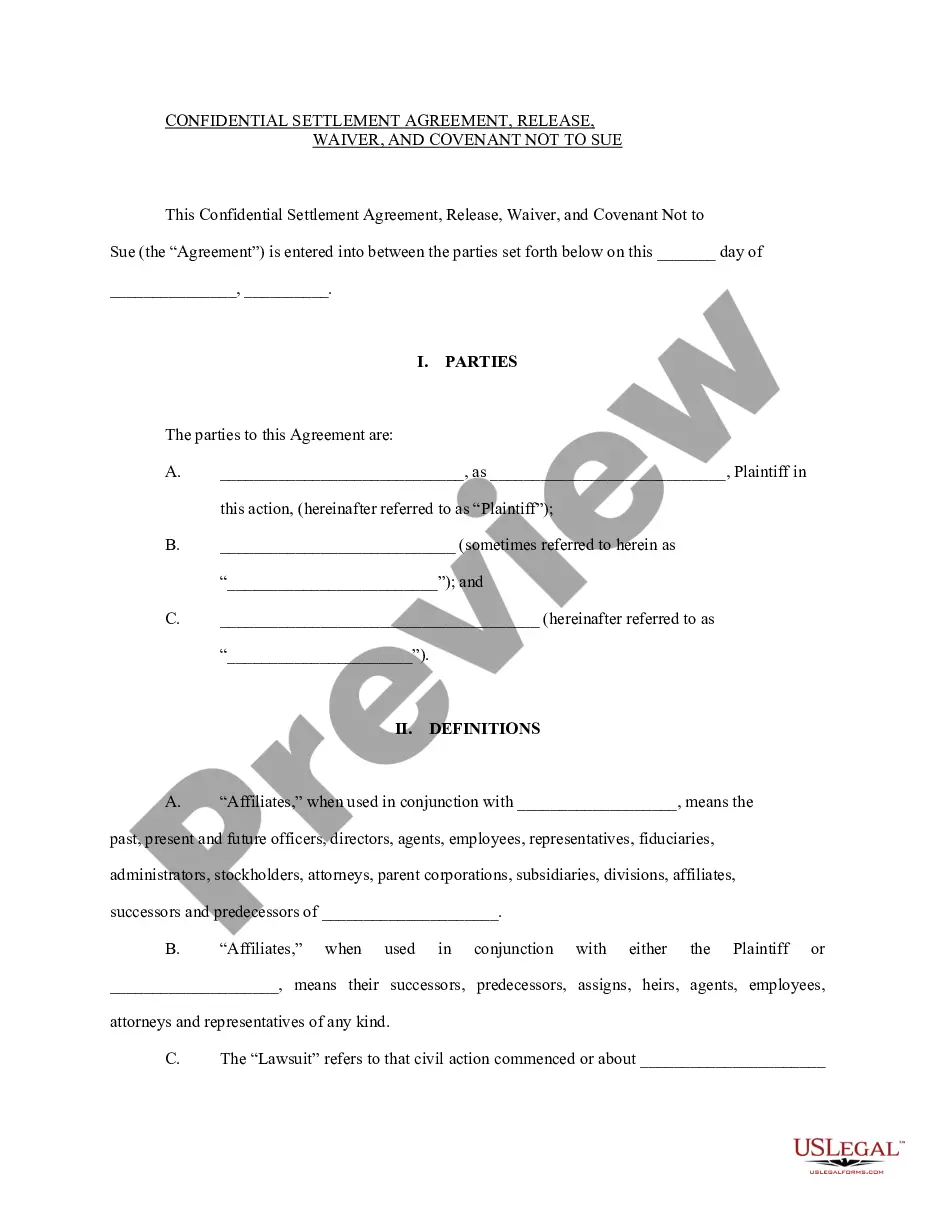

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Extension of Credit means the right to defer payment of debt or to incur debt and defer its payment offered or granted primarily for personal, family, or household purposes. Alright, it's a loan.

A creditor is an individual or institution that extends credit to another party to borrow money usually by a loan agreement or contract.