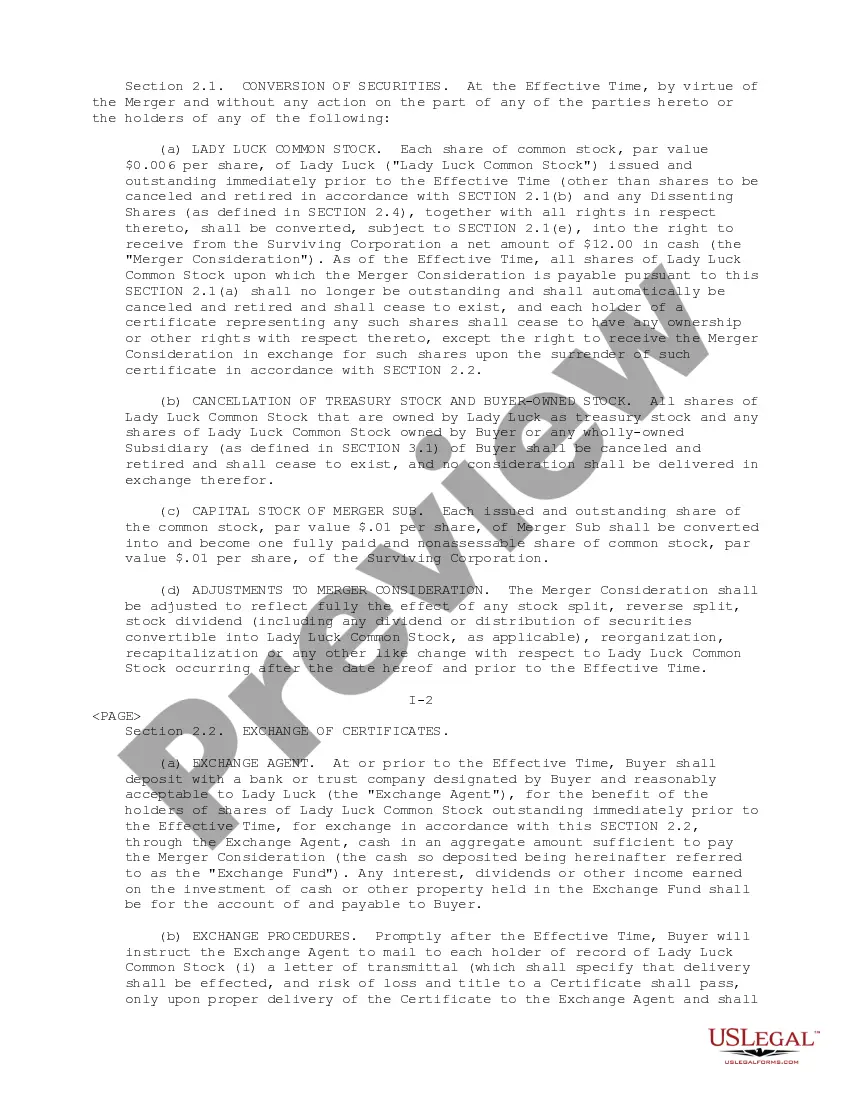

The Colorado Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation is a comprehensive agreement outlining the consolidation of these companies within the state of Colorado. This merger plan involves the combination of Isle of Capri Casinos, Inc., a leading gaming and entertainment company, with Isle Merger Corporation and Lady Luck Gaming Corporation, both recognized entities in the gaming industry. The merger aims to enhance the growth and market reach of all involved companies by leveraging their individual strengths and resources. Through this consolidation, the merged entity seeks to create a unified platform for providing exceptional gaming and entertainment experiences to customers in the vibrant Colorado market. The Colorado Plan of Merger includes various key elements and provisions to ensure a seamless integration of operations, resources, and business strategies. It encompasses legal, financial, and operational aspects to govern the merger process effectively. The plan also addresses issues related to corporate governance, management structure, and decision-making frameworks to maintain stability during and after the merger. Additionally, the Colorado Plan of Merger outlines the financial terms, stock exchanges, and share conversion ratios that will govern the merger. It establishes the rights and entitlements of the shareholders of each company, ensuring fairness and transparency in the transaction. The merger plan might consist of different types or phases, which can include regulatory approvals, due diligence processes, and integration planning. These stages are essential for assessing the feasibility and potential synergies of the merger. By following a meticulous approach, the parties involved can minimize any potential risks and maximize the benefits arising from this strategic combination. Some relevant keywords related to the Colorado Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation, and Lady Luck Gaming Corporation may include: merger agreement, consolidation, gaming industry, entertainment experiences, growth, market reach, resources, legal provisions, financial terms, stock conversion, shareholders' rights, regulatory approvals, due diligence, integration planning, synergy, risk mitigation, and strategic combination.

Colorado Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation

Description

How to fill out Plan Of Merger Between Isle Of Capri Casinos, Inc., Isle Merger Corporation And Lady Luck Gaming Corporation?

Choosing the best authorized papers template can be quite a battle. Obviously, there are tons of layouts accessible on the Internet, but how can you discover the authorized type you require? Use the US Legal Forms internet site. The assistance delivers a huge number of layouts, for example the Colorado Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation, that can be used for enterprise and private demands. All of the forms are checked by professionals and meet up with federal and state requirements.

Should you be already signed up, log in to the profile and then click the Obtain button to get the Colorado Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation. Make use of profile to check with the authorized forms you have purchased previously. Visit the My Forms tab of the profile and obtain an additional duplicate of the papers you require.

Should you be a new user of US Legal Forms, here are simple instructions that you can stick to:

- Initially, be sure you have chosen the proper type for the city/state. You may look through the form utilizing the Preview button and look at the form outline to make sure it will be the right one for you.

- In case the type is not going to meet up with your needs, use the Seach discipline to find the proper type.

- When you are sure that the form is suitable, go through the Acquire now button to get the type.

- Pick the costs strategy you desire and enter in the essential info. Design your profile and pay for the order using your PayPal profile or bank card.

- Opt for the submit structure and obtain the authorized papers template to the product.

- Complete, edit and print out and indication the received Colorado Plan of Merger between Isle of Capri Casinos, Inc., Isle Merger Corporation and Lady Luck Gaming Corporation.

US Legal Forms is definitely the most significant local library of authorized forms in which you will find numerous papers layouts. Use the company to obtain professionally-manufactured documents that stick to condition requirements.