The Colorado Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. is an important collaboration aimed at improving health insurance coverage for individuals in the state of Colorado. This agreement reflects the commitment of both insurance providers to mitigate the high costs associated with providing coverage to high-risk individuals. The purpose of the reinsurance agreement is to create a more stable and affordable health insurance market by sharing some financial risks associated with providing coverage to individuals with high healthcare needs. By doing so, it allows insurance providers like Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. to offer more affordable premiums to individuals and small businesses. The Colorado Reinsurance Agreement works by establishing a reinsurance program that helps pay for a portion of the claims costs incurred by insurers for high-cost individuals. Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. contribute funds to this program, which is then used to reimburse insurers for a portion of the high-cost claims incurred by their beneficiaries. This prevents insurers from having to cover the entire cost of healthcare for these individuals, thereby reducing their financial burden. Through this collaboration, Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. aim to increase access to quality healthcare for Coloradans, particularly those who have traditionally faced difficulties in obtaining affordable coverage. By offering more reasonable premiums, the reinsurance agreement seeks to attract a larger number of individuals into the insurance market, encouraging the uninsured or under insured to seek coverage and receive adequate healthcare services. The Colorado Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. may encompass different types, depending on the specific terms and conditions agreed upon by the parties involved. Some of these types may include: 1. Annual Reinsurance Agreement: This type of agreement is typically valid for one year and sets out the terms and requirements for the reinsurance program during that period. 2. Stop-Loss Reinsurance Agreement: This type of agreement allows insurance providers to limit their financial exposure by setting a maximum limit on the amount they will pay out for a single individual's claims. When the claims exceed this limit, the reinsurer (such as Healthy Alliance Life Insurance Co.) takes over and covers the excess costs. 3. Specific Reinsurance Agreement: This type of agreement focuses on covering specific types of healthcare claims, such as those related to specific medical conditions or services. It provides additional protection to the insurer by reducing their liabilities for designated claims. 4. Aggregate Reinsurance Agreement: In this type of agreement, the reinsurer agrees to cover a specific percentage of all claims costs incurred by the insurer during a certain timeframe. This helps distribute the risk across multiple insurers and provides more predictable financial outcomes. These different types of Colorado Reinsurance Agreements allow Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. to customize their collaboration based on their specific needs, priorities, and market conditions.

Colorado Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co.

Description

How to fill out Colorado Reinsurance Agreement Between Blue Cross Blue Shield Of Missouri And Healthy Alliance Life Insurance Co.?

Have you been within a position the place you will need files for sometimes business or personal functions almost every working day? There are a lot of authorized file themes available online, but locating kinds you can trust isn`t easy. US Legal Forms offers thousands of type themes, much like the Colorado Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co., that happen to be written to satisfy federal and state demands.

Should you be previously knowledgeable about US Legal Forms site and also have a free account, merely log in. Next, you are able to down load the Colorado Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. design.

Should you not provide an bank account and need to begin using US Legal Forms, adopt these measures:

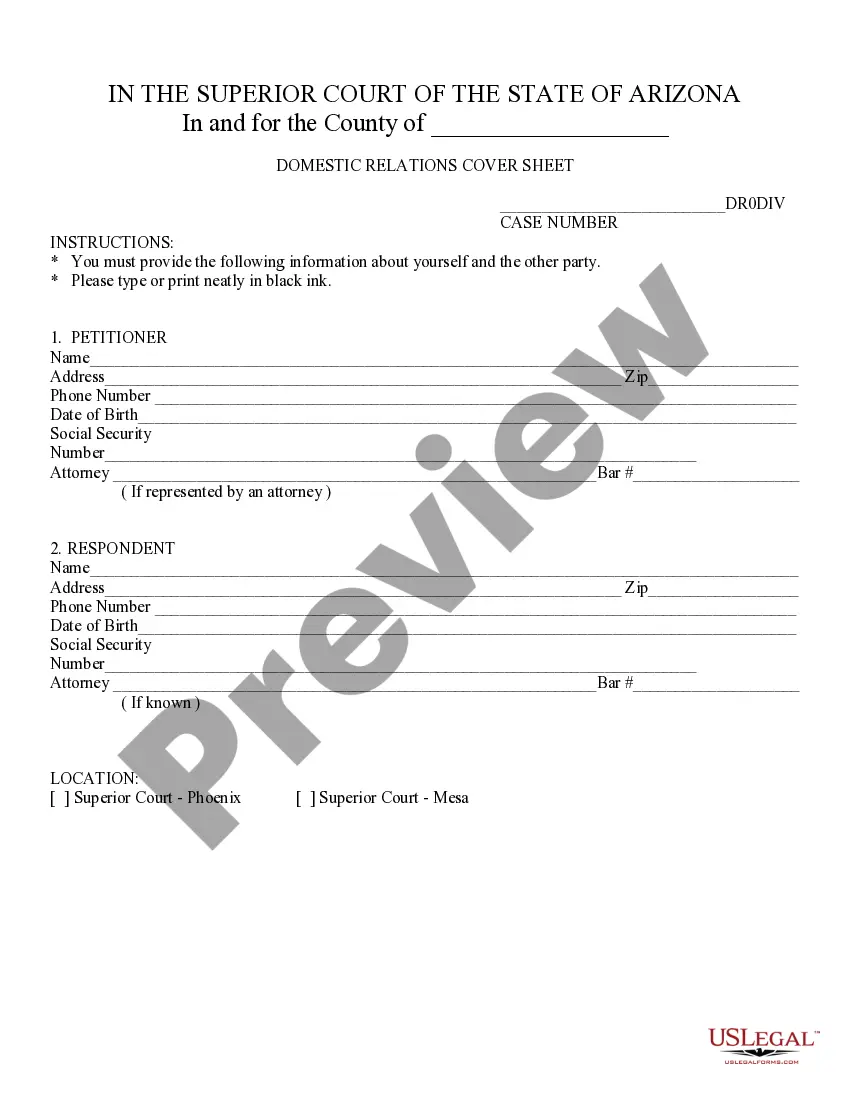

- Find the type you want and make sure it is for your appropriate city/region.

- Utilize the Preview switch to examine the form.

- See the outline to ensure that you have chosen the appropriate type.

- If the type isn`t what you`re seeking, utilize the Look for industry to get the type that meets your needs and demands.

- If you get the appropriate type, simply click Get now.

- Choose the costs strategy you would like, fill in the desired information and facts to create your money, and buy your order utilizing your PayPal or charge card.

- Select a practical paper structure and down load your backup.

Get every one of the file themes you may have purchased in the My Forms menus. You can aquire a additional backup of Colorado Reinsurance Agreement between Blue Cross Blue Shield of Missouri and Healthy Alliance Life Insurance Co. any time, if necessary. Just select the necessary type to down load or print out the file design.

Use US Legal Forms, the most extensive collection of authorized types, to save lots of time and stay away from faults. The assistance offers appropriately produced authorized file themes which you can use for a selection of functions. Generate a free account on US Legal Forms and commence producing your lifestyle easier.