Colorado Closing Agreement is a legal document that solidifies the terms and conditions for the settlement of tax liabilities between the Colorado Department of Revenue and a taxpayer. It serves as a resolution to disputes regarding unpaid taxes, penalties, and interest imposed by the state. The Colorado Closing Agreement ensures that both parties reach a mutually agreeable solution to outstanding tax issues in a comprehensive and final manner. This agreement provides taxpayers with an opportunity to settle their tax obligations without undergoing costly and time-consuming litigation procedures. There are several types of Colorado Closing Agreements, each designed to address specific tax scenarios: 1. Penalty Abatement Agreement: This type of agreement aims to provide taxpayers with relief from penalties imposed due to non-compliance such as late filing, understatement of tax liabilities, or negligence. Through penalty abatement agreements, taxpayers can negotiate reduced or waived penalties. 2. Payment Plan Agreement: Colorado Closing Agreement can be used to establish an installment payment plan for taxpayers unable to immediately pay their entire tax liability. This agreement allows taxpayers to pay off their tax debts over time, usually in monthly installments, while avoiding more drastic enforcement actions. 3. Offer in Compromise Agreement: In certain cases, a taxpayer may demonstrate financial hardship and an inability to pay their entire tax liability. An Offer in Compromise Agreement, often referred to as a tax settlement, allows eligible taxpayers to settle their tax debts for less than the total amount owed. This requires the taxpayer to make a lump sum payment or regular installments, depending on their financial circumstances. 4. Liability Settlement Agreement: This agreement serves as a comprehensive settlement for taxpayers who have significant outstanding tax liabilities. It involves negotiations between the taxpayer and the Colorado Department of Revenue to establish a reduced settlement amount, taking into account the taxpayer's financial situation and ability to pay. Regardless of the type of Colorado Closing Agreement, it is essential to consult a tax professional or attorney who can guide individuals or businesses through the negotiation process. These agreements help taxpayers resolve their tax issues efficiently, avoid further legal actions, and achieve peace of mind regarding their tax obligations in the state of Colorado.

Colorado Closing Agreement

Description

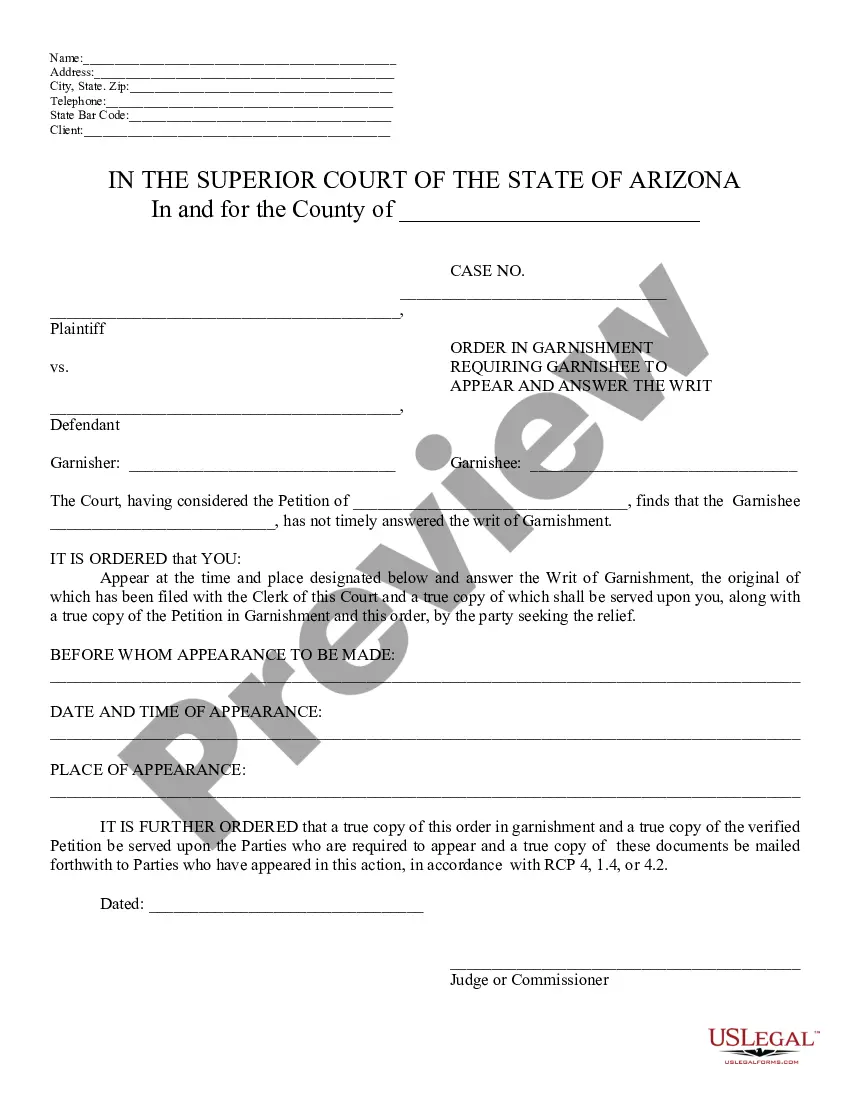

How to fill out Colorado Closing Agreement?

If you wish to comprehensive, acquire, or printing lawful document layouts, use US Legal Forms, the largest selection of lawful forms, which can be found online. Utilize the site`s basic and practical research to find the paperwork you require. Numerous layouts for business and individual reasons are sorted by groups and says, or search phrases. Use US Legal Forms to find the Colorado Closing Agreement in just a couple of clicks.

If you are previously a US Legal Forms customer, log in in your account and then click the Obtain option to have the Colorado Closing Agreement. You may also accessibility forms you earlier acquired in the My Forms tab of your respective account.

Should you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape for the proper area/land.

- Step 2. Take advantage of the Preview choice to look over the form`s articles. Don`t forget about to see the information.

- Step 3. If you are unsatisfied together with the kind, use the Look for field near the top of the display screen to find other versions from the lawful kind web template.

- Step 4. Once you have identified the shape you require, go through the Acquire now option. Pick the pricing program you like and include your references to register to have an account.

- Step 5. Method the deal. You should use your bank card or PayPal account to complete the deal.

- Step 6. Pick the structure from the lawful kind and acquire it in your product.

- Step 7. Complete, modify and printing or indication the Colorado Closing Agreement.

Every lawful document web template you acquire is yours for a long time. You may have acces to every kind you acquired in your acccount. Click the My Forms portion and pick a kind to printing or acquire once again.

Contend and acquire, and printing the Colorado Closing Agreement with US Legal Forms. There are millions of skilled and express-particular forms you can use for your personal business or individual needs.

Form popularity

FAQ

Sellers often pay real estate agent commissions, title transfer fees, transfer taxes and property taxes.

The Bottom Line Appraisal fees, attorney's fees and inspection fees are examples of common closing costs. The specific closing costs you'll pay depend on the type of loan you have, your home's value and your state's laws. Sellers may also need to pay for closing costs, depending on the sale agreement.

In Colorado, the seller typically pays for most of the closing costs. Buyers may be responsible for prepaids like mortgage insurance and taxes as well as document preparation fees or applicable home appraisal fees. Depending on negotiations with a cash buyer, these could also be covered by the seller.

Sellers often pay real estate agent commissions, title transfer fees, transfer taxes and property taxes.

Closing Company will prepare and deliver accurate, complete and detailed closing statements to Buyer, Seller and the real estate brokers working with Buyer and Seller.

Pursuant to 12-61-113 (l)(h), at time of closing, the individual licensee who has established a brokerage relationship with the buyer or seller or who works with the buyer or seller as a customer, either personally or on behalf of an employing broker, shall be responsible for the proper closing of the transaction and ...

Does the buyer pay closing costs in Colorado? Both buyers and sellers pay their share of closing costs, in Colorado and in every state. Although buyers typically pay most of the traditional closing costs, sellers usually pay more monetarily, because they cover the cost of the real estate agents' commissions.

Typically, buyers are responsible for paying these costs as they are needed by both the seller and the mortgage lender to ensure a successful sale. But depending on the home and seller's circumstances, there may be seller concessions to incentivize buyers and move the transaction forward.