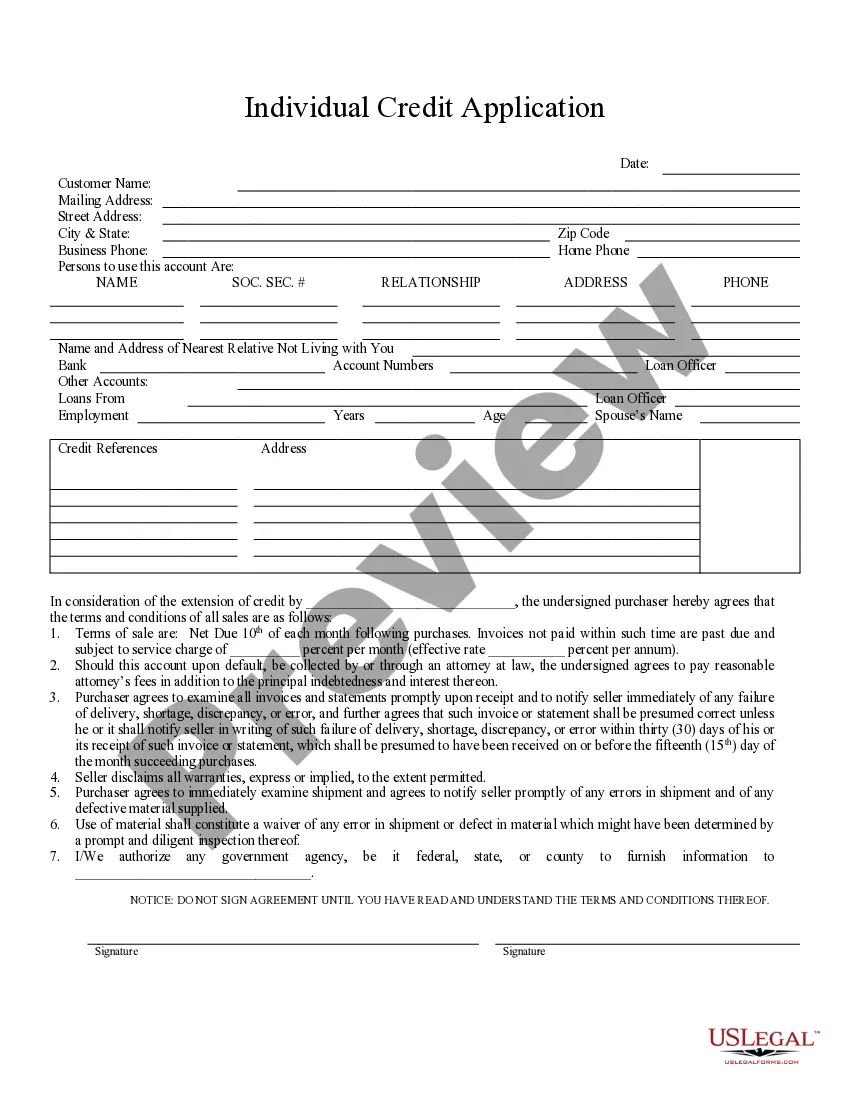

Colorado Totalcast Agreement

Description

How to fill out Totalcast Agreement?

Discovering the right authorized record design can be a battle. Of course, there are a lot of layouts available on the net, but how would you find the authorized kind you want? Take advantage of the US Legal Forms web site. The assistance gives thousands of layouts, such as the Colorado Totalcast Agreement, that can be used for business and private demands. All the forms are checked out by professionals and meet up with federal and state needs.

In case you are previously authorized, log in for your bank account and click the Acquire option to obtain the Colorado Totalcast Agreement. Use your bank account to search through the authorized forms you possess purchased earlier. Proceed to the My Forms tab of your own bank account and have yet another backup of your record you want.

In case you are a whole new consumer of US Legal Forms, listed below are straightforward recommendations for you to follow:

- Initially, make sure you have selected the correct kind for your city/area. You are able to examine the form utilizing the Preview option and look at the form information to make sure it is the right one for you.

- In the event the kind is not going to meet up with your expectations, make use of the Seach industry to discover the correct kind.

- Once you are positive that the form is acceptable, go through the Buy now option to obtain the kind.

- Choose the pricing strategy you need and enter in the required details. Build your bank account and buy your order with your PayPal bank account or bank card.

- Select the data file formatting and down load the authorized record design for your system.

- Full, edit and print and indication the obtained Colorado Totalcast Agreement.

US Legal Forms may be the biggest catalogue of authorized forms for which you can discover a variety of record layouts. Take advantage of the company to down load appropriately-created files that follow state needs.

Form popularity

FAQ

Enter on DR 0108 the name and Social Security number, ITIN or FEIN of the nonresident partner or shareholder who will ultimately claim this payment. Do not send cash. Enclose, but do not staple or attach, your payment with this form. The State may convert your check to a one-time electronic banking transaction.

You can establish residency in one of the following ways: Own or operate a business in Colorado. Are gainfully employed in Colorado. Reside in Colorado for 90 consecutive days. New Colorado Resident | Frequently Asked Questions colorado.gov ? new-colorado-resident colorado.gov ? new-colorado-resident

You must file a Colorado income tax return if during the year you were: A full-year resident of Colorado, or. A part-year resident of Colorado with taxable income during that part of the year you were a resident, or. Individual Income Tax | Filing Requirements colorado.gov ? individual-income-tax-filing-r... colorado.gov ? individual-income-tax-filing-r...

A partnership or S corporation may file a composite income tax return for its nonresident partners or shareholders, as a simplified way of paying the income tax owed by those partners or shareholders. Nonresident Partners & Shareholders | Department of Revenue Colorado Department of Revenue-Taxation (.gov) ? nonresident-partners-shareh... Colorado Department of Revenue-Taxation (.gov) ? nonresident-partners-shareh...

Be at least 18 years of age on or before December 31, 2021; Be a Colorado resident for the entire 2021 income tax year; And file a state income tax return for the 2021 income tax year (or on extension by October 17, 2022) or apply for a Property Tax/Rent/Heat Credit (PTC) Rebate. Colorado Cash Back | Department of Revenue - Taxation colorado.gov ? cash-back colorado.gov ? cash-back

An S CORPORATION must file Form 106 for any year it is doing business in Colorado. Doing business in a state is defined as having income arising from the activity of one or more employees located in the state; or arising from the fact that real or personal property is located in the state for business purposes.

Nonresident Definition However, the person may have temporarily worked in Colorado and/or received income from a source in Colorado. A nonresident is required to file a Colorado income tax return if they: are required to file a federal income tax return, and. had taxable Colorado-sourced income.

A partnership or S corporation may file a composite income tax return for its nonresident partners or shareholders, as a simplified way of paying the income tax owed by those partners or shareholders.