A Colorado General Security Agreement granting secured party secured interest is a legal document that establishes a relationship between a borrower (known as the debtor) and a lender (known as the secured party) in Colorado. This agreement essentially provides the lender with a security interest in the debtor's collateral, such as assets, real estate, or personal property, to secure the repayment of a loan or the fulfillment of a debt obligation. Keywords: Colorado, General Security Agreement, secured party, secured interest, collateral, borrower, lender, debtor, assets, real estate, personal property, loan, debt obligation. There are different types of Colorado General Security Agreements granting secured party secured interest, which include: 1. Real Estate Security Agreement: This type of agreement focuses on securing the lender's interest in real property or real estate owned by the debtor, such as land, buildings, or other immovable structures. 2. Chattel Security Agreement: This agreement secures the lender's interest in movable personal property, excluding real estate. It can cover assets like vehicles, equipment, inventory, or intellectual property. 3. Floating Charge Agreement: This agreement allows the debtor to use various assets as collateral, even if those assets may change over time. It provides flexibility for the debtor's business operations while securing the lender's interest. 4. Purchase Money Security Agreement: This agreement applies when a lender provides funds for a debtor to acquire specific collateral, such as purchasing a vehicle or equipment. The collateral itself serves as security for the loan. 5. Inventory Security Agreement: This agreement secures the lender's interest in the debtor's inventory or stock, which may include goods or products held for sale or in the manufacturing process. 6. Accounts Receivable Security Agreement: This agreement focuses on securing the lender's interest in the debtor's accounts receivable, which represents the amounts owed to the debtor by its customers for goods or services provided. In conclusion, a Colorado General Security Agreement granting secured party secured interest is a legally binding document that provides the lender with a security interest in the debtor's collateral. Different types of such agreements exist, depending on the nature of the collateral involved, such as real estate, personal property, inventory, or accounts receivable.

Colorado General Security Agreement granting secured party secured interest

Description

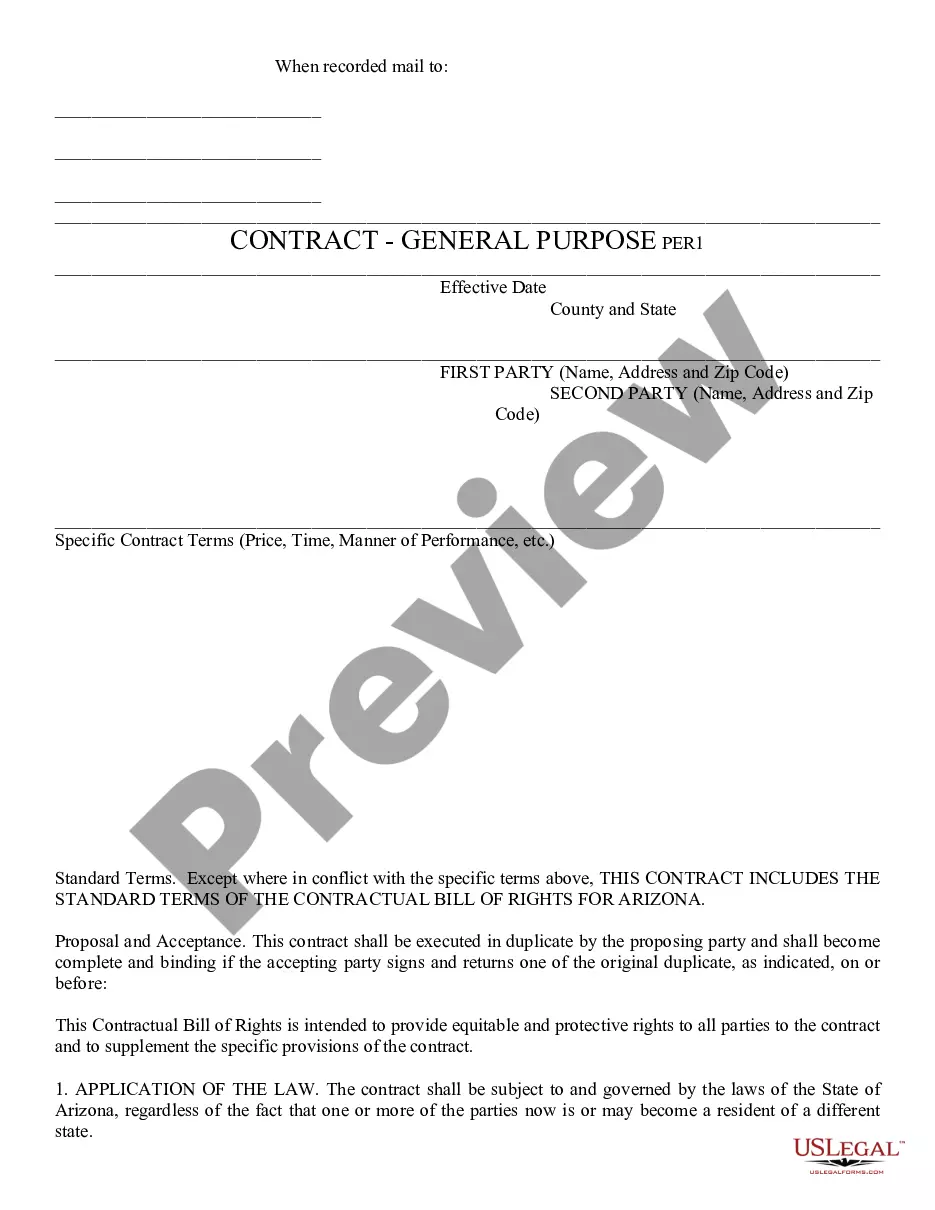

How to fill out Colorado General Security Agreement Granting Secured Party Secured Interest?

You can commit hours on the web attempting to find the legitimate document template which fits the state and federal specifications you want. US Legal Forms supplies thousands of legitimate varieties which are analyzed by professionals. You can easily obtain or print out the Colorado General Security Agreement granting secured party secured interest from the assistance.

If you currently have a US Legal Forms account, you can log in and click the Down load option. Following that, you can full, change, print out, or indication the Colorado General Security Agreement granting secured party secured interest. Every legitimate document template you purchase is yours permanently. To acquire an additional duplicate associated with a bought kind, visit the My Forms tab and click the related option.

If you work with the US Legal Forms website the very first time, keep to the simple recommendations under:

- First, make certain you have chosen the best document template to the area/town of your choice. Read the kind explanation to ensure you have picked out the proper kind. If accessible, make use of the Preview option to look with the document template too.

- If you want to get an additional variation of your kind, make use of the Lookup field to discover the template that meets your requirements and specifications.

- Upon having identified the template you want, simply click Acquire now to carry on.

- Pick the prices plan you want, type in your references, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You can use your bank card or PayPal account to purchase the legitimate kind.

- Pick the structure of your document and obtain it in your device.

- Make adjustments in your document if required. You can full, change and indication and print out Colorado General Security Agreement granting secured party secured interest.

Down load and print out thousands of document web templates making use of the US Legal Forms website, which offers the largest selection of legitimate varieties. Use professional and express-particular web templates to take on your company or specific requirements.