Colorado Subscription Agreement

Description

How to fill out Subscription Agreement?

If you need to total, download, or print out authorized papers themes, use US Legal Forms, the most important selection of authorized kinds, that can be found on the web. Use the site`s basic and hassle-free search to obtain the paperwork you will need. Numerous themes for enterprise and personal reasons are sorted by categories and says, or search phrases. Use US Legal Forms to obtain the Colorado Subscription Agreement in just a handful of mouse clicks.

When you are previously a US Legal Forms customer, log in in your bank account and click the Down load option to have the Colorado Subscription Agreement. You may also accessibility kinds you earlier delivered electronically in the My Forms tab of your bank account.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for your correct city/land.

- Step 2. Make use of the Preview method to look over the form`s information. Don`t forget to see the information.

- Step 3. When you are unsatisfied using the develop, take advantage of the Lookup field near the top of the screen to discover other types of your authorized develop format.

- Step 4. After you have found the shape you will need, select the Acquire now option. Choose the rates prepare you choose and add your credentials to sign up for the bank account.

- Step 5. Approach the financial transaction. You can use your credit card or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the format of your authorized develop and download it on the product.

- Step 7. Total, change and print out or indication the Colorado Subscription Agreement.

Each and every authorized papers format you acquire is your own for a long time. You may have acces to each and every develop you delivered electronically inside your acccount. Select the My Forms section and decide on a develop to print out or download yet again.

Remain competitive and download, and print out the Colorado Subscription Agreement with US Legal Forms. There are thousands of skilled and condition-specific kinds you can use for your personal enterprise or personal requires.

Form popularity

FAQ

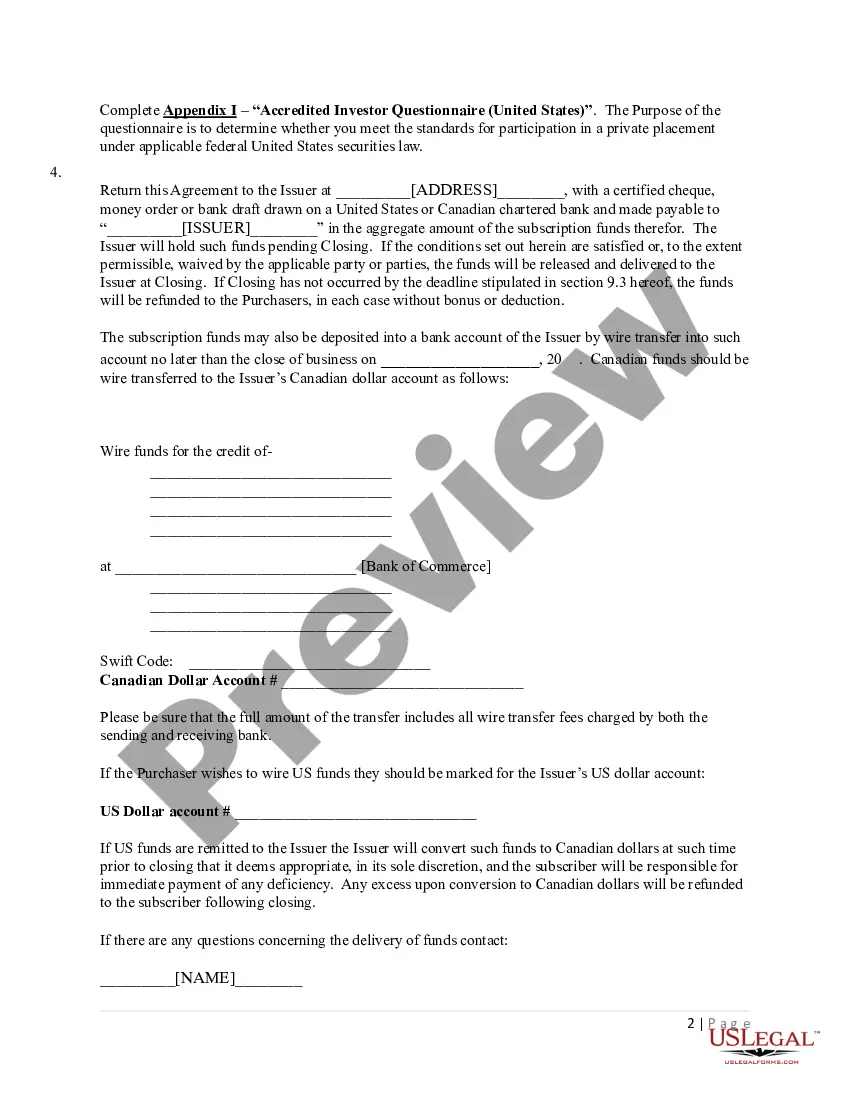

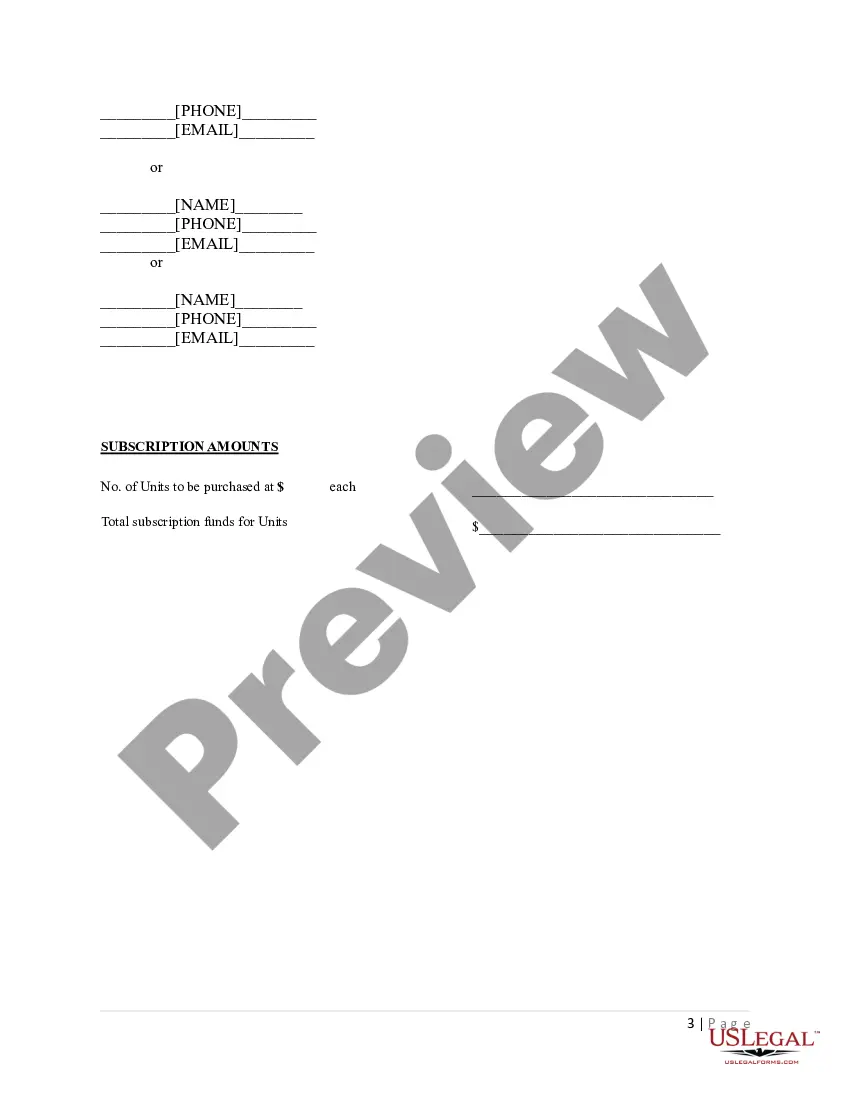

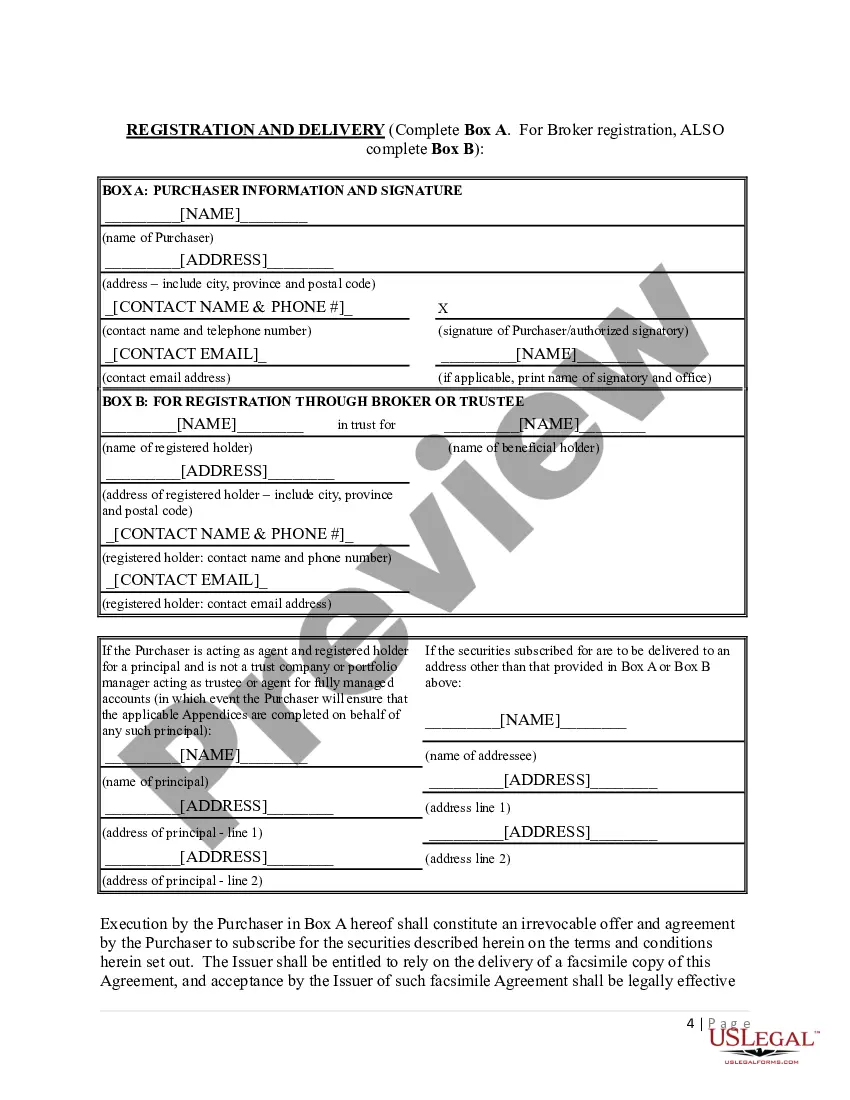

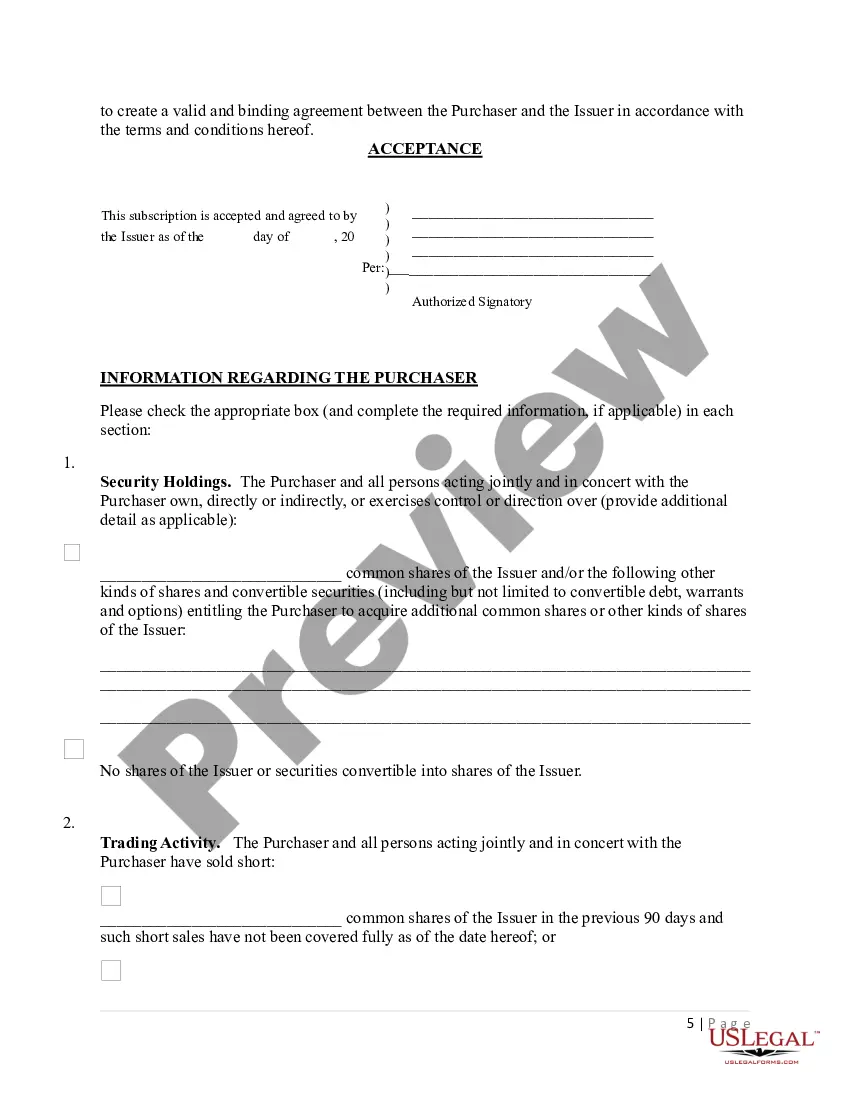

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

The Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.