Colorado Letter of Transmittal

Description

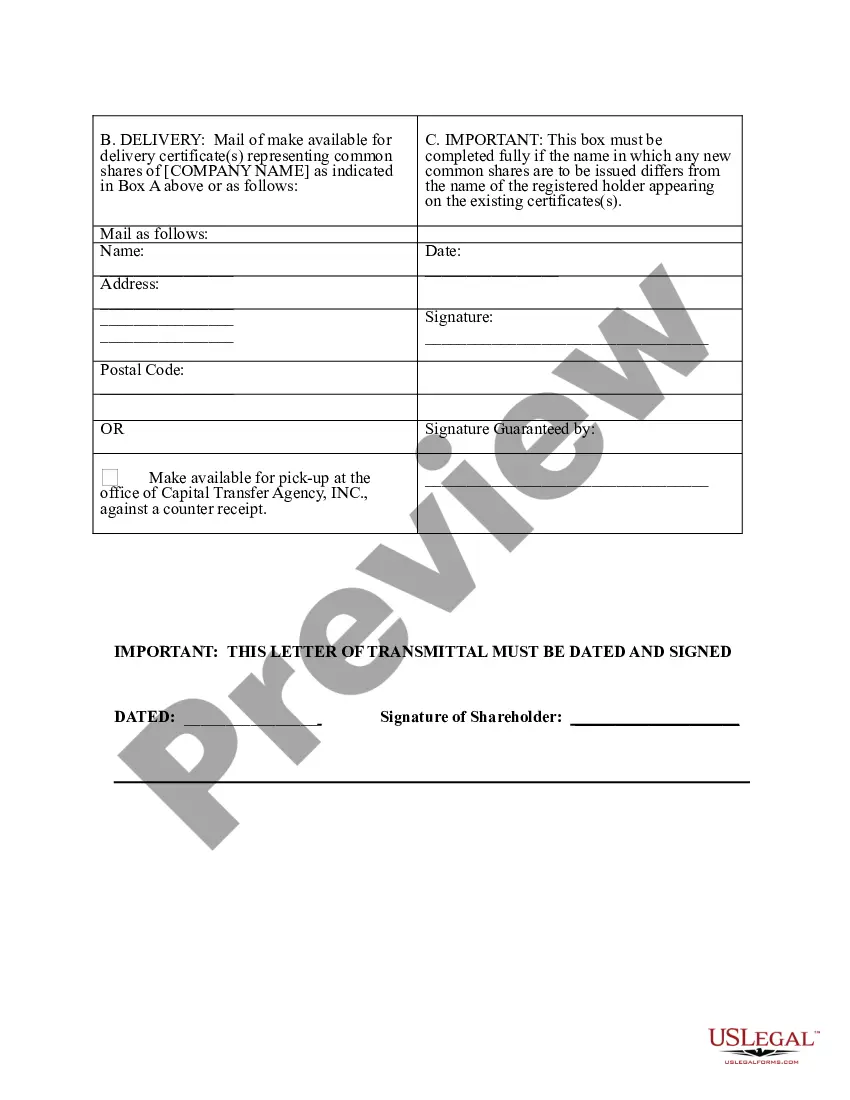

How to fill out Letter Of Transmittal?

Have you been in a position in which you will need papers for sometimes company or person uses almost every day? There are a lot of legitimate document web templates available online, but locating ones you can rely is not simple. US Legal Forms gives thousands of type web templates, just like the Colorado Letter of Transmittal, that happen to be created in order to meet state and federal specifications.

In case you are previously familiar with US Legal Forms website and possess a free account, basically log in. Next, you can obtain the Colorado Letter of Transmittal template.

Unless you offer an accounts and want to begin to use US Legal Forms, adopt these measures:

- Discover the type you require and ensure it is for your correct area/county.

- Make use of the Review button to check the shape.

- See the outline to ensure that you have chosen the right type.

- If the type is not what you`re seeking, take advantage of the Search area to find the type that suits you and specifications.

- Once you obtain the correct type, just click Acquire now.

- Select the rates program you need, complete the necessary info to produce your bank account, and purchase an order utilizing your PayPal or bank card.

- Decide on a hassle-free file structure and obtain your duplicate.

Get all the document web templates you may have bought in the My Forms food list. You can aquire a additional duplicate of Colorado Letter of Transmittal at any time, if needed. Just select the needed type to obtain or print the document template.

Use US Legal Forms, the most comprehensive selection of legitimate kinds, to conserve some time and stay away from faults. The assistance gives appropriately made legitimate document web templates which can be used for a selection of uses. Create a free account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

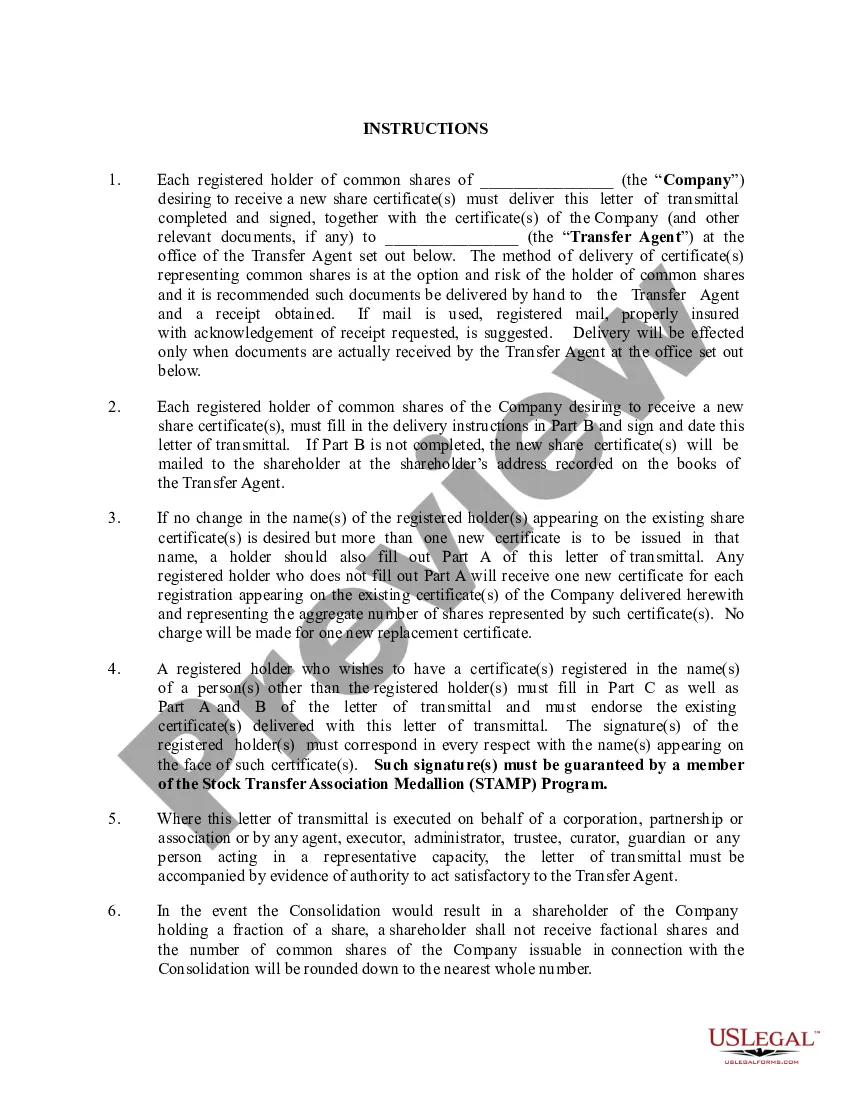

Letters of transmittal are usually brief, often with three paragraphs, each one devoted to a specific purpose: review the purpose of the report, offer a brief overview of main ideas in the report, and offer to provide fuller information as needed, along with a ?thank you? and contact information.

Form DR-1093 is Annual Transmittal of State W-2 Forms used to report income tax withheld per W-2s and income tax withheld and paid.

For W-2s, the electronic file must be IRS Format 1220 or CDOR-EFW2. The RA record on the file must match what you enter as the Submitter Information in Revenue Online. Follow the prompts in Revenue Online and click "Submit."

As you draft your letter of transmittal, adhere to these guidelines: Follow proper business letter. Maintain a professional tone. Clarify the purpose of the letter (to notify the recipient that the report is enclosed) Offer any specific details necessary for the reader to understand why the report was written.

How to write a letter of transmittal Include a heading with the date and recipient's address. Include a heading with your full name and company address, located in the top left corner of the page. ... Greet the recipient appropriately. ... Write the letter body. ... Include a short closing paragraph.

The income tax withholding formula for the State of Colorado includes the following changes: The annual amount per exemption has increased from $4,050 to $4,200.

We have received federal 1040 and 1040-SR tax forms, 1040 instructions, and Colorado state 104 tax booklets. These are the only forms and instructions issued to us for the current tax year. The Internal Revenue Service is moving to a web-first service approach and reducing the availability of paper tax products.

DR 0004. Colorado Employee Withholding Certificate ? This form gives employees the option to adjust their Colorado wage withholding ing to their specific tax situation. If an employee does not submit this form, the employer will calculate their withholding based on their federal withholding certificate, form W-4.