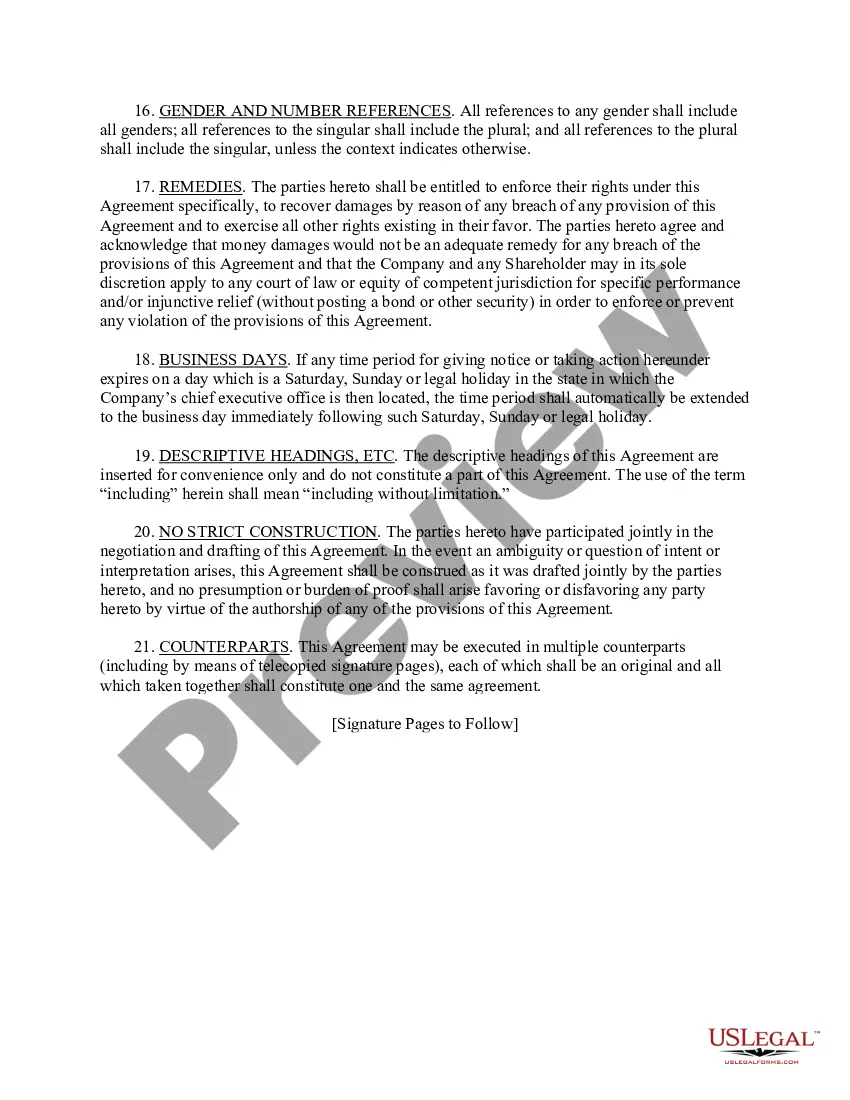

Colorado Shareholders Agreement

Description

How to fill out Shareholders Agreement?

US Legal Forms - one of the greatest libraries of authorized varieties in America - provides a wide range of authorized file layouts you can download or print. Utilizing the website, you can find 1000s of varieties for company and specific functions, sorted by categories, states, or keywords and phrases.You will find the latest versions of varieties like the Colorado Shareholders Agreement in seconds.

If you currently have a membership, log in and download Colorado Shareholders Agreement in the US Legal Forms catalogue. The Acquire option will appear on each and every form you view. You gain access to all earlier delivered electronically varieties inside the My Forms tab of the bank account.

If you would like use US Legal Forms the first time, allow me to share simple instructions to obtain began:

- Be sure you have picked the best form for your area/region. Click on the Preview option to examine the form`s information. See the form explanation to actually have selected the correct form.

- In case the form doesn`t match your requirements, make use of the Look for discipline at the top of the display screen to discover the one that does.

- In case you are pleased with the form, confirm your choice by clicking on the Get now option. Then, opt for the costs plan you favor and offer your references to register for an bank account.

- Process the deal. Make use of credit card or PayPal bank account to finish the deal.

- Choose the formatting and download the form on the gadget.

- Make adjustments. Load, revise and print and indicator the delivered electronically Colorado Shareholders Agreement.

Every template you included in your account lacks an expiry day and is also the one you have for a long time. So, if you would like download or print another duplicate, just go to the My Forms portion and click in the form you will need.

Gain access to the Colorado Shareholders Agreement with US Legal Forms, one of the most considerable catalogue of authorized file layouts. Use 1000s of skilled and status-certain layouts that meet up with your organization or specific needs and requirements.

Form popularity

FAQ

An S CORPORATION must file Form 106 for any year it is doing business in Colorado. Doing business in a state is defined as having income arising from the activity of one or more employees located in the state; or arising from the fact that real or personal property is located in the state for business purposes.

Colorado taxes capital gains as income and the rate reaches 4.55%.

A partnership or S corporation may file a composite income tax return for its nonresident partners or shareholders, as a simplified way of paying the income tax owed by those partners or shareholders.

The Colorado Department of RevenueA revised its guidelines in FYI Income 54A regarding people who do not live in Colorado but are partners and/or shareholders of partnerships and/or S corporations in Colorado, ensuring that pass-through entities pay Colorado income tax on their Colorado-source income.

Bonus tax rates for 2023-2024 to know: The flat withholding rate for bonuses is 22% ? except when those bonuses are above $1 million. If your employee's bonus exceeds $1 million, congratulations to both of you on your success! These large bonuses are taxed at a flat rate of 37%.

Colorado Income Tax PERA can withhold Colorado state income tax if requested. PERA does not withhold taxes for any other state. Colorado law excludes from Colorado state income tax total pension income up to $20,000 per year per person for those retirees age 55 through 64, or $24,000 for those retirees age 65 and over.

A partnership or S corporation may file a composite income tax return for its nonresident partners or shareholders, as a simplified way of paying the income tax owed by those partners or shareholders.

Enter on DR 0108 the name and Social Security number, ITIN or FEIN of the nonresident partner or shareholder who will ultimately claim this payment. Do not send cash. Enclose, but do not staple or attach, your payment with this form. The State may convert your check to a one-time electronic banking transaction.