Colorado Investment-Grade Bond Optional Redemption (with a Par Call) refers to a type of bond issued by the state of Colorado, which offers investors the option to redeem the bond before its maturity at a specified price known as the "par call" price. The par call price is typically equal to the face value or the original price at which the bond was issued. Investment-grade bonds are considered to have a relatively low risk of default and are assigned a high credit rating by well-established credit agencies. This makes them an attractive investment option for risk-averse investors seeking a stable income stream. The optional redemption feature provides flexibility for bondholders, enabling them to potentially capitalize on favorable market conditions or changes in interest rates. By calling the bond before its maturity, investors have the opportunity to reinvest their capital at potentially higher yields in alternative investment opportunities. It is important to note that there may be different types or variations of Colorado Investment-Grade Bond Optional Redemption (with a Par Call), each with its own specific terms and conditions. Some possible variations could include: 1. Callable Bonds: These bonds can be called by the issuer at any time, typically after a certain period, giving them the right to redeem the bonds before maturity. 2. Make-Whole Call Provision: In addition to a par call option, these bonds may include a make-whole call provision, whereby the issuer compensates the bondholder for potential lost interest payments if the bond is called before maturity. 3. Sinking Fund Provision: Some Colorado investment-grade bonds may include a sinking fund provision. This provision requires the issuer to set aside a portion of funds periodically to redeem a predetermined amount of bonds before the maturity date. 4. Serial Bonds: These bonds are issued in multiple tranches, each with its own maturity date and par call option. This approach offers investors flexibility by allowing them to choose bonds with different maturity and redemption dates. In conclusion, Colorado Investment-Grade Bond Optional Redemption (with a Par Call) presents a viable investment option for individuals or institutions seeking stable income with a relatively low-risk profile. The optional redemption feature allows investors to potentially optimize returns and react to market conditions, potentially enhancing their investment strategies. Different variations of these bonds may exist, offering further customization to suit specific investment needs.

Colorado Investment - Grade Bond Optional Redemption (with a Par Call)

Description

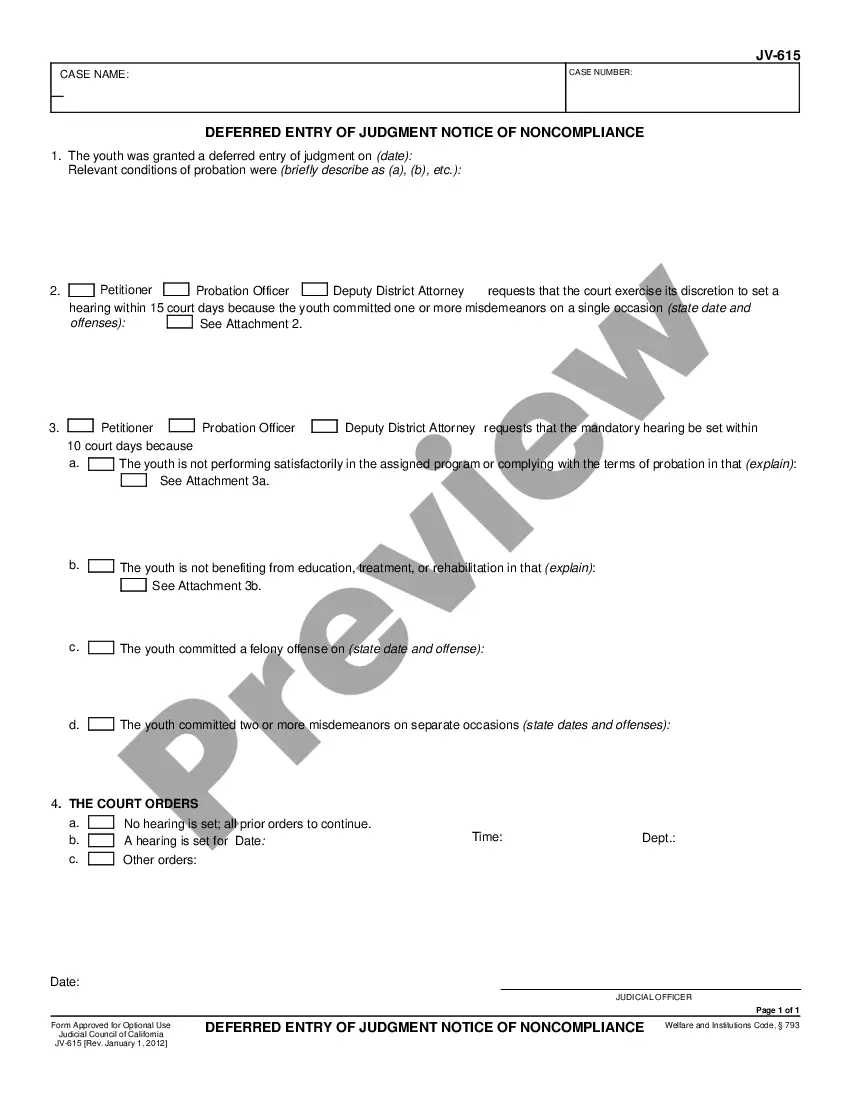

How to fill out Colorado Investment - Grade Bond Optional Redemption (with A Par Call)?

If you need to comprehensive, down load, or print out legal record web templates, use US Legal Forms, the most important collection of legal types, that can be found on the web. Utilize the site`s simple and hassle-free lookup to get the documents you require. A variety of web templates for enterprise and specific functions are sorted by groups and says, or keywords. Use US Legal Forms to get the Colorado Investment - Grade Bond Optional Redemption (with a Par Call) with a few mouse clicks.

When you are previously a US Legal Forms customer, log in for your account and click on the Down load switch to get the Colorado Investment - Grade Bond Optional Redemption (with a Par Call). Also you can entry types you earlier downloaded inside the My Forms tab of the account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have chosen the form for the proper city/nation.

- Step 2. Utilize the Review method to check out the form`s content material. Do not neglect to read through the explanation.

- Step 3. When you are unhappy with the type, make use of the Research industry on top of the monitor to get other models of your legal type template.

- Step 4. Upon having located the form you require, go through the Buy now switch. Opt for the rates strategy you like and put your references to sign up for the account.

- Step 5. Method the purchase. You can utilize your bank card or PayPal account to finish the purchase.

- Step 6. Select the structure of your legal type and down load it in your product.

- Step 7. Full, modify and print out or indication the Colorado Investment - Grade Bond Optional Redemption (with a Par Call).

Each and every legal record template you buy is yours forever. You might have acces to every single type you downloaded inside your acccount. Select the My Forms area and decide on a type to print out or down load once more.

Remain competitive and down load, and print out the Colorado Investment - Grade Bond Optional Redemption (with a Par Call) with US Legal Forms. There are many specialist and condition-specific types you can utilize for the enterprise or specific requires.

Form popularity

FAQ

Optional Redemption On or after the Par Call Date, the Company may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to the redemption date. SIFMA Model Provision?Investment-Grade Bond Optional ... Shearman & Sterling ? files ? 2021/11 ? s... Shearman & Sterling ? files ? 2021/11 ? s... PDF

Bond redemption is the process by which a bond issuer repays the principal amount of a bond to the bondholder on the bond's maturity date. When a bond is issued, it has a specified term or maturity date, which is the date when the bond issuer is obligated to pay back the principal amount of the bond to the bondholder. Bond Redemption and Types of Bond Redemption | IndiaBonds indiabonds.com ? news-and-insight ? bond-... indiabonds.com ? news-and-insight ? bond-...

Bond Redemption Date means, with respect to any Bond, the date on which such Bond is redeemed pursuant to the applicable Bond Documents. Bond Redemption Date means any date, other than an Interest Payment Date, upon which Bonds shall be redeemed pursuant to the Indenture. Bond Redemption Date Definition | Law Insider lawinsider.com ? dictionary ? bond-redempt... lawinsider.com ? dictionary ? bond-redempt...

A bond redemption is the full repayment of the principal amount (the amount you invested) and any interest owed to date. What is bond redemption? - Help Centre - Crowdcube crowdcube.com ? en-us ? articles ? 3600006... crowdcube.com ? en-us ? articles ? 3600006...

Optional Redemption. Allows the issuer, at its option, to redeem the bonds. Many municipal bonds, for example, have optional call features that issuers may exercise after a certain number of years, often 10 years. Sinking Fund Redemption. Callable or Redeemable Bonds - Investor.gov investor.gov ? investing-basics ? glossary investor.gov ? investing-basics ? glossary