Colorado Investors Rights Agreement

Description

How to fill out Investors Rights Agreement?

Choosing the right legitimate papers template can be quite a have difficulties. Naturally, there are tons of themes available on the Internet, but how can you get the legitimate form you require? Utilize the US Legal Forms website. The services delivers 1000s of themes, like the Colorado Investors Rights Agreement, which you can use for business and personal demands. All of the types are inspected by professionals and meet up with federal and state requirements.

When you are presently registered, log in in your profile and click the Down load option to find the Colorado Investors Rights Agreement. Utilize your profile to check from the legitimate types you possess bought earlier. Visit the My Forms tab of your own profile and acquire another version of the papers you require.

When you are a fresh consumer of US Legal Forms, listed below are easy directions that you can follow:

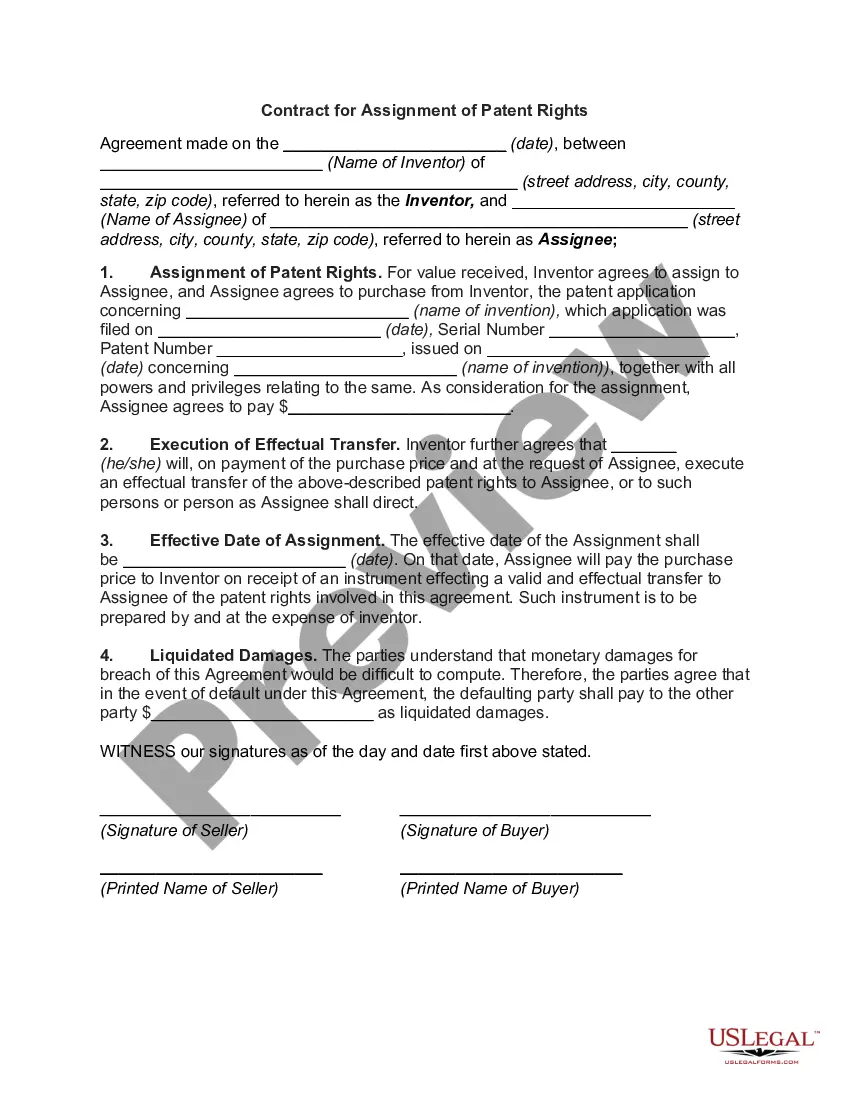

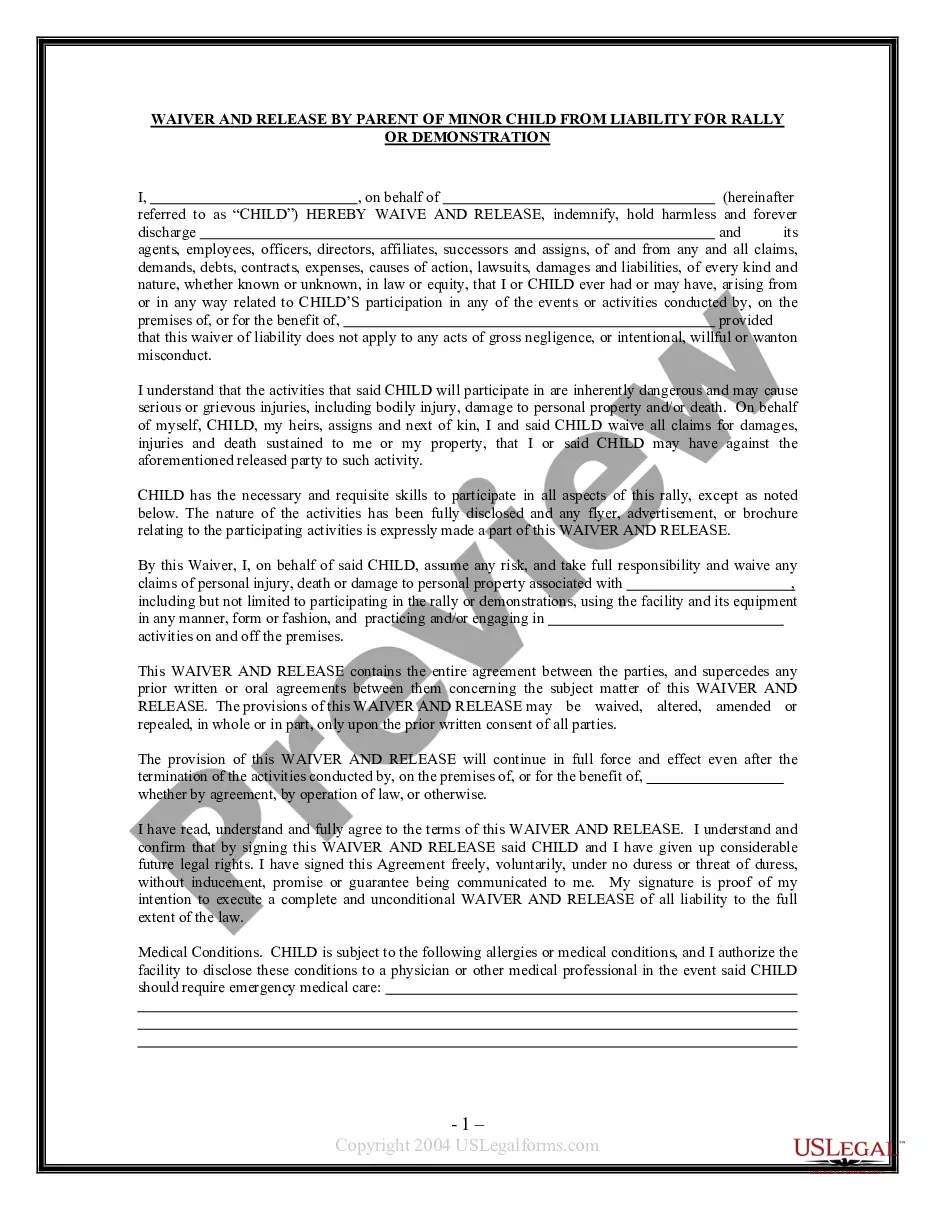

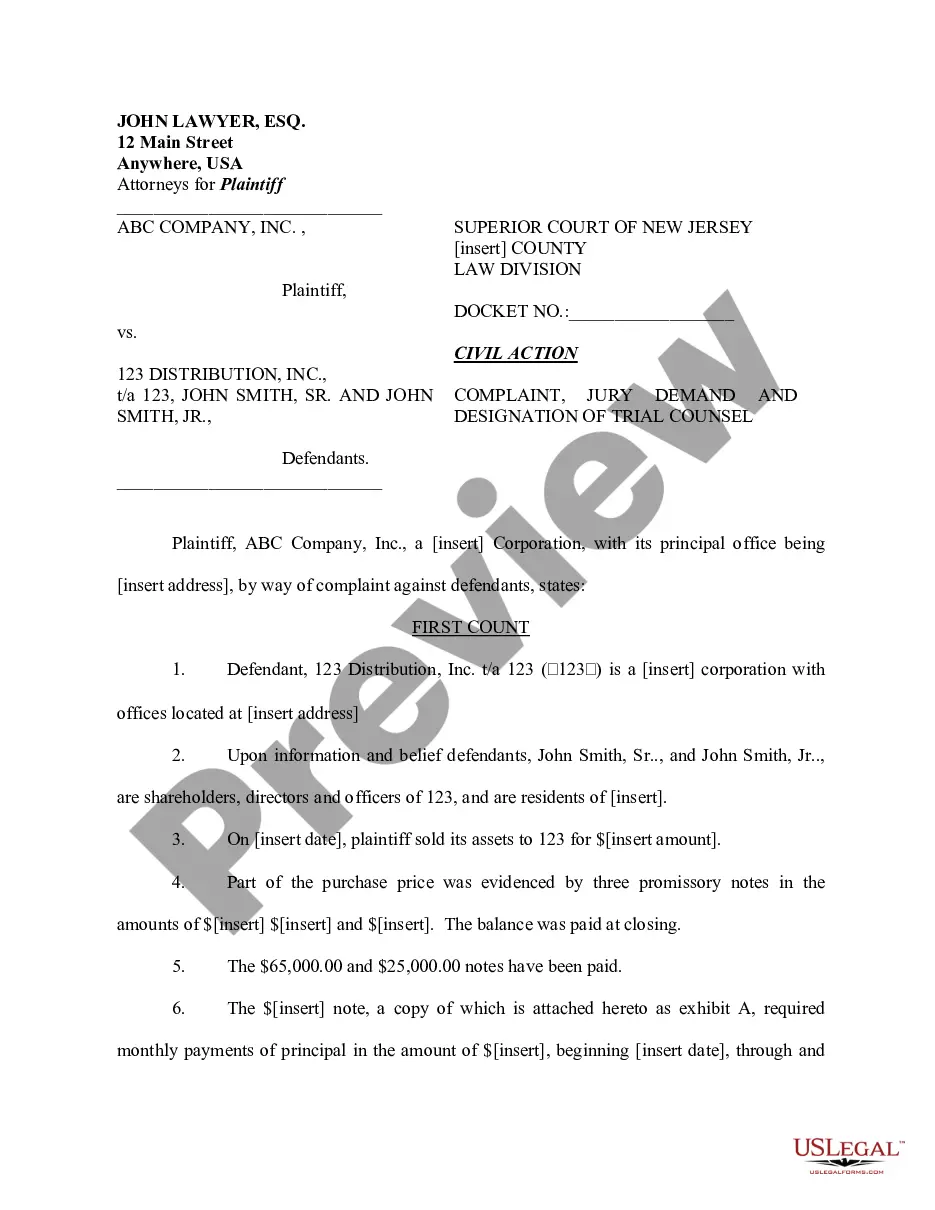

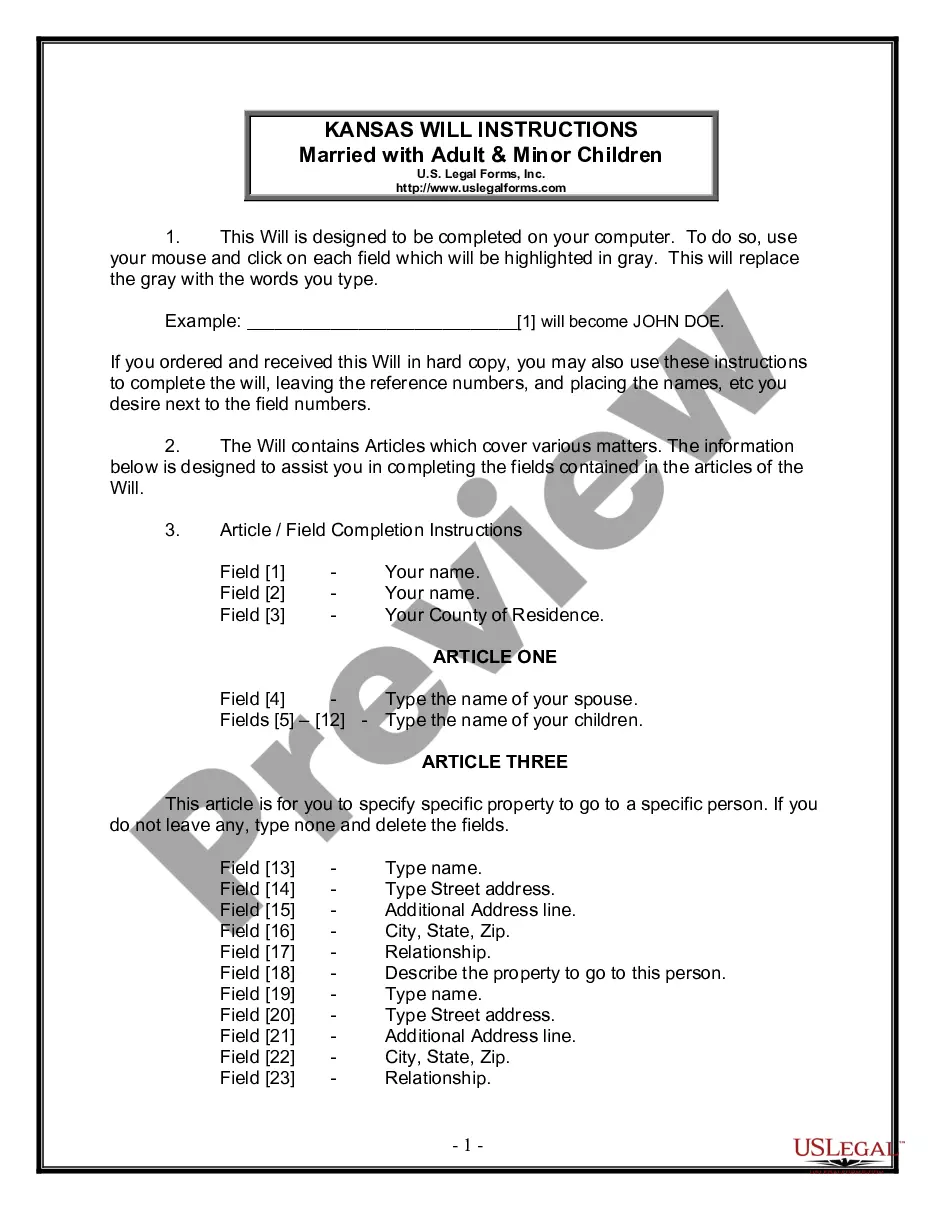

- Initially, make certain you have selected the proper form for your personal area/state. You can check out the form utilizing the Review option and look at the form information to ensure this is basically the best for you.

- In the event the form is not going to meet up with your needs, take advantage of the Seach industry to get the right form.

- When you are positive that the form would work, click the Purchase now option to find the form.

- Opt for the rates plan you would like and enter in the required info. Create your profile and purchase your order making use of your PayPal profile or Visa or Mastercard.

- Opt for the document format and down load the legitimate papers template in your system.

- Complete, edit and produce and indicator the received Colorado Investors Rights Agreement.

US Legal Forms is the largest library of legitimate types where you can find a variety of papers themes. Utilize the company to down load skillfully-manufactured documents that follow condition requirements.

Form popularity

FAQ

An investor rights agreement (IRA) is a typical document negotiated between a venture capitalist (VC) and other concerns providing capital financing to a startup company. It provides the rights and privileges afforded these new stockholders in the company.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

What to include in an investor agreement. A well-executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures. In addition, when drafting an investor agreement, the Kumar Law Firm said to be concise and not leave room for ambiguity.

An example would be if Dexter gives $100,000 to ABC (company) in exchange for a convertible debt note that will either be repaid in 1 year with 50% gain or converted into 100,000 shares of the company's stock.

An investment agreement is a legally binding contract between two or more parties that outlines the terms and conditions of an investment arrangement.

How to draft a contract agreement Check out the parties. Come to an agreement on the terms. Specify the length of the contract. Spell out the consequences. Determine how you would resolve any disputes. Think about confidentiality. Check the contract's legality. Open it up to negotiation.

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards.

What to include in an investor agreement. A well-executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures. In addition, when drafting an investor agreement, the Kumar Law Firm said to be concise and not leave room for ambiguity.