This guide has two parts: Part A to help you determine whether your business or organization is at low risk, and Part B to help you design your written Identity Theft Prevention Program if your business is in the low risk category.

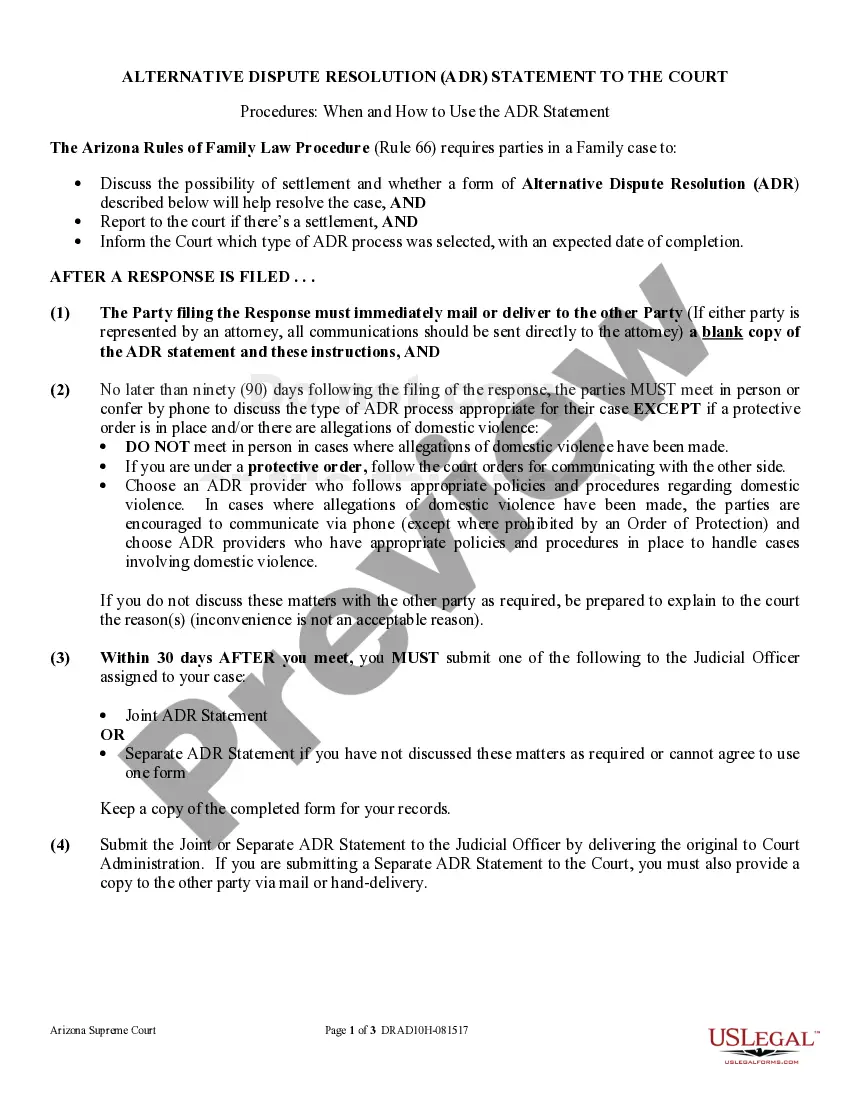

Note: The preview only shows the 1st page of the document.

Colorado Guide to Complying with the Red Flags Rule under FCRA and FACT: The Colorado Guide to Complying with the Red Flags Rule under FCRA (Fair Credit Reporting Act) and FACT (Fair and Accurate Credit Transactions Act) is a comprehensive resource designed to assist businesses and organizations operating in Colorado with understanding and complying with the Red Flags Rule. The Red Flags Rule mandates that certain businesses and organizations must implement a written Identity Theft Prevention Program to detect, prevent, and mitigate identity theft. This regulation is enforced by the Federal Trade Commission (FTC) and applies to entities that are considered "creditors" or "financial institutions" under the FCRA and FACT. The Colorado Guide provides detailed guidance on how businesses can identify and assess potential Red Flags, which are indicators of possible identity theft. It emphasizes the importance of having clear policies and procedures in place to identify suspicious patterns or activities that may indicate identity theft. Key aspects covered in the Colorado Guide include: 1. Scope and Applicability: The guide explains which types of businesses and organizations fall under the scope of the Red Flags Rule in Colorado. This includes financial institutions such as banks and credit unions, as well as creditors such as healthcare providers, telecommunications companies, and utility companies. 2. Red Flags Identification: The guide provides a comprehensive list of potential red flags that businesses should consider when developing their Identity Theft Prevention Program. These red flags may include suspicious account activity, unusual requests for personal information, or discrepancies in customer information. 3. Risk Assessment: To ensure an effective program, businesses must assess the risk of identity theft in their specific operations. The Colorado Guide offers guidance on how to conduct this risk assessment and tailor preventive measures accordingly. 4. Program Development: The guide provides a step-by-step process for developing an Identity Theft Prevention Program in compliance with the Red Flags Rule. It includes templates and examples to assist businesses in designing their own comprehensive program. 5. Staff Training and Awareness: As employees play a crucial role in detecting and preventing identity theft, the Colorado Guide emphasizes the importance of training staff on Red Flags Rule compliance. It provides tips and resources for creating effective employee training programs and promoting ongoing awareness. It is worth noting that the Colorado Guide may have specific versions or adaptations tailored to different industries or sectors, such as healthcare, banking, or utilities. These versions provide industry-specific guidance while still aligning with the requirements of the Red Flags Rule under FCRA and FACT. In conclusion, the Colorado Guide to Complying with the Red Flags Rule under FCRA and FACT is a valuable resource for businesses and organizations operating in Colorado. It offers detailed guidance on implementing a comprehensive Identity Theft Prevention Program, identifying potential red flags, conducting risk assessments, and training staff to effectively combat identity theft and protect consumers' personal information. Compliance with the Red Flags Rule is crucial to maintain the integrity and security of customer data and to mitigate the risks associated with identity theft.