Colorado Framework Contractor Agreement - Self-Employed

Description

How to fill out Colorado Framework Contractor Agreement - Self-Employed?

Are you within a situation in which you need documents for sometimes enterprise or person functions just about every working day? There are a variety of lawful papers web templates available on the net, but locating ones you can rely is not straightforward. US Legal Forms offers a huge number of develop web templates, just like the Colorado Framework Contractor Agreement - Self-Employed, that happen to be written in order to meet state and federal requirements.

If you are previously knowledgeable about US Legal Forms website and have an account, simply log in. Afterward, you may down load the Colorado Framework Contractor Agreement - Self-Employed template.

If you do not have an bank account and wish to begin using US Legal Forms, adopt these measures:

- Obtain the develop you require and ensure it is for that proper city/area.

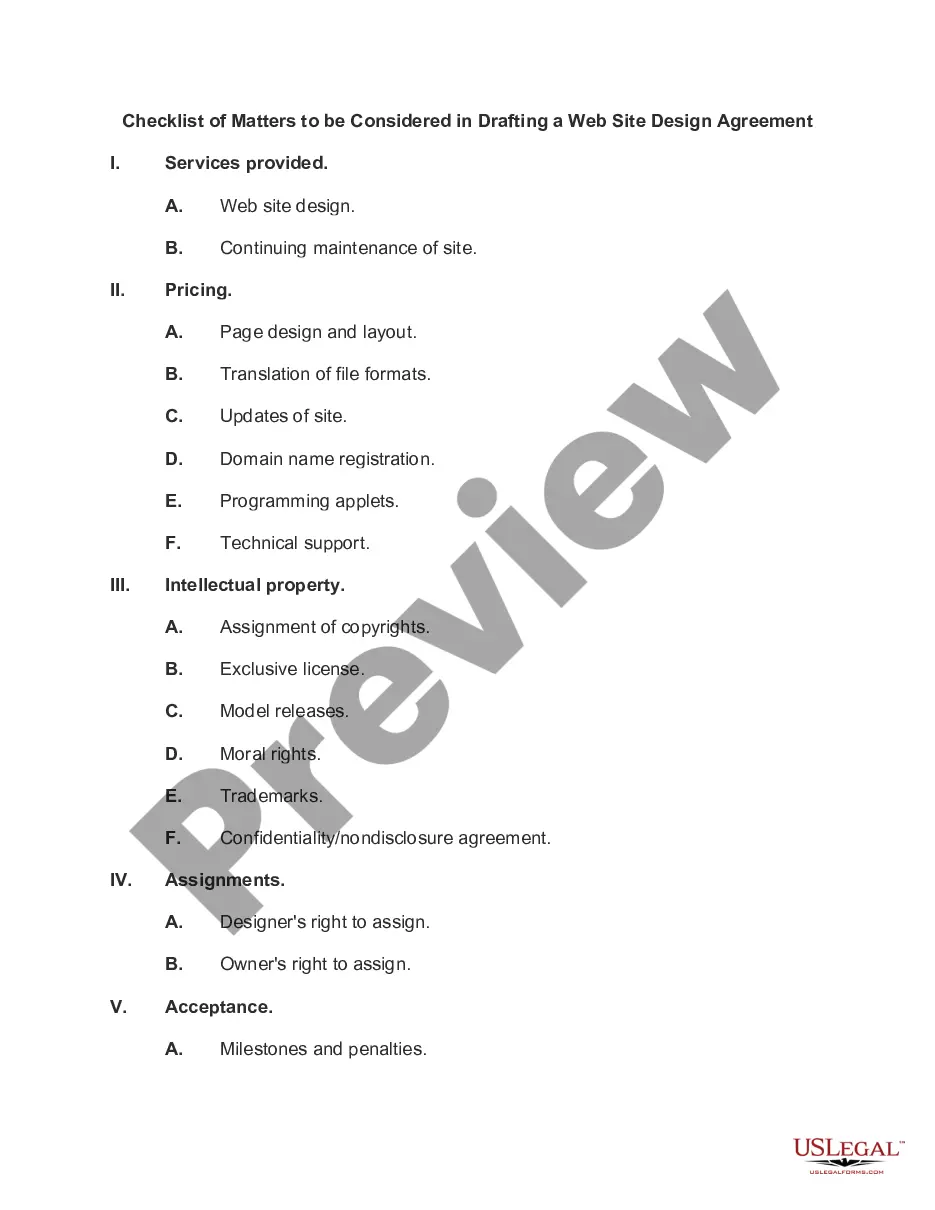

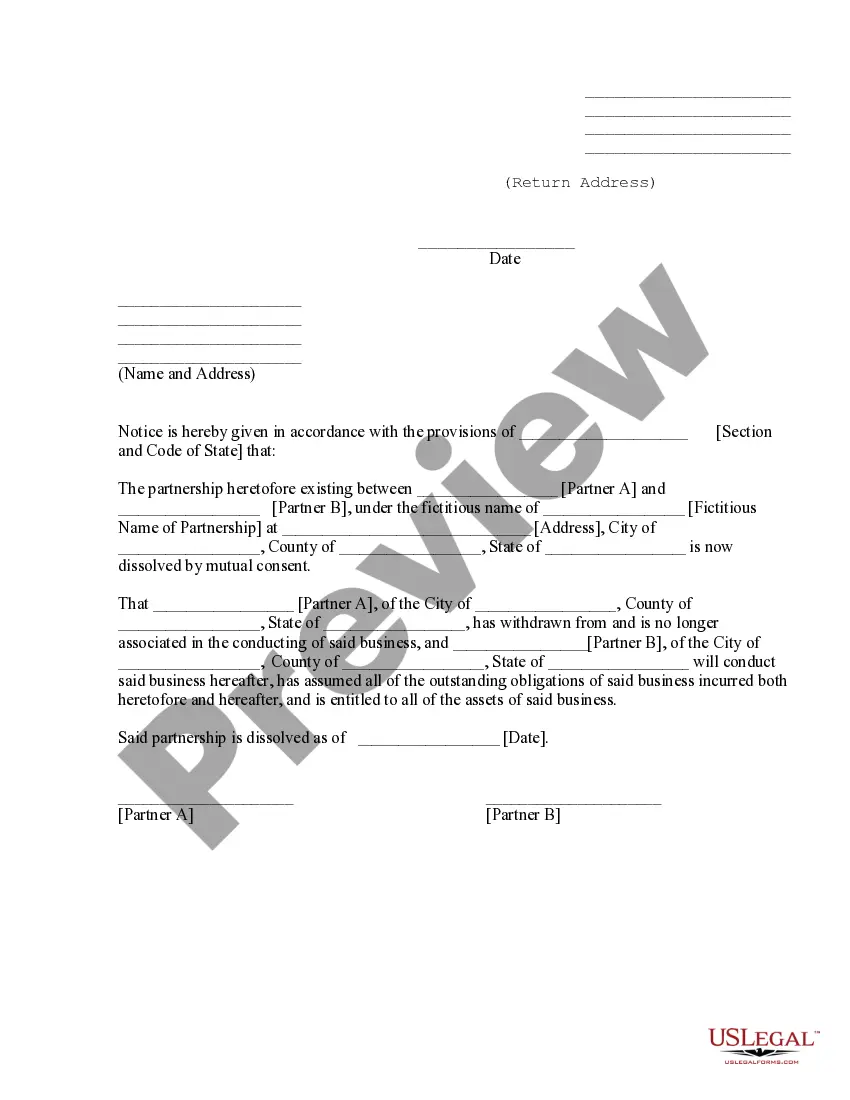

- Take advantage of the Review key to examine the form.

- See the description to actually have chosen the right develop.

- When the develop is not what you`re looking for, use the Lookup area to find the develop that meets your needs and requirements.

- If you discover the proper develop, click on Acquire now.

- Opt for the prices plan you want, fill in the specified info to produce your bank account, and purchase the order making use of your PayPal or charge card.

- Pick a convenient file formatting and down load your version.

Get all the papers web templates you may have bought in the My Forms menu. You may get a extra version of Colorado Framework Contractor Agreement - Self-Employed anytime, if necessary. Just select the needed develop to down load or print the papers template.

Use US Legal Forms, the most considerable selection of lawful varieties, to save efforts and prevent blunders. The support offers expertly created lawful papers web templates that you can use for a variety of functions. Produce an account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

Under Colorado Law, an individual is presumed to be in covered employment unless and until it is shown that the individual is free from control and direction in the performance of services, both under contract and in fact, and that the individual is customarily engaged in an independent trade, occupation, profession or

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Persons who follow a trade, business or professions such as lawyers, accountants or construction contractors who offer their services to the general public are usually considered independent contractors.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The state now requires that anyone filing a 1099 either has an LLC associated with their operations as a contractor or that they fully incorporate their business.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.