Colorado Marketing Personnel Agreement - Self-Employed Independent Contractor

Description

How to fill out Colorado Marketing Personnel Agreement - Self-Employed Independent Contractor?

If you want to comprehensive, acquire, or print legitimate papers web templates, use US Legal Forms, the biggest variety of legitimate forms, that can be found on-line. Use the site`s simple and easy convenient look for to obtain the paperwork you need. Numerous web templates for organization and individual purposes are categorized by groups and suggests, or key phrases. Use US Legal Forms to obtain the Colorado Marketing Personnel Agreement - Self-Employed Independent Contractor in a couple of click throughs.

When you are already a US Legal Forms buyer, log in in your bank account and click the Down load key to find the Colorado Marketing Personnel Agreement - Self-Employed Independent Contractor. You can also access forms you in the past delivered electronically within the My Forms tab of your bank account.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that right town/nation.

- Step 2. Make use of the Preview method to look through the form`s content material. Never neglect to learn the information.

- Step 3. When you are unhappy with all the kind, utilize the Look for discipline on top of the screen to discover other variations from the legitimate kind format.

- Step 4. Upon having identified the shape you need, select the Purchase now key. Select the prices prepare you favor and add your references to register on an bank account.

- Step 5. Method the deal. You should use your charge card or PayPal bank account to accomplish the deal.

- Step 6. Find the structure from the legitimate kind and acquire it in your gadget.

- Step 7. Full, revise and print or indication the Colorado Marketing Personnel Agreement - Self-Employed Independent Contractor.

Every single legitimate papers format you purchase is the one you have eternally. You possess acces to every single kind you delivered electronically within your acccount. Click on the My Forms segment and pick a kind to print or acquire once more.

Contend and acquire, and print the Colorado Marketing Personnel Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many skilled and express-specific forms you may use for the organization or individual requires.

Form popularity

FAQ

Five Ways to Market Your Brand as an Independent ContractorKnow Your Online Audience. In order to market yourself effectively as an independent contractor, you have to know who you're marketing to!Build a Brand for Yourself.Know Your Professional Goals.Get Clients More Involved.Take Advantage of Booksy Marketing Tools.

Who Needs A Contractor License In Colorado? You Need to Determine Which Contractor License You Need In Colorado, general contractors must obtain licenses at the municipal level, while electricians and plumbers must obtain licenses at the state level.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

Persons who follow a trade, business or professions such as lawyers, accountants or construction contractors who offer their services to the general public are usually considered independent contractors.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Under Colorado Law, an individual is presumed to be in covered employment unless and until it is shown that the individual is free from control and direction in the performance of services, both under contract and in fact, and that the individual is customarily engaged in an independent trade, occupation, profession or

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

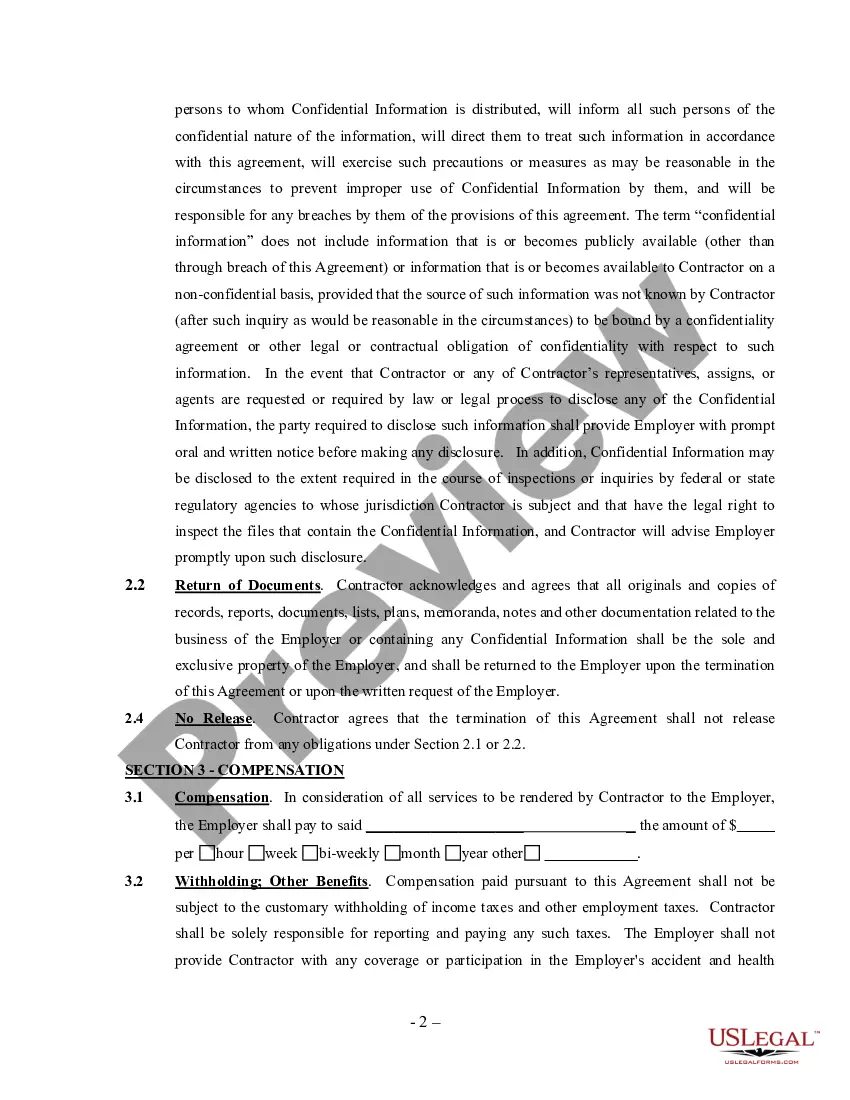

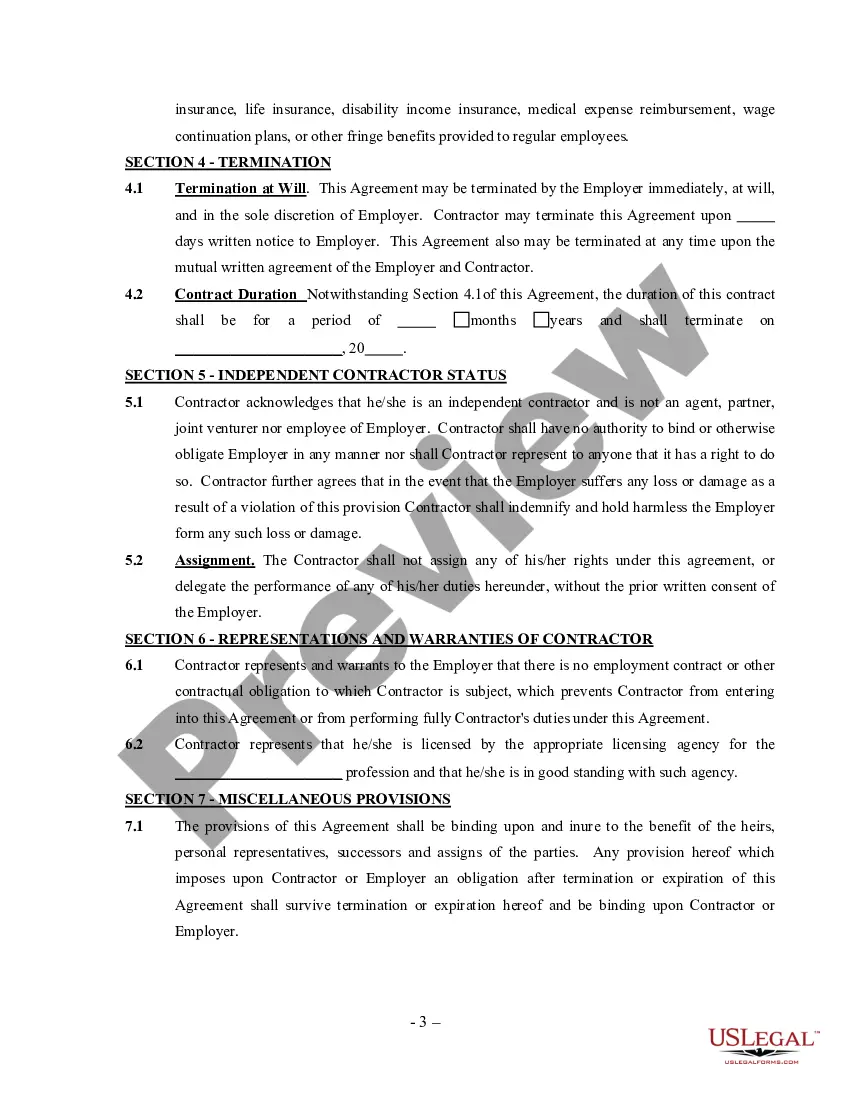

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.