Colorado Dancer Agreement - Self-Employed Independent Contractor

Description

How to fill out Colorado Dancer Agreement - Self-Employed Independent Contractor?

You can spend time online attempting to find the authorized file template that suits the federal and state demands you need. US Legal Forms gives 1000s of authorized varieties which can be analyzed by pros. It is possible to down load or printing the Colorado Dancer Agreement - Self-Employed Independent Contractor from your support.

If you already have a US Legal Forms bank account, it is possible to log in and click the Download option. Afterward, it is possible to comprehensive, modify, printing, or signal the Colorado Dancer Agreement - Self-Employed Independent Contractor. Every single authorized file template you purchase is your own for a long time. To get one more copy of the purchased form, check out the My Forms tab and click the corresponding option.

If you use the US Legal Forms web site the first time, keep to the straightforward guidelines below:

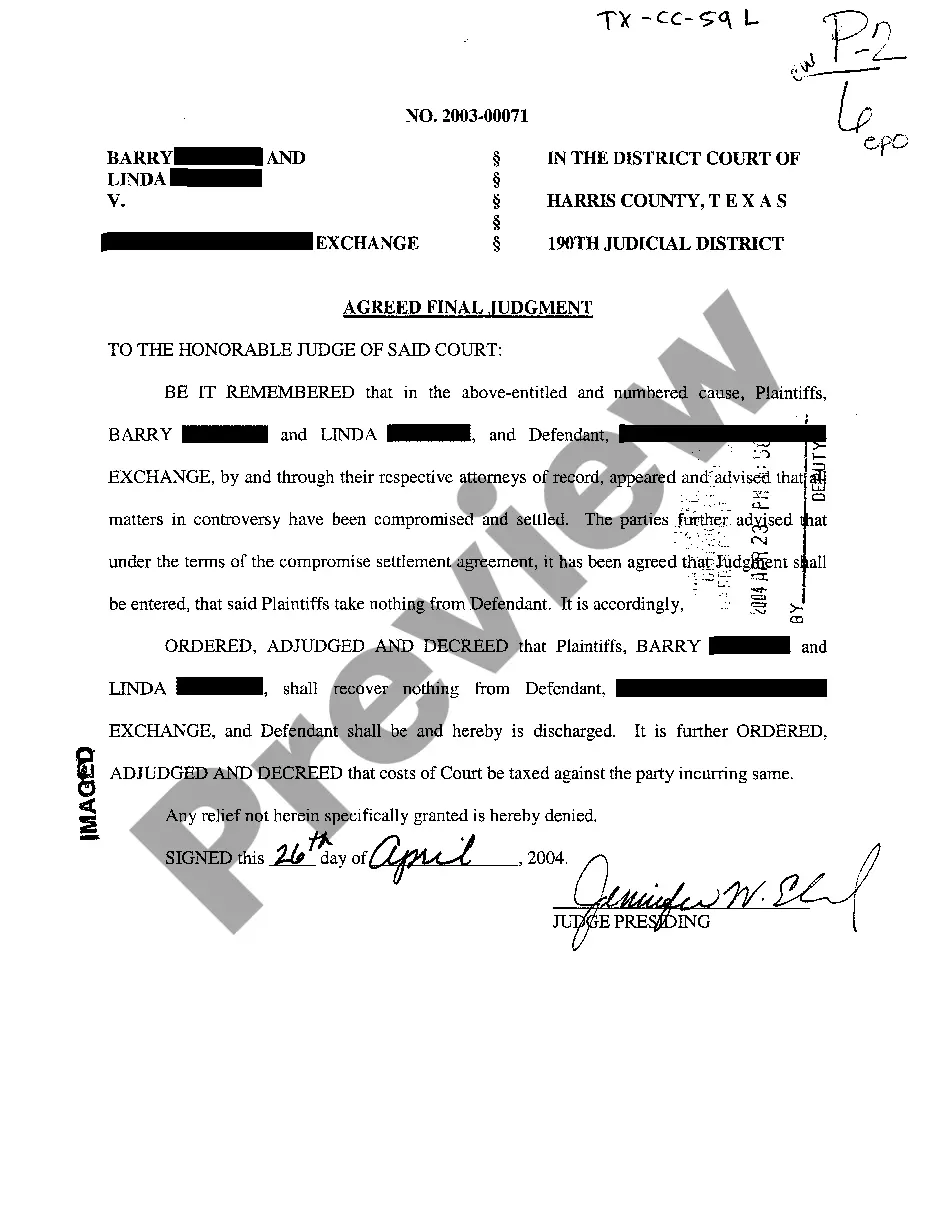

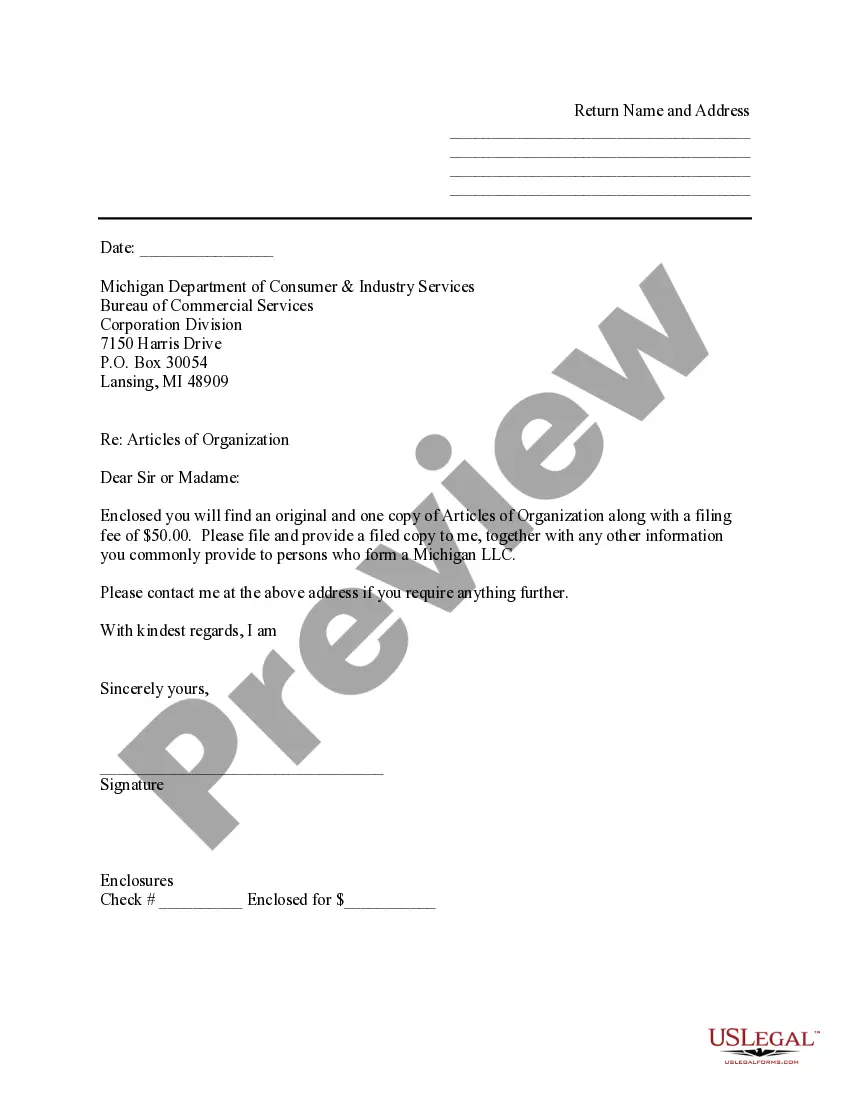

- Initial, make sure that you have selected the correct file template for your area/metropolis of your liking. See the form explanation to ensure you have picked the correct form. If readily available, utilize the Preview option to search from the file template at the same time.

- If you want to get one more model of your form, utilize the Search industry to discover the template that fits your needs and demands.

- When you have located the template you desire, click Get now to proceed.

- Pick the costs plan you desire, key in your references, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You should use your credit card or PayPal bank account to fund the authorized form.

- Pick the structure of your file and down load it in your gadget.

- Make alterations in your file if needed. You can comprehensive, modify and signal and printing Colorado Dancer Agreement - Self-Employed Independent Contractor.

Download and printing 1000s of file templates making use of the US Legal Forms website, which offers the most important selection of authorized varieties. Use expert and state-specific templates to take on your organization or individual requires.

Form popularity

FAQ

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The strong indicators a performer (or group) is an independent contractor when performing services for an establishment are: 1. The performers share in the fee received from the establishment for services performed. 2.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

1. PURPOSE. To establish a legal contract between the college and individuals who provide a service to the college and to determine whether an individual is an independent contractor or an employee based on Internal Revenue Service criteria.