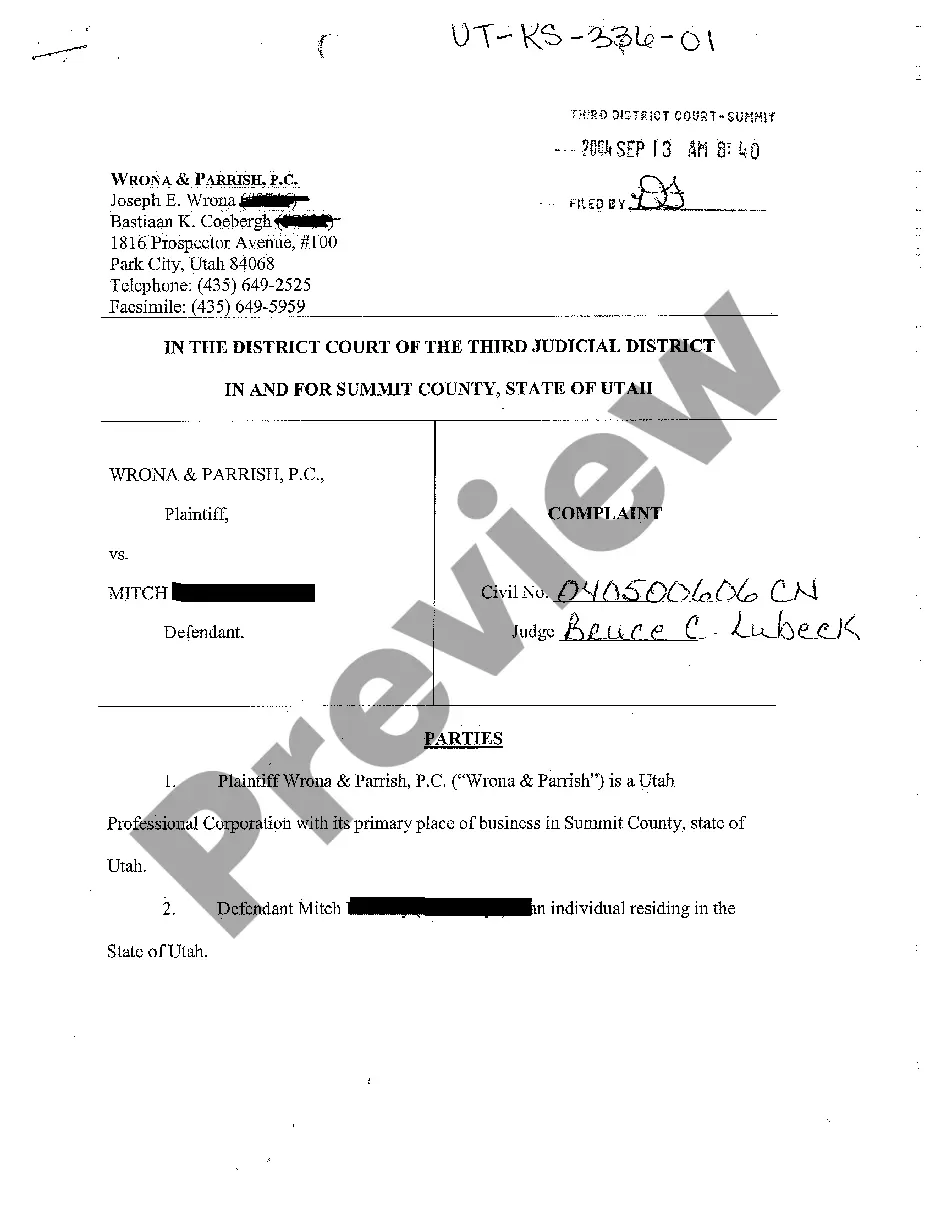

Colorado Medical Transcriptionist Agreement - Self-Employed Independent Contractor

Description

How to fill out Colorado Medical Transcriptionist Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the most significant libraries of legal forms in the States - provides an array of legal record templates you may down load or printing. Using the web site, you may get a huge number of forms for business and person reasons, sorted by types, claims, or search phrases.You will find the most recent variations of forms such as the Colorado Medical Transcriptionist Agreement - Self-Employed Independent Contractor in seconds.

If you already possess a subscription, log in and down load Colorado Medical Transcriptionist Agreement - Self-Employed Independent Contractor in the US Legal Forms collection. The Obtain switch will appear on each and every form you look at. You have accessibility to all previously delivered electronically forms within the My Forms tab of your respective bank account.

If you would like use US Legal Forms for the first time, allow me to share straightforward directions to help you get began:

- Be sure to have chosen the correct form for the town/county. Select the Review switch to analyze the form`s content material. Browse the form description to ensure that you have chosen the right form.

- If the form does not suit your demands, make use of the Lookup discipline at the top of the display to obtain the the one that does.

- In case you are satisfied with the form, confirm your option by clicking on the Get now switch. Then, pick the rates program you prefer and offer your references to register on an bank account.

- Approach the transaction. Make use of Visa or Mastercard or PayPal bank account to complete the transaction.

- Pick the formatting and down load the form on your system.

- Make modifications. Load, edit and printing and signal the delivered electronically Colorado Medical Transcriptionist Agreement - Self-Employed Independent Contractor.

Every single web template you included with your account lacks an expiry particular date and is your own property forever. So, in order to down load or printing one more backup, just go to the My Forms segment and then click around the form you will need.

Gain access to the Colorado Medical Transcriptionist Agreement - Self-Employed Independent Contractor with US Legal Forms, one of the most considerable collection of legal record templates. Use a huge number of specialist and state-particular templates that meet your organization or person demands and demands.

Form popularity

FAQ

Most medical transcriptionists work for hospitals, physicians' offices, and third-party transcription service companies that provide transcription services to healthcare establishments. Others are self-employed.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

The IRS classifies freelance workers as 1099 employees. In contrast to full-time or part-time employees of a company, who receive a W-2, freelance workers receive a 1099 form from each client.

If you run a small business that hires 1099 contractors, also known as independent contractors, it is vital that you have them sign an independent contractor contract. This is because there is a significant gray area between who is classified as an independent contractor and who is classified as an employee.

Medical transcriptionists are often hired as independent contractors (ICs) by companies that hire them. The IC status is indicated in job listings. As a result, you and the hiring company are contracting instead of hiring an employee and employer.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

Under Colorado Law, an individual is presumed to be in covered employment unless and until it is shown that the individual is free from control and direction in the performance of services, both under contract and in fact, and that the individual is customarily engaged in an independent trade, occupation, profession or

The state now requires that anyone filing a 1099 either has an LLC associated with their operations as a contractor or that they fully incorporate their business.

In the event that you are not paid as an employee, you are considered an independent contractor and must have a business license.

Persons who follow a trade, business or professions such as lawyers, accountants or construction contractors who offer their services to the general public are usually considered independent contractors.