Colorado Boiler And Radiator Services Contract - Self-Employed

Description

How to fill out Colorado Boiler And Radiator Services Contract - Self-Employed?

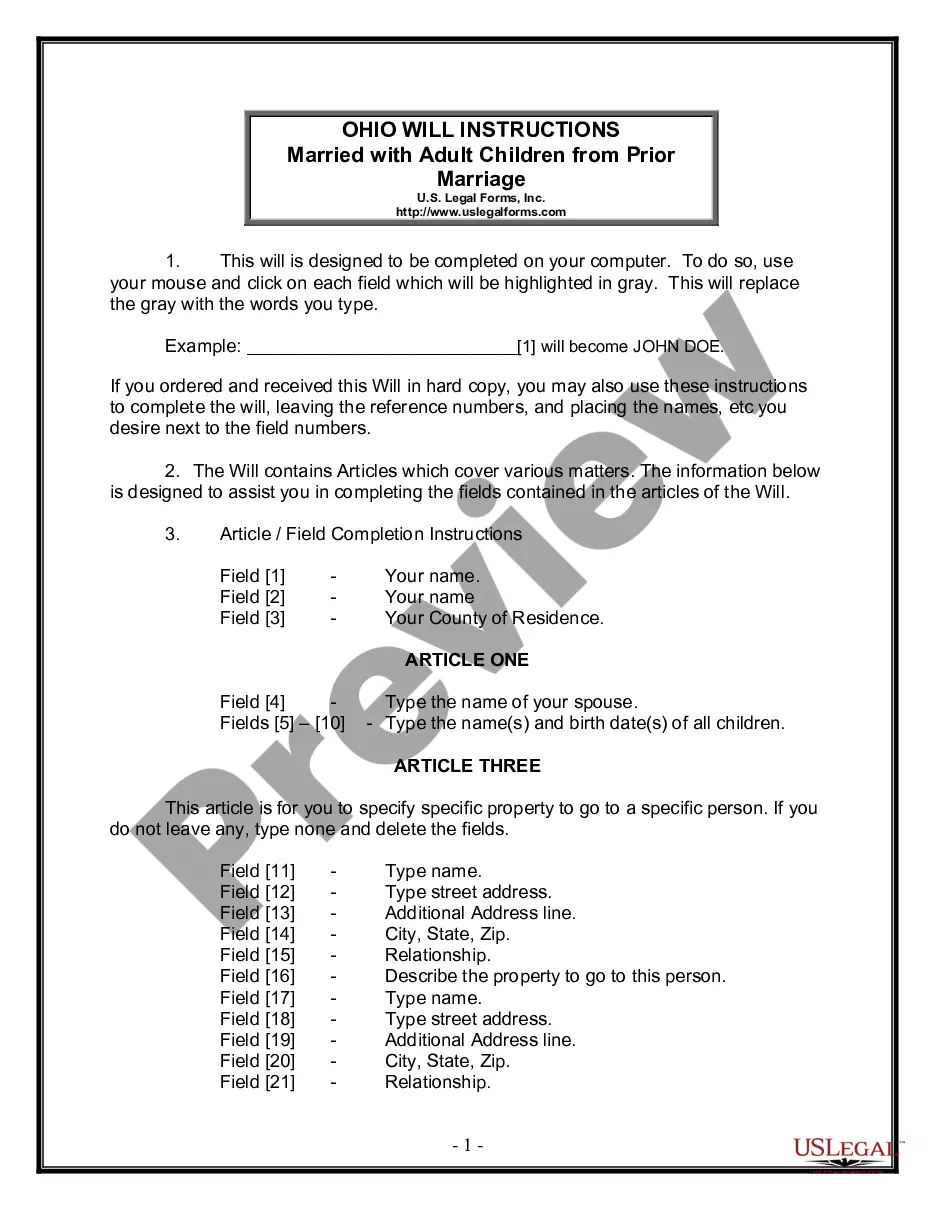

You may spend several hours on-line trying to find the legitimate document template that fits the state and federal demands you want. US Legal Forms gives a large number of legitimate types which can be analyzed by specialists. You can actually download or print out the Colorado Boiler And Radiator Services Contract - Self-Employed from your support.

If you have a US Legal Forms bank account, you may log in and click the Acquire button. Following that, you may complete, edit, print out, or indication the Colorado Boiler And Radiator Services Contract - Self-Employed. Each legitimate document template you get is your own for a long time. To acquire one more duplicate of the purchased form, check out the My Forms tab and click the corresponding button.

Should you use the US Legal Forms internet site the first time, stick to the simple recommendations under:

- Initially, make certain you have chosen the proper document template to the region/area of your choosing. See the form outline to ensure you have selected the right form. If offered, take advantage of the Review button to search from the document template at the same time.

- If you would like locate one more variation in the form, take advantage of the Look for area to obtain the template that fits your needs and demands.

- Once you have found the template you desire, click on Acquire now to proceed.

- Select the rates plan you desire, key in your references, and sign up for an account on US Legal Forms.

- Complete the financial transaction. You can utilize your charge card or PayPal bank account to cover the legitimate form.

- Select the file format in the document and download it for your gadget.

- Make modifications for your document if needed. You may complete, edit and indication and print out Colorado Boiler And Radiator Services Contract - Self-Employed.

Acquire and print out a large number of document templates making use of the US Legal Forms website, which provides the greatest selection of legitimate types. Use specialist and condition-certain templates to handle your organization or specific requires.

Form popularity

FAQ

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

During President Donald Trump's administration, the DOL issued a final rule clarifying when workers are independent contractors versus employees. The rule applied an economic-reality test that primarily considers whether the worker operates his or her own business or is economically dependent on the hiring entity.

Pandemic Unemployment AssistanceAre (or were) self-employed, an independent contractor, a gig worker, or other non-traditional worker with no W-2 wages. Are not eligible to receive regular unemployment benefits in any state. Are able to work and available to work.

Pandemic Unemployment AssistanceAre (or were) self-employed, an independent contractor, a gig worker, or other non-traditional worker with no W-2 wages.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

If you have received a 1099-G document from the Colorado Department of Labor and Employment but did not file a claim for unemployment benefits, you may be a victim of identity theft.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

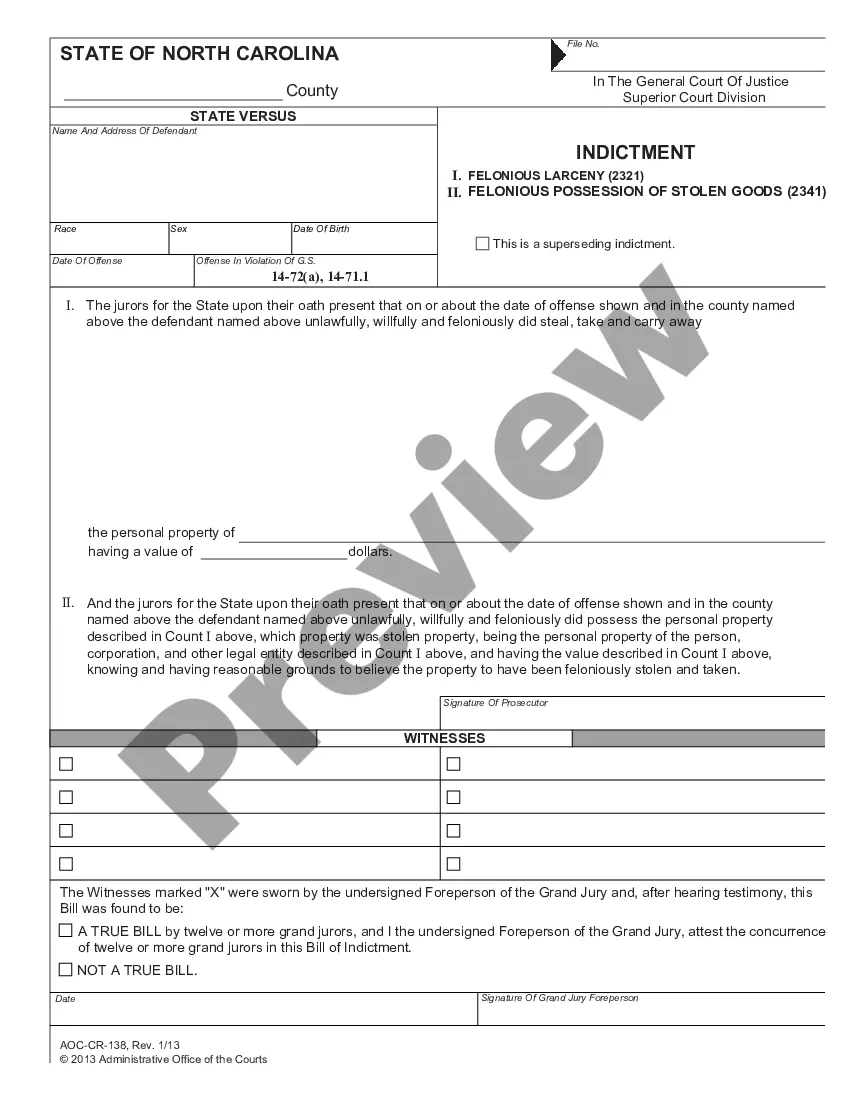

All work required of the contract is performed by the independent contractor and employees. Independent contractors are not typically considered employees of the principal. A "general contractor" is an entity with whom the principal/owner directly contracts to perform certain jobs.

Persons who follow a trade, business or professions such as lawyers, accountants or construction contractors who offer their services to the general public are usually considered independent contractors.

But there are three specific exceptions to this law: Employees could be held vicariously liable for the misconduct of independent contractors if employers were negligent in choosing or retaining the contractors. Employers could be held accountable if they assigned non-delegable tasks to the contractors.