Colorado Coaching Services Contract - Self-Employed

Description

How to fill out Colorado Coaching Services Contract - Self-Employed?

You can devote hrs on the Internet attempting to find the lawful file design which fits the federal and state requirements you will need. US Legal Forms provides thousands of lawful varieties which can be analyzed by professionals. It is possible to down load or print the Colorado Coaching Services Contract - Self-Employed from my service.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Obtain button. Afterward, you are able to total, edit, print, or sign the Colorado Coaching Services Contract - Self-Employed. Each and every lawful file design you buy is your own property eternally. To obtain yet another duplicate of the obtained form, visit the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms website the first time, adhere to the simple recommendations beneath:

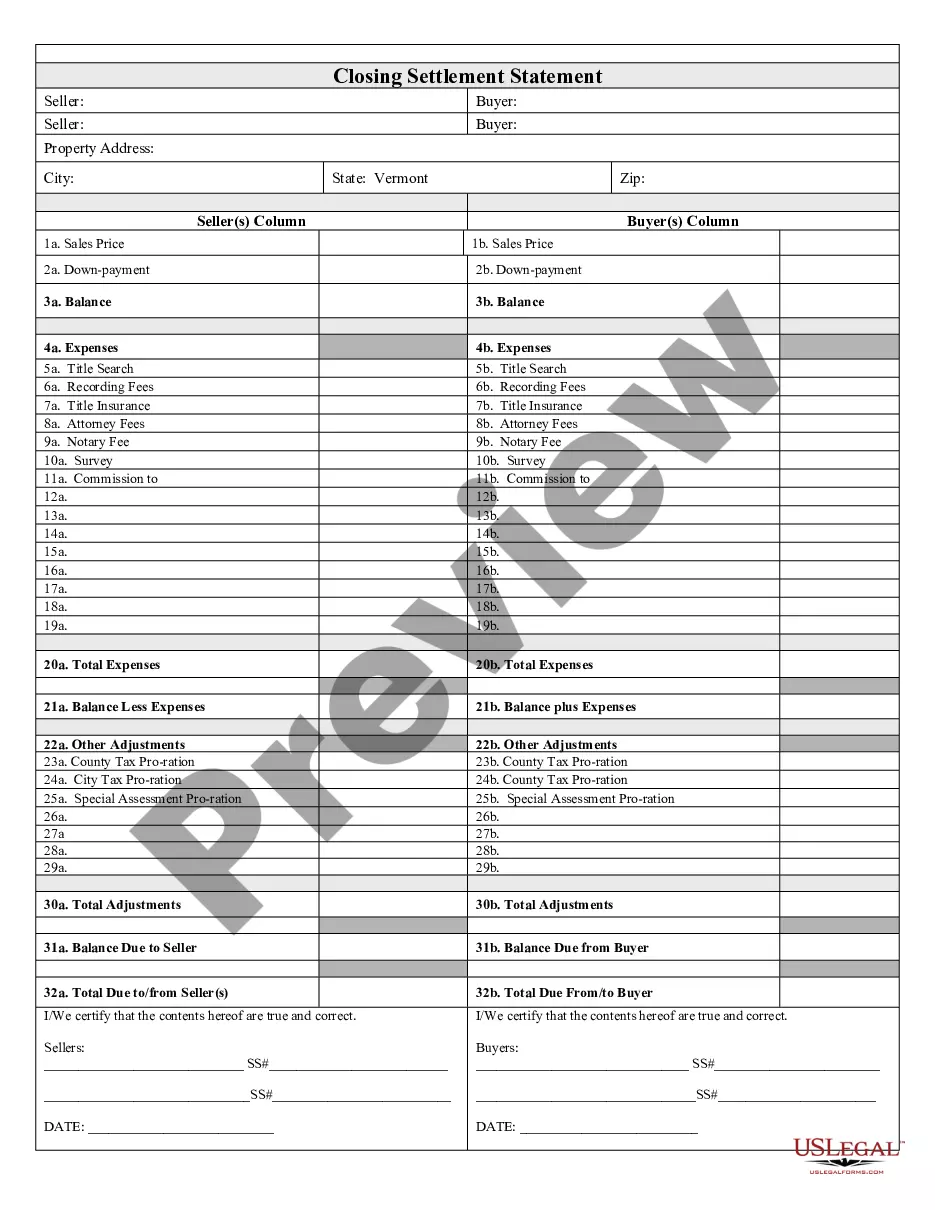

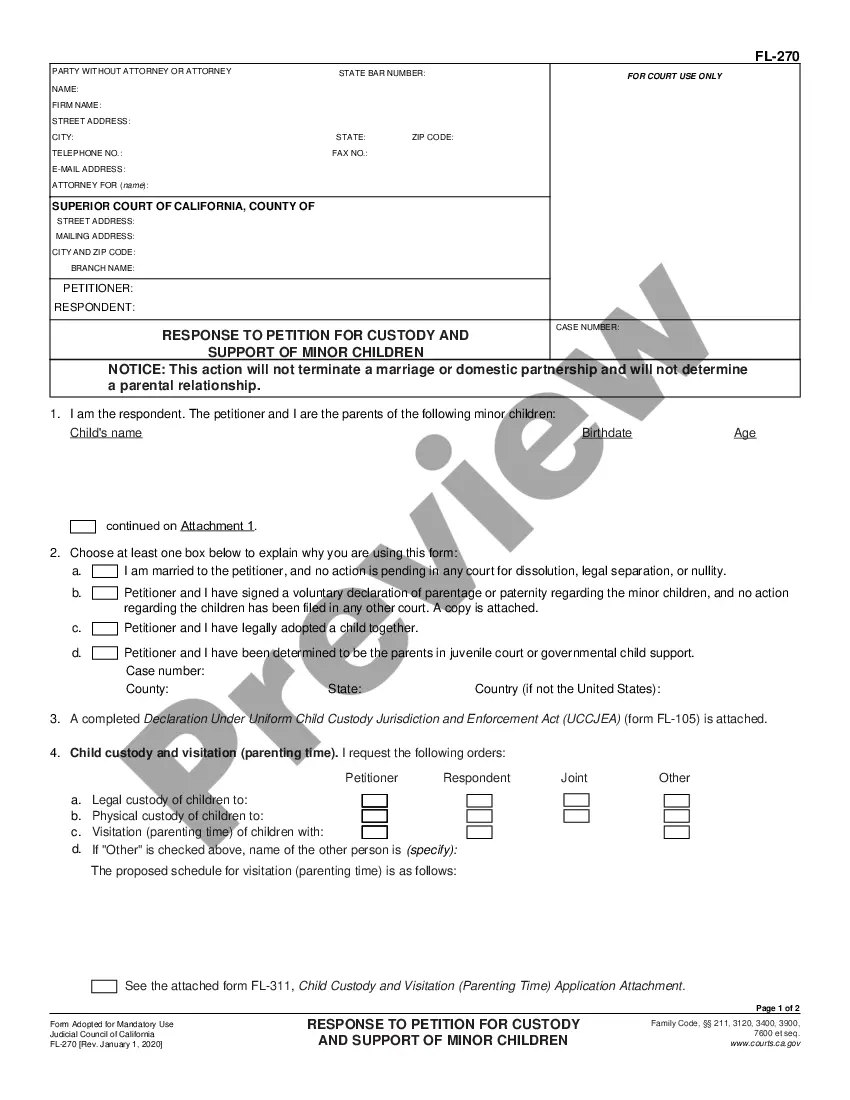

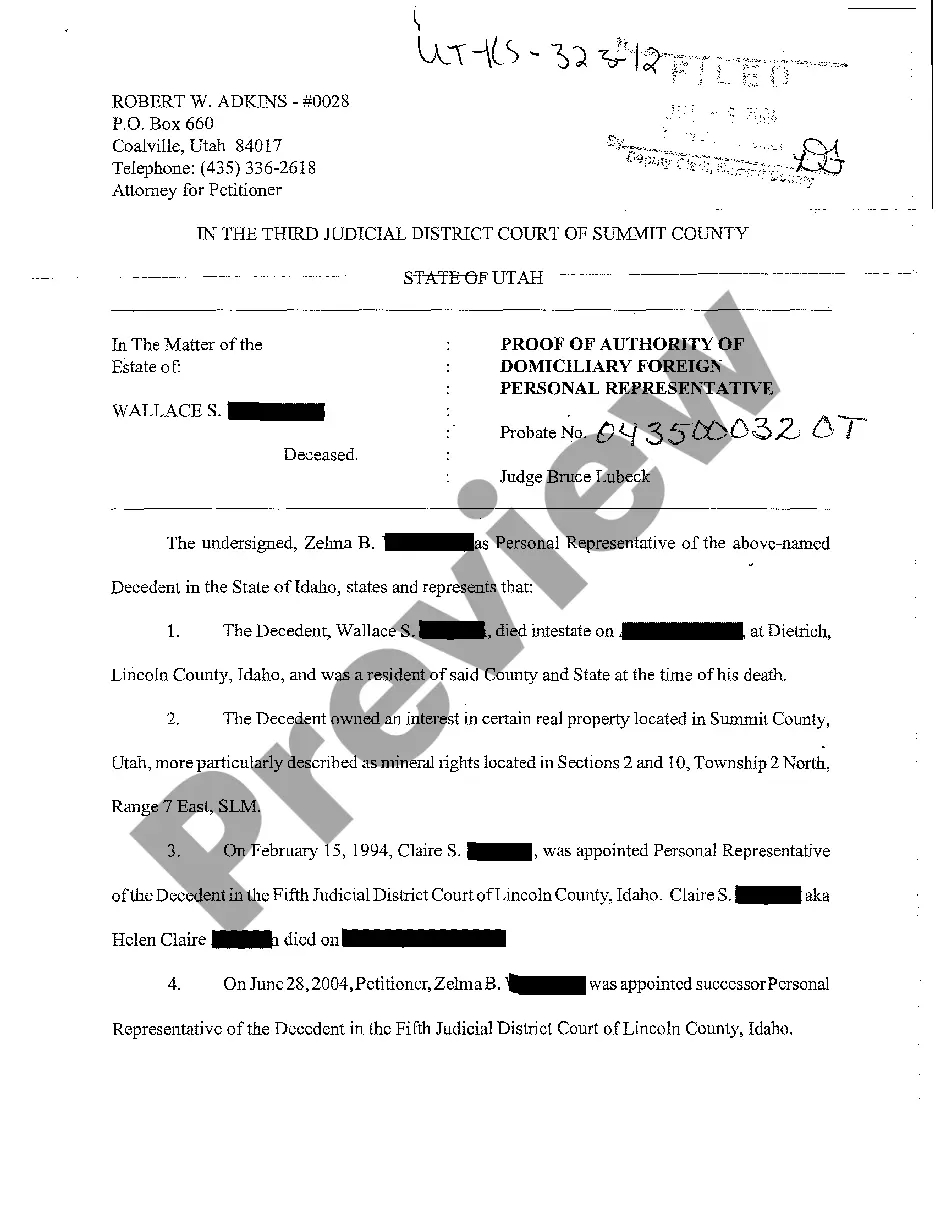

- Initial, make certain you have selected the correct file design for your area/town of your choosing. Read the form information to ensure you have selected the correct form. If accessible, utilize the Review button to appear throughout the file design also.

- In order to find yet another variation of the form, utilize the Research area to get the design that suits you and requirements.

- Once you have identified the design you would like, click Acquire now to proceed.

- Select the costs plan you would like, type in your accreditations, and register for your account on US Legal Forms.

- Total the financial transaction. You can use your bank card or PayPal accounts to pay for the lawful form.

- Select the structure of the file and down load it in your device.

- Make alterations in your file if needed. You can total, edit and sign and print Colorado Coaching Services Contract - Self-Employed.

Obtain and print thousands of file templates utilizing the US Legal Forms web site, which provides the greatest collection of lawful varieties. Use expert and express-certain templates to take on your business or individual needs.

Form popularity

FAQ

Cons of Independent ContractingContractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS. In most cases, contractors aren't eligible for state unemployment benefits, because they're self-employed, and they must fund their retirement accounts.

A coaching contract is a legal document that protects both the coach and the client. This document is a helpful way to establish boundaries for the coach-client relationship.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Professional AthleteAn athlete is an employee or an independent contractor depending upon the sport involved and the terms of the contract under which he/she performs. In team sports, such as football and baseball, where the player competes under the direction and control of a coach or manager, he/she is an employee.

Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Employees are longer-term, on the company's payroll, and generally not hired for one specific project.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

Most clubs currently classify their coaches as independent contractors and do not pay employment taxes on payments to coaches.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.