The Colorado Accounting Agreement — Self-Employed Independent Contractor is a legal document that outlines the terms and conditions for accounting services provided by an individual who operates as a self-employed independent contractor in the state of Colorado. This agreement is designed to establish a professional relationship between the accounting contractor and the client, ensuring a clear understanding of the scope of work, responsibilities, and expectations. It covers various key aspects to protect both parties involved. The agreement typically includes the following important elements: 1. Identification of the parties: It begins by clearly stating the names of the independent contractor and the client, along with their contact details and legal information. 2. Scope of work: This section thoroughly describes the specific accounting services to be provided by the contractor. It can include bookkeeping, payroll, tax preparation, financial analysis, and other related tasks, tailored to the needs of the client and the contractor's expertise. 3. Compensation: The agreement specifies the payment terms such as hourly rates, fixed fees, or a combination of both. It also addresses issues like invoicing, payment deadlines, and potential late payment penalties. 4. Confidentiality: To protect the client's sensitive financial information, this section sheds light on the contractor's responsibilities regarding confidentiality. It often includes a non-disclosure clause to maintain the privacy and security of the client's business data. 5. Duration and termination: The agreement specifies the duration of the contract, which can be a fixed term or ongoing until either party terminates. It also outlines the conditions under which the agreement can be terminated, including notice periods and potential penalties. 6. Independent contractor relationship: As self-employed individuals, contractors should not be considered employees of the client, and this section clarifies the agreement's nature as an independent contractor relationship. It highlights that the contractor is responsible for their own taxes, insurance, and legal obligations. 7. Governing law and jurisdiction: This clause identifies the state of Colorado as the governing law and jurisdiction in case of any legal disputes related to the agreement. Types of Colorado Accounting Agreement — Self-Employed Independent Contractor: 1. Bookkeeping Agreement: Focused on bookkeeping services including managing financial records, reconciling accounts, and producing financial statements. 2. Payroll Agreement: Centered around payroll processing, ensuring compliance with Colorado's wage and hour laws, calculating taxes and deductions, and issuing payslips to employees. 3. Tax Preparation Agreement: Primarily focused on tax compliance, this agreement outlines tax preparation services for individuals or businesses, ensuring accurate and timely filing of state and federal tax returns. Overall, the Colorado Accounting Agreement — Self-Employed Independent Contractor is a comprehensive contract that provides a framework for accounting services, protecting both the contractor and the client by establishing clear expectations and responsibilities.

Colorado Accounting Agreement - Self-Employed Independent Contractor

Description

How to fill out Colorado Accounting Agreement - Self-Employed Independent Contractor?

Finding the right legal record template can be quite a battle. Needless to say, there are plenty of layouts available on the Internet, but how will you find the legal kind you require? Utilize the US Legal Forms web site. The service delivers a huge number of layouts, such as the Colorado Accounting Agreement - Self-Employed Independent Contractor, which can be used for enterprise and personal requirements. All of the varieties are examined by professionals and fulfill federal and state requirements.

If you are previously listed, log in to the bank account and then click the Acquire option to have the Colorado Accounting Agreement - Self-Employed Independent Contractor. Utilize your bank account to appear from the legal varieties you might have ordered in the past. Visit the My Forms tab of the bank account and have one more copy from the record you require.

If you are a fresh user of US Legal Forms, listed below are basic guidelines for you to stick to:

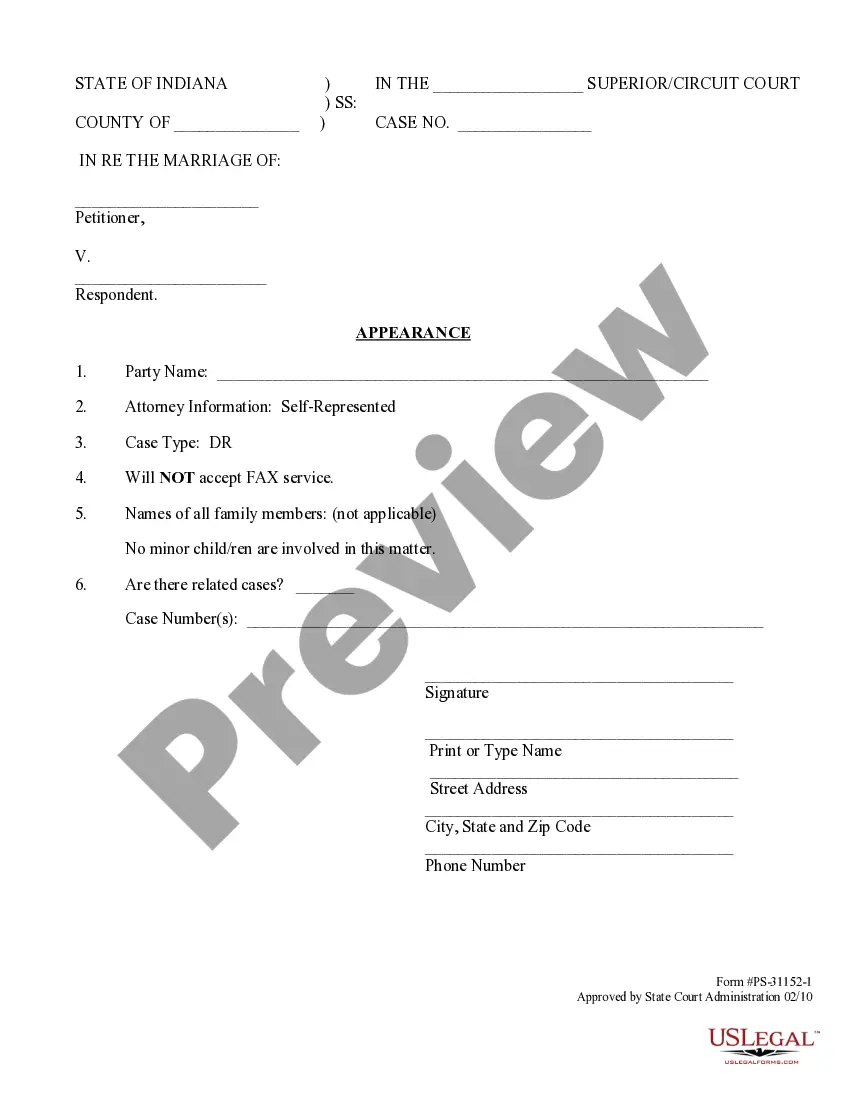

- Very first, ensure you have selected the right kind for the town/region. You are able to examine the shape making use of the Review option and browse the shape description to ensure this is the right one for you.

- In case the kind is not going to fulfill your requirements, make use of the Seach discipline to get the correct kind.

- Once you are positive that the shape is proper, select the Acquire now option to have the kind.

- Pick the pricing prepare you want and type in the required info. Create your bank account and buy an order making use of your PayPal bank account or charge card.

- Choose the data file file format and download the legal record template to the system.

- Total, edit and print out and sign the obtained Colorado Accounting Agreement - Self-Employed Independent Contractor.

US Legal Forms is definitely the biggest local library of legal varieties that you will find a variety of record layouts. Utilize the company to download skillfully-created paperwork that stick to state requirements.

Form popularity

FAQ

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.

Accrual Method Accounting When you operate a business providing services as an independent contractor, you have the option of using the accrual method of accounting for your contractor earnings and expenses while reporting your personal income and deductions using the cash method.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Here is a list of some of the things you can write off on your 1099 if you are self-employed:Mileage and Car Expenses.Home Office Deductions.Internet and Phone Bills.Health Insurance.Travel Expenses.Meals.Interest on Loans.Subscriptions.More items...?