Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

How to fill out Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor?

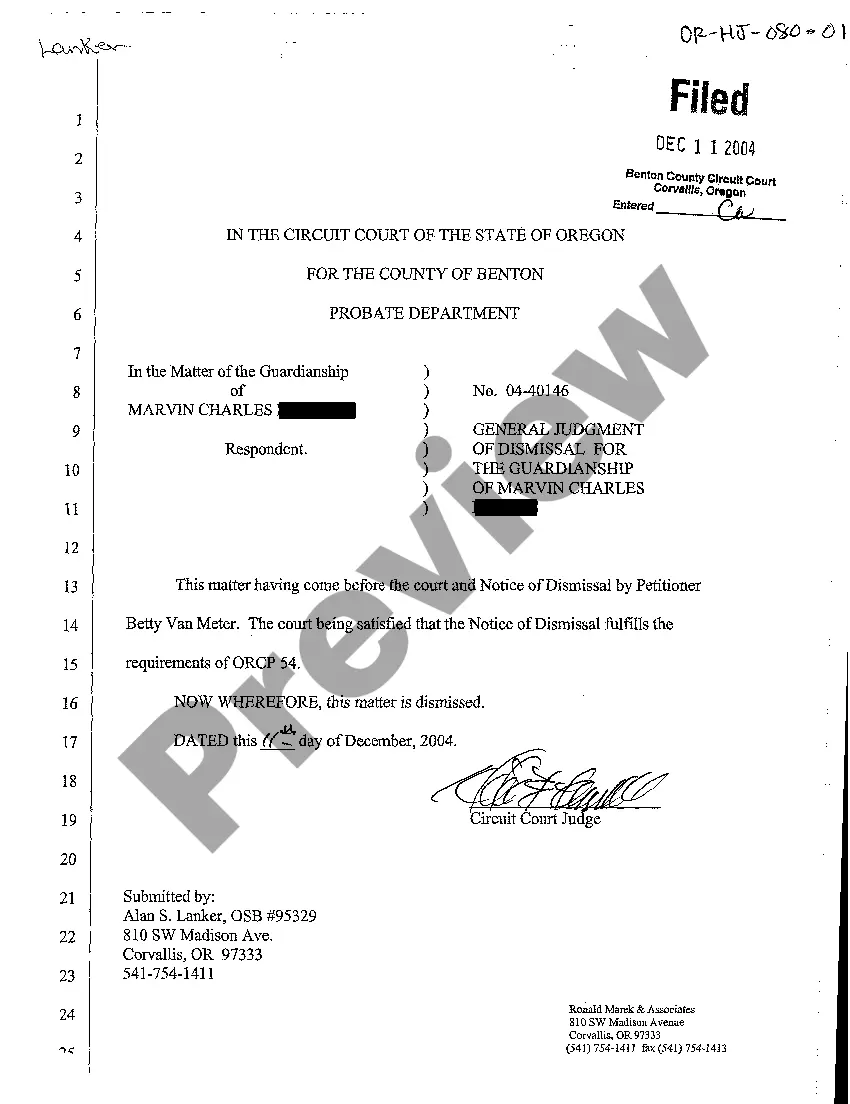

It is possible to devote time online trying to find the legal papers web template which fits the state and federal needs you need. US Legal Forms provides thousands of legal types which are evaluated by professionals. It is possible to acquire or print out the Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor from our service.

If you already have a US Legal Forms profile, you can log in and then click the Down load key. After that, you can complete, edit, print out, or indicator the Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor. Each and every legal papers web template you acquire is your own property forever. To have one more copy of the obtained form, go to the My Forms tab and then click the related key.

Should you use the US Legal Forms web site the first time, adhere to the basic directions under:

- First, make certain you have chosen the correct papers web template for that state/city of your choice. Read the form outline to ensure you have picked the appropriate form. If accessible, use the Preview key to search throughout the papers web template too.

- If you would like get one more variation from the form, use the Research discipline to get the web template that suits you and needs.

- Upon having discovered the web template you need, click Purchase now to carry on.

- Find the prices program you need, type in your accreditations, and sign up for your account on US Legal Forms.

- Full the transaction. You can use your charge card or PayPal profile to cover the legal form.

- Find the formatting from the papers and acquire it to your device.

- Make changes to your papers if necessary. It is possible to complete, edit and indicator and print out Colorado Self-Employed X-Ray Technician Self-Employed Independent Contractor.

Down load and print out thousands of papers themes using the US Legal Forms website, which provides the greatest selection of legal types. Use professional and state-certain themes to deal with your company or individual requires.

Form popularity

FAQ

An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Simply put, being an independent contractor is a way of being self-employed. Is an independent contractor self-employed? Yes. Independent contractors are self-employed who earn an income but do not work as employees.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Among those who can apply for the benefits are the self-employed, independent contractors and gig workers, like Uber and Lyft drivers, and also anyone who's out of work because of COVID-19. Examples are someone caring for a child who's out of school, or someone who is diagnosed with COVID-19.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.

The difference between the two designations is how they earn income: Independent contractors do specific tasks for clients for a set fee. Sole proprietors may do contract work, but may also have other revenue streams, like selling their own products to customers.

Reporting self-employment income Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.