This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Collections Letter Dispute

Description

How to fill out Colorado Letter Of Dispute - Complete Balance?

If you want to total, download, or printing authorized file web templates, use US Legal Forms, the greatest variety of authorized forms, which can be found on the web. Utilize the site`s easy and handy research to obtain the paperwork you need. Various web templates for company and personal reasons are categorized by categories and states, or search phrases. Use US Legal Forms to obtain the Colorado Letter of Dispute - Complete Balance in a couple of click throughs.

Should you be currently a US Legal Forms client, log in for your accounts and click the Obtain option to have the Colorado Letter of Dispute - Complete Balance. You can even entry forms you formerly acquired within the My Forms tab of your respective accounts.

If you use US Legal Forms the very first time, follow the instructions listed below:

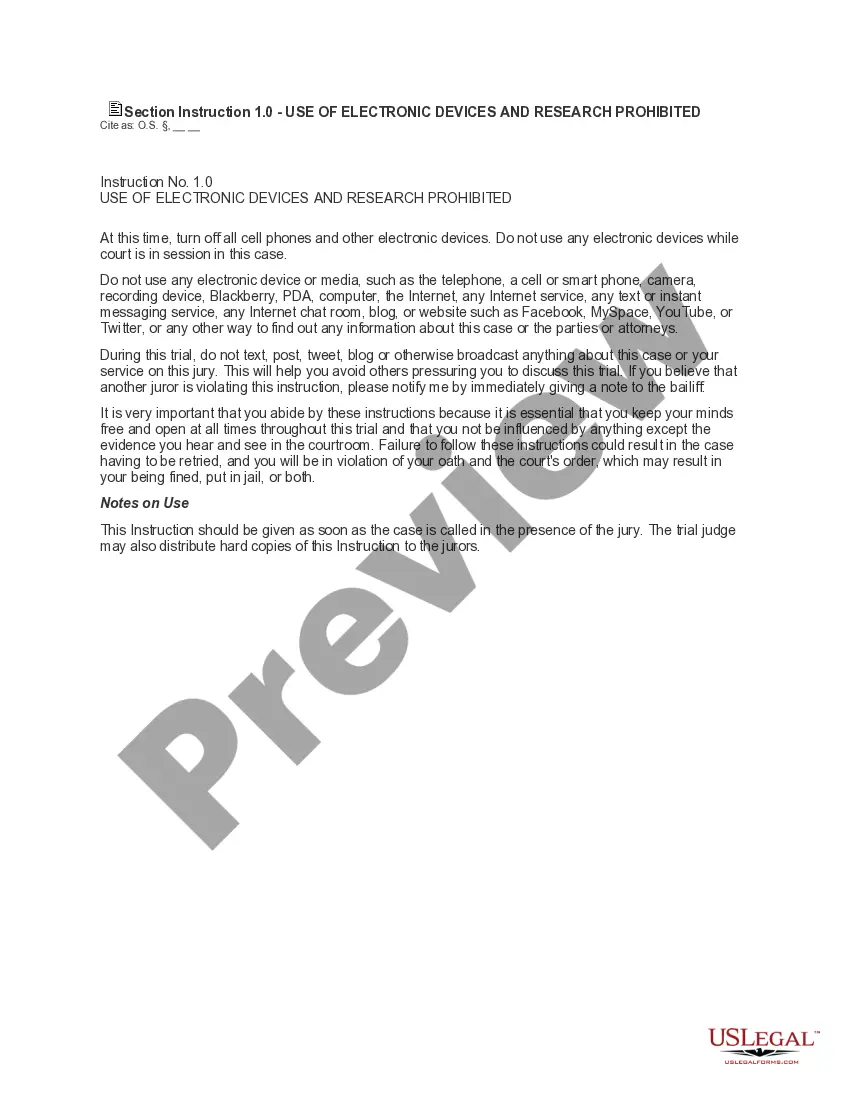

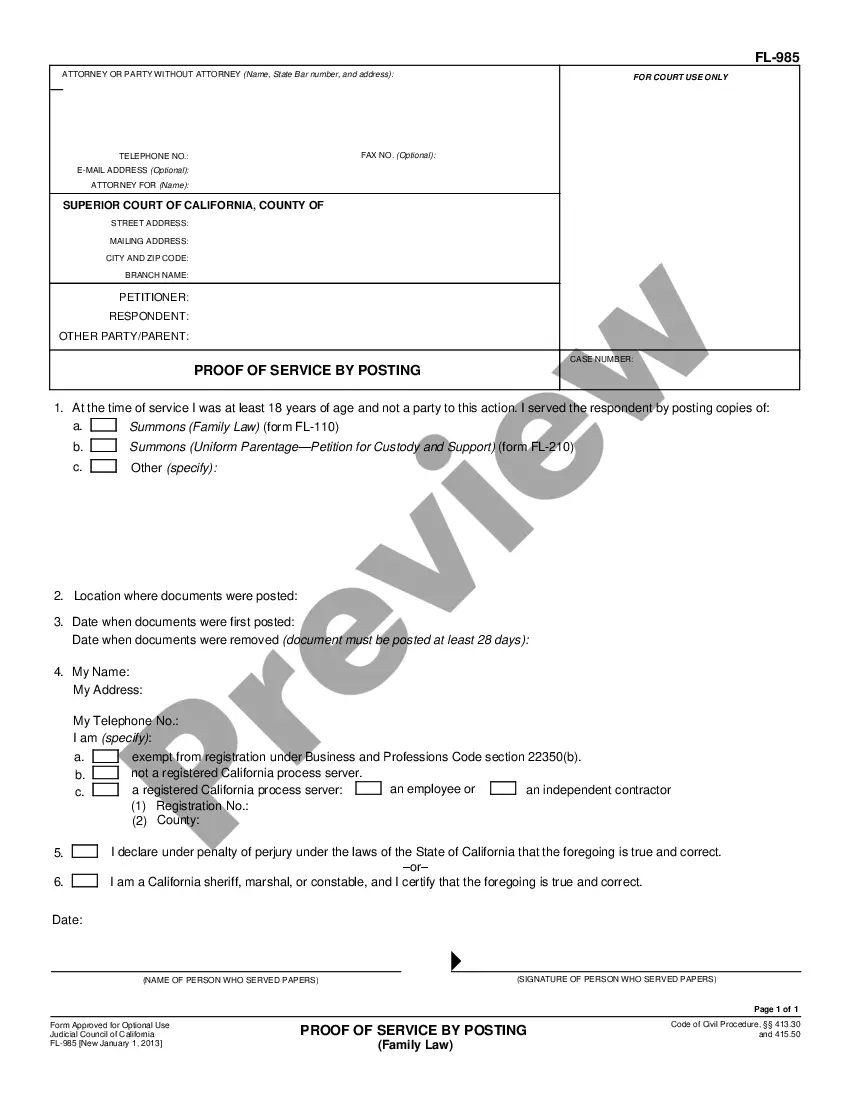

- Step 1. Be sure you have selected the shape for your appropriate town/country.

- Step 2. Take advantage of the Review choice to examine the form`s articles. Don`t neglect to read the description.

- Step 3. Should you be not happy together with the form, make use of the Lookup field towards the top of the monitor to find other versions from the authorized form web template.

- Step 4. After you have located the shape you need, go through the Acquire now option. Pick the pricing program you choose and add your accreditations to register to have an accounts.

- Step 5. Approach the transaction. You should use your bank card or PayPal accounts to perform the transaction.

- Step 6. Select the formatting from the authorized form and download it on your own product.

- Step 7. Full, revise and printing or indicator the Colorado Letter of Dispute - Complete Balance.

Each and every authorized file web template you acquire is your own for a long time. You might have acces to every form you acquired within your acccount. Select the My Forms area and select a form to printing or download once more.

Remain competitive and download, and printing the Colorado Letter of Dispute - Complete Balance with US Legal Forms. There are millions of skilled and state-distinct forms you can utilize for the company or personal needs.

Form popularity

FAQ

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit reportit's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

Your dispute should be made in writing to ensure that the debt collector has to send you verification of the debt. If you're having trouble with debt collection, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).

How to Write a 609 LetterStep 1: Get your free credit report. Before writing a 609 letter, request a free copy of your credit report online to check it for any erroneous negative items.Step 2: Write your 609 letter.Step 3: Mail your 609 letter via certified mail with a return receipt.17-Dec-2021

I am writing to dispute a charge of $ to my credit or debit card account on date of the charge. The charge is in error because explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc..

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

Consumers can dispute fraudulent charges on their bill by calling their issuer. This is typically a quick process where the issuer will cancel the credit card in question and reissue a new one. You also have the right to dispute a credit card charge for a purchase you willingly made.

The Federal Trade Commission advises that you be as specific as possible in the letter about the reason why you think you do not owe this debt (or owe all of it, if you're disputing the amount), but you should give as little personal information as possible in the letter.

Be aware that Section 609 gives you the right to request information about the items listed on your credit reports, but not specifically to dispute them. Such disputes are covered in Sections 611 and 623 of the FCRA.

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices. Written by Natasha Wiebusch, J.D..

A credit dispute letter doesn't automatically fix this issue or repair your credit. And there are no guarantees the credit reporting agency will remove an itemespecially if you don't have strong documentation that it's an error. But writing a credit dispute letter costs little more than a bit of time.