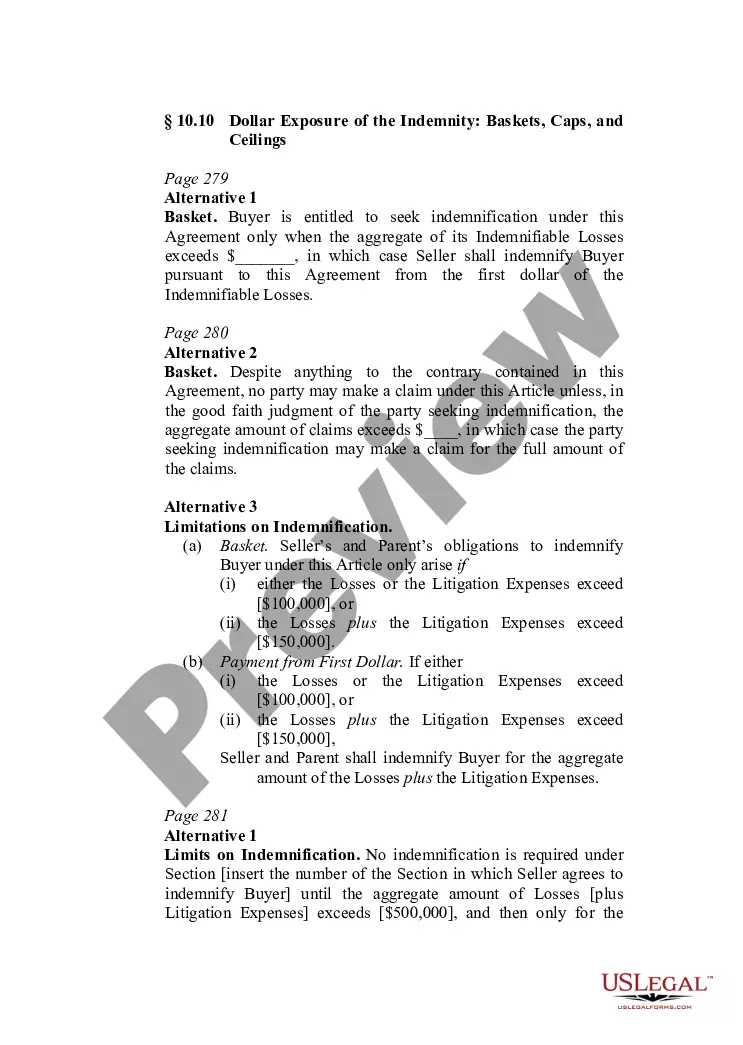

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement with regards to taxes or insurance considerations.

Colorado Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations

Description

How to fill out Indemnity Provisions - Dollar Exposure Of The Indemnity Regarding Tax And Insurance Considerations?

US Legal Forms - among the biggest libraries of legal varieties in the States - delivers a variety of legal papers web templates you can acquire or print. Using the internet site, you can find a large number of varieties for company and individual uses, categorized by groups, suggests, or search phrases.You will discover the latest variations of varieties just like the Colorado Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations within minutes.

If you have a registration, log in and acquire Colorado Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations through the US Legal Forms collection. The Acquire key will appear on each kind you see. You get access to all previously downloaded varieties from the My Forms tab of your own profile.

If you want to use US Legal Forms the first time, listed below are simple guidelines to help you started off:

- Be sure you have picked out the proper kind for the metropolis/region. Go through the Preview key to review the form`s content. Look at the kind information to ensure that you have selected the proper kind.

- In the event the kind doesn`t satisfy your requirements, utilize the Lookup area at the top of the display to get the one who does.

- In case you are satisfied with the form, confirm your decision by clicking the Get now key. Then, opt for the rates program you like and supply your credentials to sign up on an profile.

- Process the transaction. Make use of your credit card or PayPal profile to complete the transaction.

- Choose the file format and acquire the form on your own device.

- Make alterations. Fill up, edit and print and indication the downloaded Colorado Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations.

Each web template you put into your bank account does not have an expiry date which is your own eternally. So, if you wish to acquire or print yet another copy, just check out the My Forms area and then click around the kind you need.

Get access to the Colorado Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations with US Legal Forms, by far the most substantial collection of legal papers web templates. Use a large number of professional and status-particular web templates that fulfill your organization or individual requires and requirements.

Form popularity

FAQ

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

It is primarily intended to protect the person who is providing goods or services from being held legally liable for the consequences of actions taken or not taken in providing that service to the person who signs the form. Indemnity clauses vary widely.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

An LOI must clearly list all of the parties involved (shipper, carrier and when applicable, consignee or recipient) and should include as much detail as possible (i.e. vessel name, ports of origin and destination, description of goods, container number, specifics from the original bill of lading, etc.).

A typical example is an insurance company wherein the insurer or indemnitor agrees to compensate the insured or indemnitee for any damages or losses he/she may incur during a period of time.

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

Blinder, Robinson & Co., the Colorado Supreme Court defined an indemnity agreement as ?[a]n agreement by one person to hold another person harmless from such loss or damage as may be specified in the agreement.?19 If ?indemnify? and ?hold harmless? are synonymous, the term ?hold harmless? is unnecessary in an indemnity ...

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.