This is a Promissory Note for use in any state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Colorado Unsecured Installment Payment Promissory Note for Fixed Rate

Description

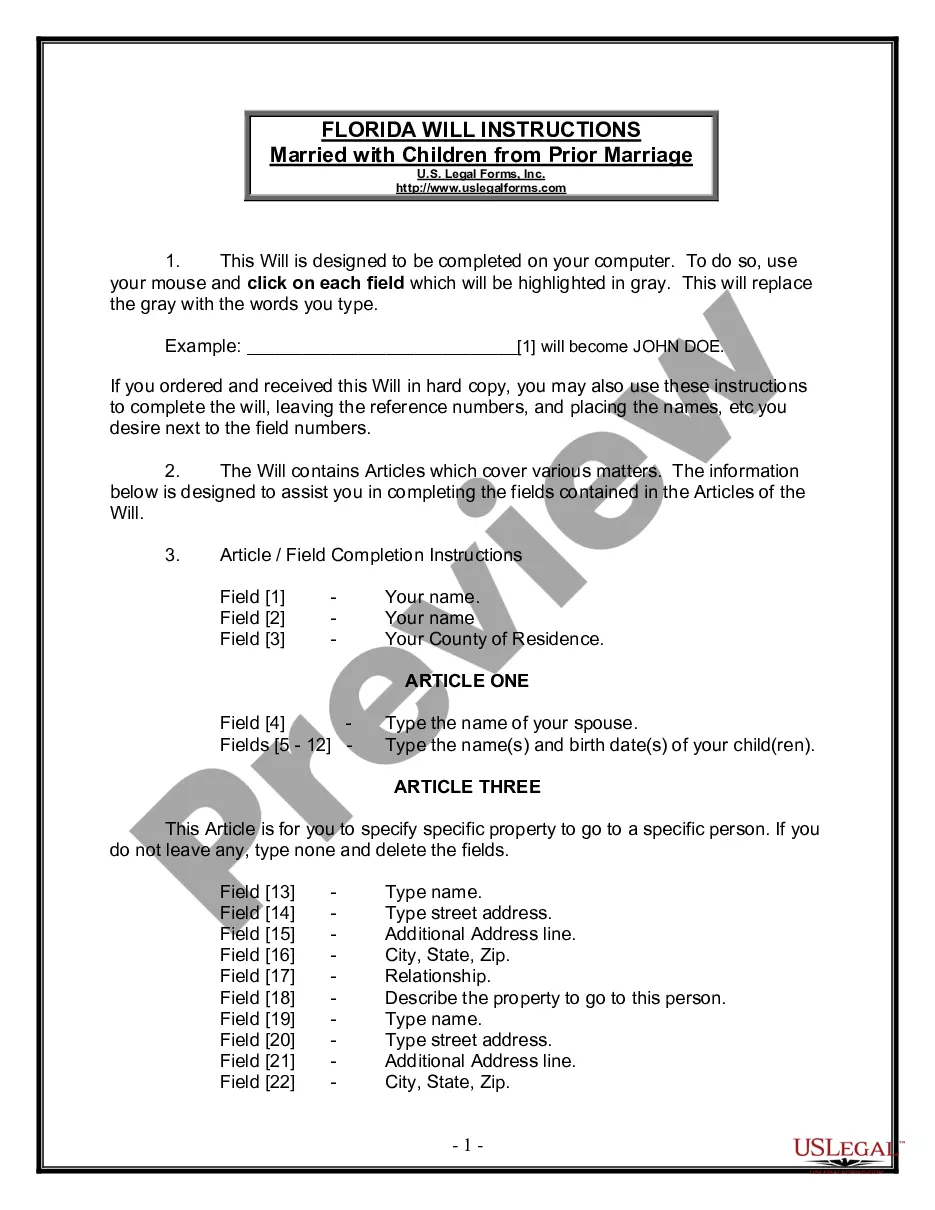

How to fill out Colorado Unsecured Installment Payment Promissory Note For Fixed Rate?

You are able to spend several hours online attempting to find the legitimate document design that suits the federal and state needs you require. US Legal Forms supplies 1000s of legitimate types which are analyzed by specialists. It is possible to acquire or produce the Colorado Unsecured Installment Payment Promissory Note for Fixed Rate from your support.

If you have a US Legal Forms account, you are able to log in and then click the Download button. Afterward, you are able to complete, change, produce, or indicator the Colorado Unsecured Installment Payment Promissory Note for Fixed Rate. Each legitimate document design you get is your own eternally. To have yet another duplicate of the acquired kind, proceed to the My Forms tab and then click the related button.

If you use the US Legal Forms website initially, stick to the simple recommendations below:

- Initially, ensure that you have chosen the correct document design for the region/town that you pick. Browse the kind explanation to ensure you have chosen the correct kind. If accessible, use the Review button to search through the document design too.

- In order to discover yet another model of your kind, use the Look for area to obtain the design that suits you and needs.

- Upon having discovered the design you need, simply click Acquire now to continue.

- Pick the prices prepare you need, key in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You should use your charge card or PayPal account to purchase the legitimate kind.

- Pick the file format of your document and acquire it to the gadget.

- Make modifications to the document if needed. You are able to complete, change and indicator and produce Colorado Unsecured Installment Payment Promissory Note for Fixed Rate.

Download and produce 1000s of document themes using the US Legal Forms website, that offers the greatest variety of legitimate types. Use professional and condition-certain themes to tackle your company or personal requires.

Form popularity

FAQ

There is no legal requirement for a promissory note to be witnessed or notarized in Colorado. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

There is no legal requirement for a promissory note to be witnessed or notarized in Colorado. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

3 attorney answersPromissory Notes are legally binding. They do not have to be notarized but it does make them look more substantial which never hurts. If you have security (e.g. a Deed of Trust), it is notarized so might as well have the Note notarized as well.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."