Colorado Gift Deed of Nonparticipating Royalty Interest with No Warranty

Description

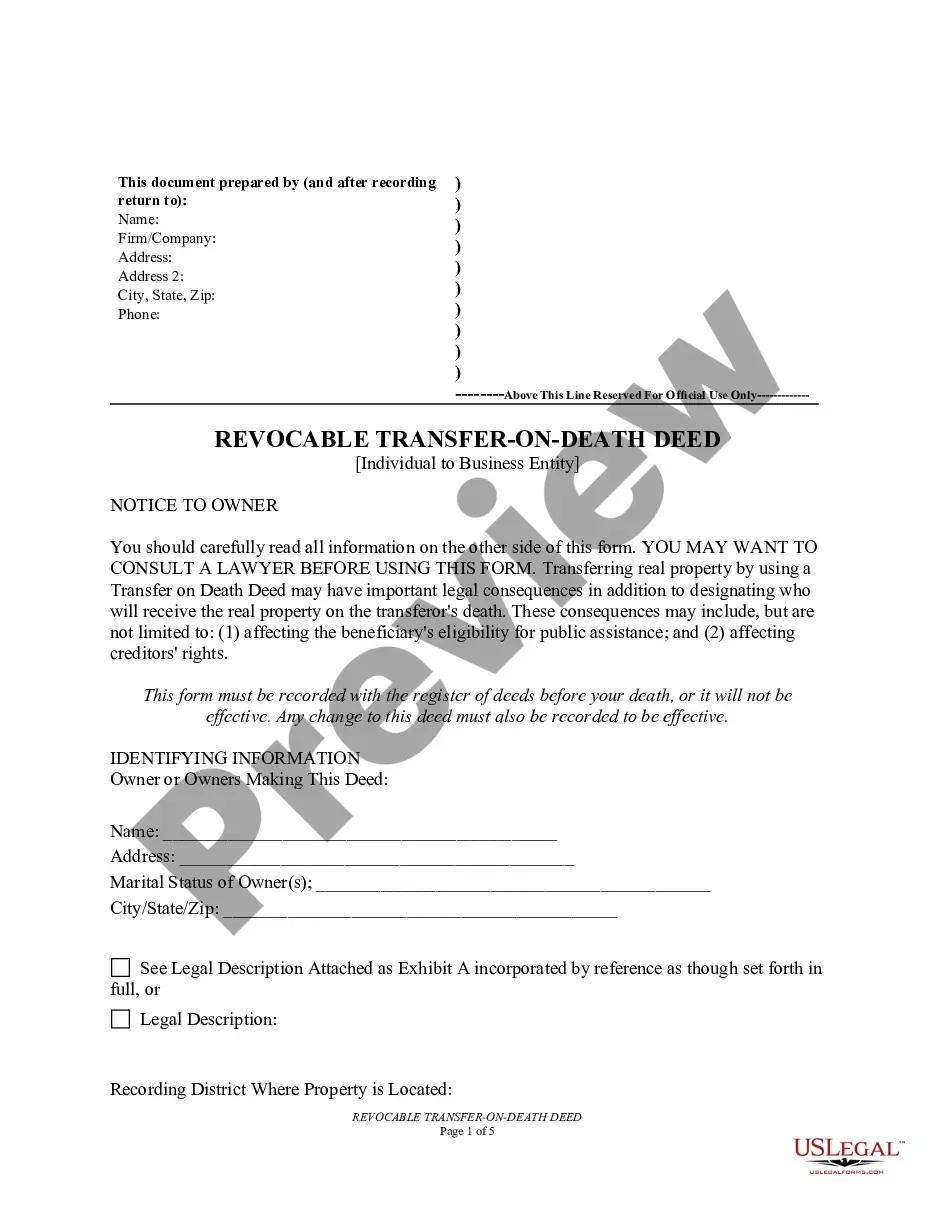

How to fill out Gift Deed Of Nonparticipating Royalty Interest With No Warranty?

If you need to complete, down load, or print out legitimate document web templates, use US Legal Forms, the biggest assortment of legitimate kinds, that can be found on the Internet. Use the site`s simple and easy practical research to get the paperwork you require. Numerous web templates for business and specific functions are sorted by types and says, or key phrases. Use US Legal Forms to get the Colorado Gift Deed of Nonparticipating Royalty Interest with No Warranty with a handful of clicks.

Should you be already a US Legal Forms buyer, log in in your account and then click the Down load button to have the Colorado Gift Deed of Nonparticipating Royalty Interest with No Warranty. You can also gain access to kinds you previously saved in the My Forms tab of your account.

If you are using US Legal Forms the first time, follow the instructions under:

- Step 1. Ensure you have chosen the form to the proper metropolis/region.

- Step 2. Utilize the Review solution to check out the form`s articles. Never overlook to read the outline.

- Step 3. Should you be unsatisfied together with the form, utilize the Search area on top of the display screen to locate other models of your legitimate form template.

- Step 4. When you have found the form you require, select the Acquire now button. Opt for the rates plan you prefer and add your credentials to sign up for the account.

- Step 5. Process the transaction. You should use your Мisa or Ьastercard or PayPal account to finish the transaction.

- Step 6. Choose the formatting of your legitimate form and down load it on your device.

- Step 7. Comprehensive, edit and print out or indication the Colorado Gift Deed of Nonparticipating Royalty Interest with No Warranty.

Every legitimate document template you get is yours forever. You may have acces to each and every form you saved within your acccount. Click the My Forms segment and select a form to print out or down load again.

Compete and down load, and print out the Colorado Gift Deed of Nonparticipating Royalty Interest with No Warranty with US Legal Forms. There are thousands of skilled and express-certain kinds you can use for the business or specific needs.

Form popularity

FAQ

Quitclaim Deed This type of deed conveys whatever interest the grantor currently has in the property?if any. No warranties or promises regarding the quality of the title are made. If the grantor has a good title, the quitclaim deed is essentially as effective as a general warranty deed.

In short, the distinction between the two forms of ?warranty? deeds is that in a general warranty deed, the seller warrants against anything any owner of the property ever did to encumber title and in a special warranty deed the seller only warrants against anything the seller did to encumber title.

Quitclaim deeds do not contain any implied warranties or covenants. Under a quitclaim deed, the grantor simply transfers its whole interest in the described real estate, but makes no covenant or representation that the grantor in fact has any interest in the subject property.

For any type of real estate title transfer, you'll need to fill out the appropriate forms and have all parties sign in front of a notary. The new owner is responsible for filling out a Real Property Transfer Declaration form and recording the deed at both the recorder's and county clerk's offices.

Quitclaim Deed This deed conveys to the grantee only that which the grantor has in the property at the time of the conveyance, which could be nothing at all. There are no covenants or warranties by the grantor and this deed offers the lowest amount of protection to the grantee.

By contrast, a quitclaim deed contains no warranties. All it does is transfer whatever interest the grantor has in the property over to the other person. There is no guarantee against the fact that the other owners have the ability to claim the property.

A quitclaim deed is a deed by which a grantor transfers only the interest the grantor has at the time the conveyance is executed. There are no implied warranties in connection with a quitclaim deed.

A bargain and sale deed may come with or without covenants of warranty.