Colorado Subordination of Lien (Deed of Trust/Mortgage to Right of Way)

Description

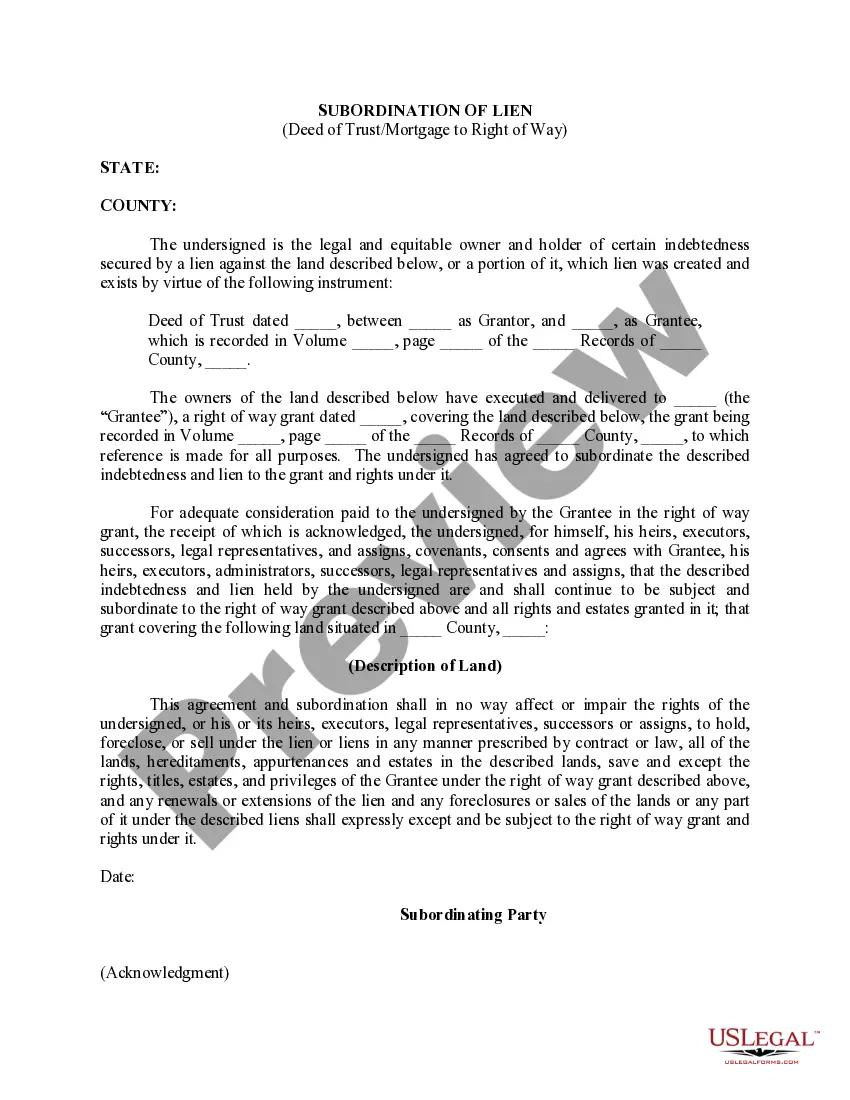

How to fill out Subordination Of Lien (Deed Of Trust/Mortgage To Right Of Way)?

Finding the right lawful record format might be a struggle. Needless to say, there are plenty of templates available on the Internet, but how do you find the lawful form you will need? Take advantage of the US Legal Forms web site. The service provides 1000s of templates, including the Colorado Subordination of Lien (Deed of Trust/Mortgage to Right of Way), that you can use for organization and personal demands. All the types are checked by specialists and meet federal and state specifications.

Should you be currently authorized, log in to your profile and click on the Obtain switch to find the Colorado Subordination of Lien (Deed of Trust/Mortgage to Right of Way). Utilize your profile to look through the lawful types you possess bought previously. Visit the My Forms tab of your own profile and have another backup from the record you will need.

Should you be a brand new consumer of US Legal Forms, allow me to share easy guidelines that you can follow:

- Initial, be sure you have selected the right form for your personal area/county. You are able to examine the shape while using Review switch and study the shape description to make certain this is basically the right one for you.

- In case the form fails to meet your needs, take advantage of the Seach area to discover the correct form.

- Once you are certain that the shape is acceptable, click the Acquire now switch to find the form.

- Pick the prices prepare you desire and type in the needed details. Make your profile and buy an order making use of your PayPal profile or credit card.

- Choose the data file formatting and obtain the lawful record format to your gadget.

- Total, revise and produce and sign the acquired Colorado Subordination of Lien (Deed of Trust/Mortgage to Right of Way).

US Legal Forms may be the most significant local library of lawful types that you can discover numerous record templates. Take advantage of the service to obtain appropriately-made paperwork that follow condition specifications.

Form popularity

FAQ

To adjust their priority, subordinate lienholders must sign subordination agreements, making their loans lower in priority than the new lender. A subordination agreement puts the new lender into first position and reassigns an existing mortgage to second position or third position, and so on.

Example of a Subordination Agreement A standard subordination agreement covers property owners that take a second mortgage against a property. One loan becomes the subordinated debt, and the other becomes (or remains) the senior debt. Senior debt has higher claim priority than junior debt.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

This transfer doesn't usually lead to an immediate tax obligation, meaning no tax is levied for merely changing the ownership. However, the trust, which now owns the stock, may become liable for taxes on dividends and capital gains from the stock.

For any type of real estate title transfer, you'll need to fill out the appropriate forms and have all parties sign in front of a notary. The new owner is responsible for filling out a Real Property Transfer Declaration form and recording the deed at both the recorder's and county clerk's offices.