Colorado Lien and Tax Search Checklist is a comprehensive tool used by individuals, businesses, and professionals involved in real estate transactions and property investments in the state of Colorado. This checklist ensures that all necessary tax and lien-related searches are conducted, providing a complete picture of any liens or taxes associated with a property. It helps buyers, sellers, lenders, and title companies to identify potential risks and make informed decisions. The Colorado Lien and Tax Search Checklist includes various steps and considerations to be followed during the search process. It covers different types of liens and taxes that can affect the property, such as: 1. Federal Tax Liens: This refers to any unpaid federal taxes owed by the property owner. These liens can arise from income taxes, estate taxes, or other federal obligations. 2. State Tax Liens: This category includes any unpaid state taxes, such as income taxes, sales taxes, property taxes, or business-related taxes. 3. County/City Tax Liens: These refer to unpaid tax obligations owed to the specific county or city in which the property is located. It may involve delinquent property taxes, local improvement district assessments, or sewer/water utility liens. 4. Judgment Liens: This type of lien arises when a court awards a monetary judgment against the property owner. It could be due to unpaid debts, lawsuits, or legal judgments. 5. Mechanics' Liens: These liens are filed by contractors, subcontractors, or suppliers to ensure payment for construction or improvement work done on the property. 6. HOA (Homeowners Association) Liens: If the property belongs to a homeowners' association, unpaid HOA fees or assessments can result in a lien against the property. 7. Mortgage Liens: This refers to any outstanding mortgage debts secured by the property. It is important to determine if there are multiple mortgage liens, as this affects the priority of repayment in case of default. 8. Bankruptcy Liens: If the property owner has filed for bankruptcy, there may be liens or restrictions on the property as a result. The checklist outlines the necessary steps to perform the lien and tax search, which may include reviewing public records, searching online databases, contacting relevant government agencies and departments, and obtaining clearance certificates. It also emphasizes the importance of working with experienced professionals, such as title companies, attorneys, or real estate agents, to ensure a thorough search and accurate interpretation of the findings. It is essential to note that there may be variations in the specific requirements or processes involved depending on the size, location, and complexity of the property. Therefore, it is recommended to consult official resources and seek legal advice to ensure compliance with applicable laws and regulations. In summary, the Colorado Lien and Tax Search Checklist is a vital tool to identify and analyze any liens or unpaid taxes associated with a property. By completing this checklist, individuals can mitigate potential risks, protect their investments, and make informed decisions during real estate transactions in Colorado.

Colorado Lien and Tax Search Checklist

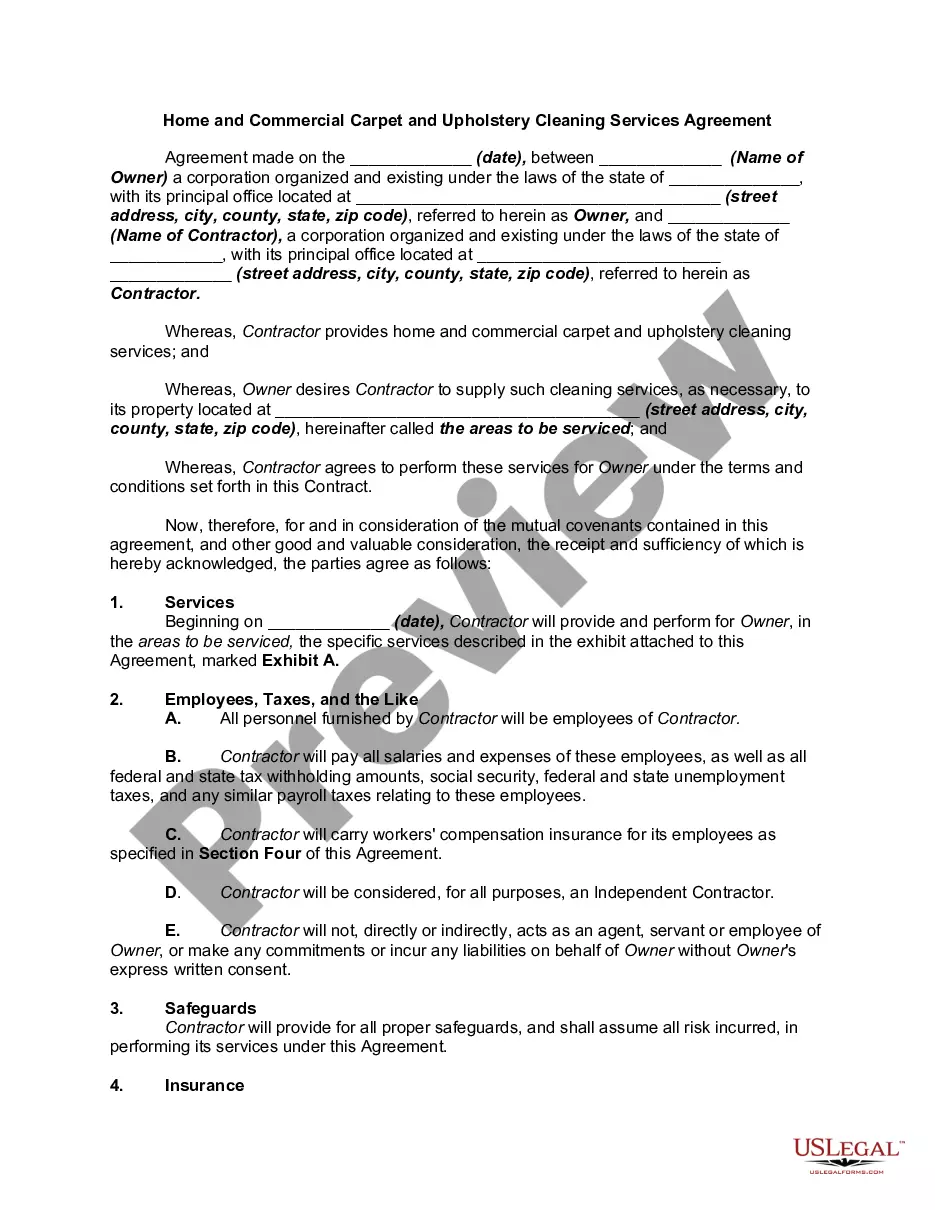

Description

How to fill out Colorado Lien And Tax Search Checklist?

You may devote hours on-line attempting to find the authorized document web template that suits the state and federal needs you require. US Legal Forms gives 1000s of authorized kinds that happen to be analyzed by professionals. It is possible to obtain or print out the Colorado Lien and Tax Search Checklist from the support.

If you already have a US Legal Forms profile, you can log in and click on the Obtain option. Afterward, you can full, revise, print out, or indication the Colorado Lien and Tax Search Checklist. Every authorized document web template you get is your own eternally. To obtain yet another backup of the bought form, go to the My Forms tab and click on the related option.

If you work with the US Legal Forms internet site the first time, adhere to the easy guidelines under:

- Very first, ensure that you have selected the correct document web template for that area/metropolis of your choosing. See the form explanation to make sure you have chosen the proper form. If readily available, make use of the Review option to appear through the document web template as well.

- If you would like locate yet another edition of your form, make use of the Look for area to obtain the web template that fits your needs and needs.

- After you have discovered the web template you would like, simply click Get now to proceed.

- Pick the prices strategy you would like, enter your qualifications, and sign up for your account on US Legal Forms.

- Complete the financial transaction. You can use your Visa or Mastercard or PayPal profile to pay for the authorized form.

- Pick the formatting of your document and obtain it to the device.

- Make adjustments to the document if necessary. You may full, revise and indication and print out Colorado Lien and Tax Search Checklist.

Obtain and print out 1000s of document templates while using US Legal Forms Internet site, which provides the largest assortment of authorized kinds. Use skilled and status-certain templates to take on your organization or specific requirements.