Colorado Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

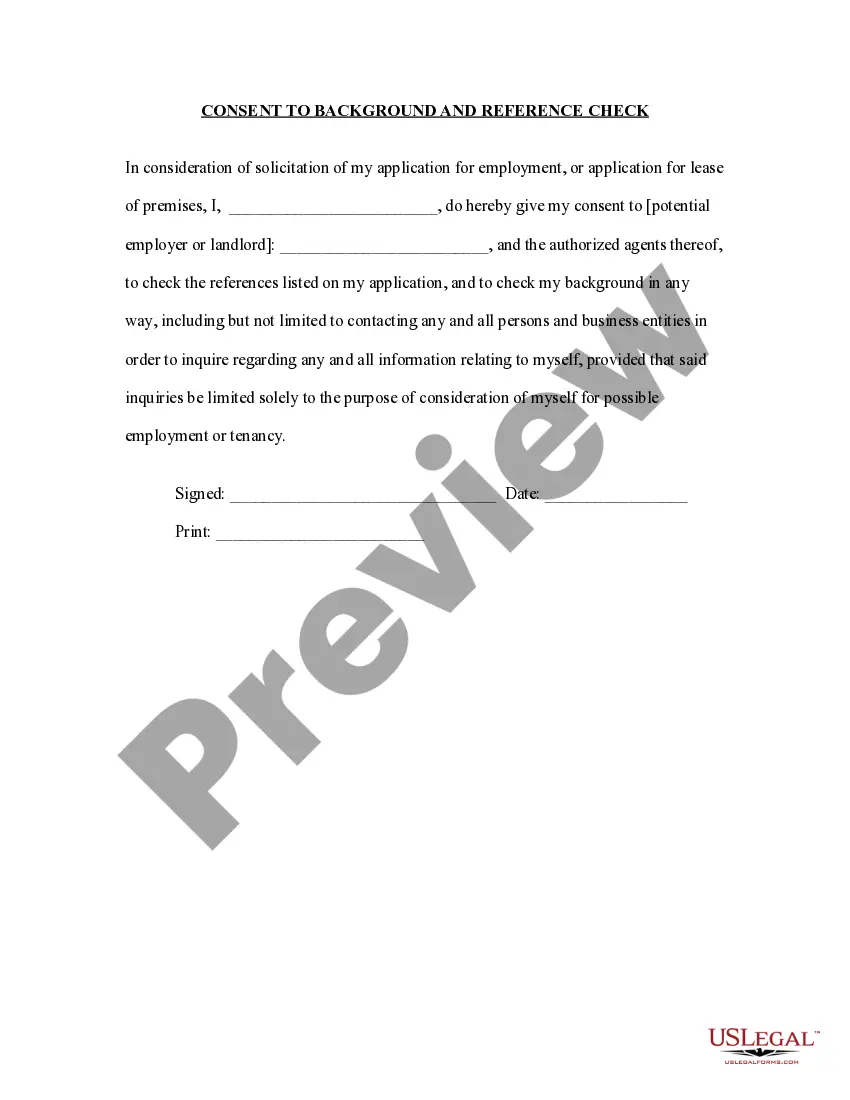

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

US Legal Forms - one of several most significant libraries of authorized forms in America - offers a variety of authorized record layouts you are able to download or produce. While using website, you may get thousands of forms for business and specific reasons, sorted by types, states, or keywords and phrases.You will discover the latest types of forms just like the Colorado Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease in seconds.

If you already possess a registration, log in and download Colorado Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease through the US Legal Forms local library. The Acquire button will appear on every kind you view. You have access to all formerly acquired forms from the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, allow me to share simple instructions to help you started:

- Be sure you have picked out the correct kind for your personal area/county. Click the Review button to check the form`s content. See the kind description to ensure that you have chosen the appropriate kind.

- When the kind does not suit your specifications, make use of the Lookup area at the top of the display to find the one who does.

- Should you be pleased with the shape, confirm your decision by visiting the Purchase now button. Then, opt for the prices strategy you want and provide your qualifications to register for the accounts.

- Method the deal. Make use of Visa or Mastercard or PayPal accounts to perform the deal.

- Pick the formatting and download the shape in your system.

- Make alterations. Fill out, edit and produce and signal the acquired Colorado Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Every single template you added to your bank account lacks an expiry date and it is the one you have for a long time. So, if you wish to download or produce yet another version, just check out the My Forms portion and click about the kind you require.

Gain access to the Colorado Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease with US Legal Forms, probably the most considerable local library of authorized record layouts. Use thousands of specialist and status-particular layouts that satisfy your organization or specific needs and specifications.

Form popularity

FAQ

Non-Participating Royalty Interest (NPRI) Unlike a mineral interest owner, the NPRI owner does not have ?executive? rights, meaning they cannot sign an oil and gas lease or participate in the benefits of lease bonus or delay rentals.

Mineral ownership, or mineral rights, are understood to be the property rights to exploit an area for the minerals, gas, or oil it harbors. The four types of mineral ownership are: Mineral Interest ? interest generated after the production of oil and gas after the sale of a deed or a lease.

In such circumstances where a gas well has been completed but no market exists for the gas, the shut-in clause enables a lessee to keep the non-producing lease in force by the payment of the shut-in royalty.

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

A stipulation of interest is a contract that consists of mutual conveyances, and therefore, it must conform to the requirements of both a contract and conveyance. Consequently, title to the property interest will be owned as set out in the stipulation, that is if it contains adequate granting language.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Surface rights are what you own on the surface of the property. These include the space, the buildings and the landscaping. Mineral rights, on the other hand, cover the specific resources beneath the surface. In areas designated for mining, it's common for surface rights and mineral rights to be separate.

Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.