Colorado Exhibit D to Operating Agreement Insurance - Form 1

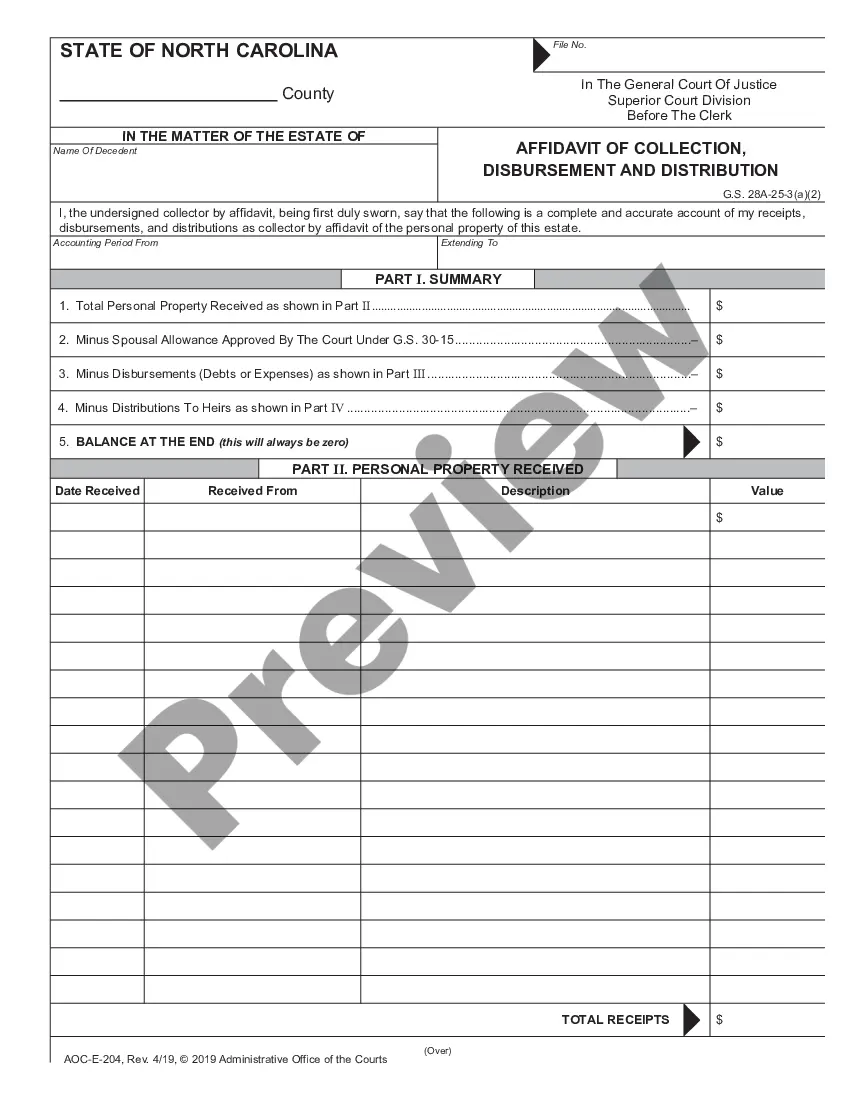

Description

How to fill out Exhibit D To Operating Agreement Insurance - Form 1?

Choosing the right lawful papers design might be a struggle. Of course, there are plenty of layouts accessible on the Internet, but how do you discover the lawful type you want? Use the US Legal Forms site. The assistance offers a huge number of layouts, like the Colorado Exhibit D to Operating Agreement Insurance - Form 1, that can be used for enterprise and private needs. Every one of the kinds are inspected by pros and fulfill state and federal needs.

In case you are currently authorized, log in in your bank account and click the Down load button to have the Colorado Exhibit D to Operating Agreement Insurance - Form 1. Make use of your bank account to look from the lawful kinds you may have ordered previously. Go to the My Forms tab of your bank account and acquire yet another copy of your papers you want.

In case you are a brand new end user of US Legal Forms, listed below are basic guidelines that you should follow:

- First, make certain you have selected the proper type for the metropolis/region. It is possible to look over the form making use of the Review button and read the form information to guarantee it is the best for you.

- In case the type fails to fulfill your needs, make use of the Seach field to obtain the correct type.

- When you are certain the form is acceptable, click the Purchase now button to have the type.

- Opt for the pricing prepare you need and enter in the required info. Design your bank account and buy an order using your PayPal bank account or bank card.

- Opt for the submit format and down load the lawful papers design in your device.

- Total, edit and print out and indication the attained Colorado Exhibit D to Operating Agreement Insurance - Form 1.

US Legal Forms is the most significant collection of lawful kinds that you can find numerous papers layouts. Use the company to down load appropriately-created documents that follow state needs.