This package is designed to assist homeowners to obtain a loan modification under the Home Affordable Modification Program (HAMP). Including in this package are the following forms:

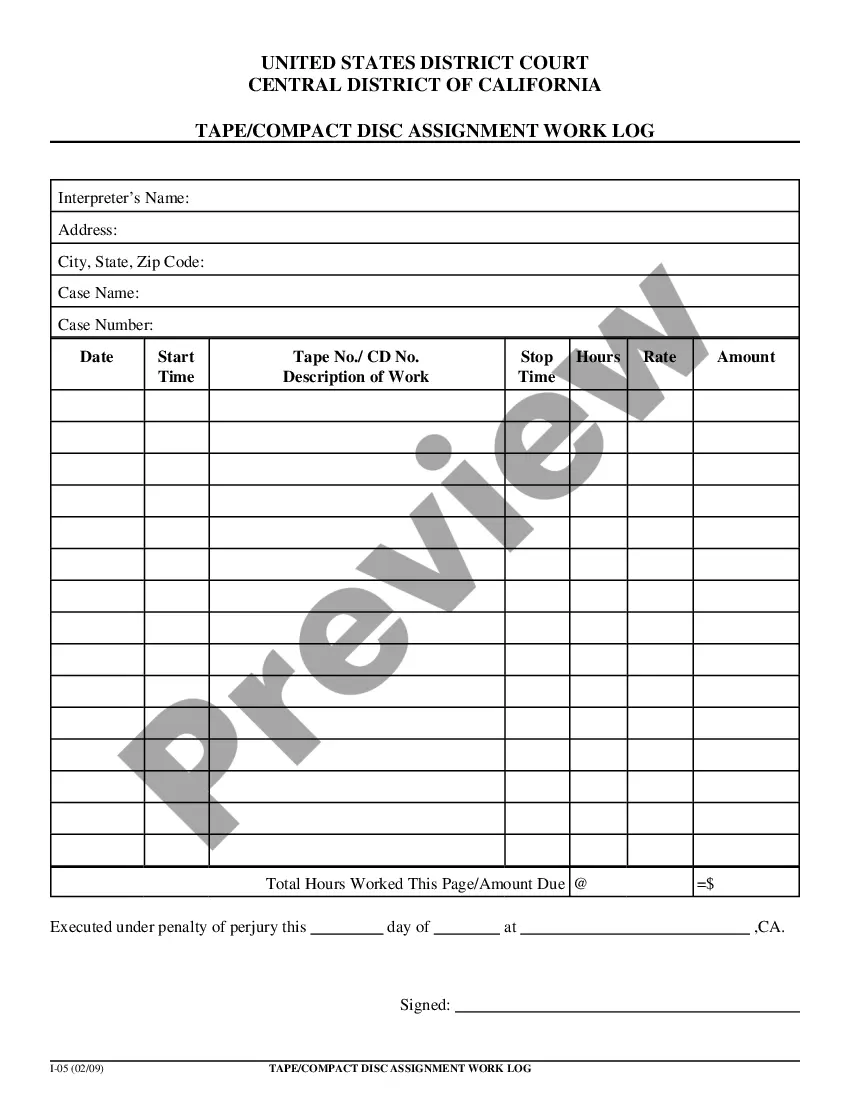

1. Request for Loan Modification and Affidavit RMA Under Home Affordable Modification Program HAMP

2. Instructions for Completing Request for Loan Modification and Affidavit RMA Form

3. IRS Form 4506-EZ Short Form Request for Individual Tax Return Transcript

4. Instructions for Completing IRS Form 4506T-EZ

5. How to Request a Home Affordable Modification Guide

Purchase of this package is a savings of nearly 30% compared to purchase of the forms individually!

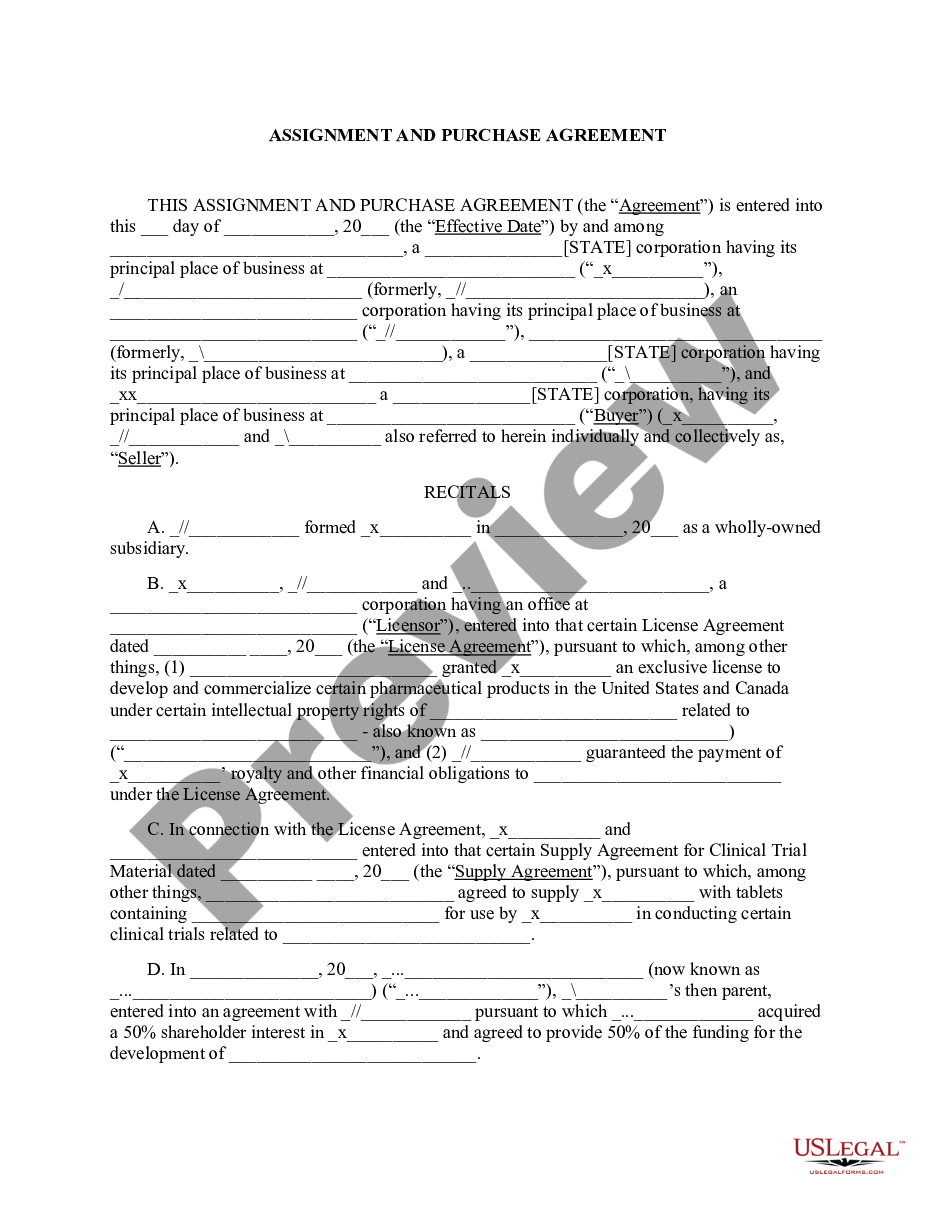

The Colorado CAMP Loan Modification Package is a foreclosure prevention program designed to assist homeowners in Colorado who are struggling to make their mortgage payments. It aims to provide eligible homeowners with a feasible loan modification plan, allowing them to stay in their homes and avoid foreclosure. The Colorado CAMP Loan Modification Package is an initiative under the Home Affordable Modification Program (CAMP), a federal program created to help homeowners facing financial hardship due to the downturn of the economy or other factors beyond their control. It offers various options to modify the terms of an existing mortgage, such as adjusting the interest rate, extending the loan term, or reducing the outstanding principal balance. This loan modification package in Colorado is tailored specifically to meet the needs of Colorado homeowners, considering the state's unique housing market and economic conditions. It provides assistance to borrowers who are facing difficulties in making their monthly mortgage payments, allowing them to obtain more affordable mortgage terms and avoid foreclosure. There are several types of Colorado CAMP Loan Modification Packages available, depending on the borrower's individual situation and financial capability. These may include: 1. Rate Reduction Modification: This type of modification aims to reduce the interest rate on the existing mortgage, making the monthly payments more affordable for the homeowner. 2. Term Extension Modification: With this type of modification, the loan term is extended, resulting in lower monthly payments. Extending the loan term allows homeowners more time to repay the loan, thereby reducing the financial burden. 3. Principal Forbearance Modification: In certain cases, the outstanding principal balance on the mortgage may be temporarily reduced or suspended. This modification helps homeowners who are facing a significant drop in income or other financial hardships. 4. Combination Modification: Sometimes, a combination of rate reduction, term extension, and principal forbearance may be implemented to achieve a modified loan that is manageable for the homeowner. It's important for Colorado homeowners to reach out to their mortgage service or a HUD-approved housing counseling agency to explore the specific options available to them under the Colorado CAMP Loan Modification Package. These professionals can guide homeowners through the application process and determine the most suitable modification plan based on their individual circumstances. It's crucial to provide all necessary documentation and meet the program's eligibility criteria to increase the chances of a successful loan modification.

The Colorado CAMP Loan Modification Package is a foreclosure prevention program designed to assist homeowners in Colorado who are struggling to make their mortgage payments. It aims to provide eligible homeowners with a feasible loan modification plan, allowing them to stay in their homes and avoid foreclosure. The Colorado CAMP Loan Modification Package is an initiative under the Home Affordable Modification Program (CAMP), a federal program created to help homeowners facing financial hardship due to the downturn of the economy or other factors beyond their control. It offers various options to modify the terms of an existing mortgage, such as adjusting the interest rate, extending the loan term, or reducing the outstanding principal balance. This loan modification package in Colorado is tailored specifically to meet the needs of Colorado homeowners, considering the state's unique housing market and economic conditions. It provides assistance to borrowers who are facing difficulties in making their monthly mortgage payments, allowing them to obtain more affordable mortgage terms and avoid foreclosure. There are several types of Colorado CAMP Loan Modification Packages available, depending on the borrower's individual situation and financial capability. These may include: 1. Rate Reduction Modification: This type of modification aims to reduce the interest rate on the existing mortgage, making the monthly payments more affordable for the homeowner. 2. Term Extension Modification: With this type of modification, the loan term is extended, resulting in lower monthly payments. Extending the loan term allows homeowners more time to repay the loan, thereby reducing the financial burden. 3. Principal Forbearance Modification: In certain cases, the outstanding principal balance on the mortgage may be temporarily reduced or suspended. This modification helps homeowners who are facing a significant drop in income or other financial hardships. 4. Combination Modification: Sometimes, a combination of rate reduction, term extension, and principal forbearance may be implemented to achieve a modified loan that is manageable for the homeowner. It's important for Colorado homeowners to reach out to their mortgage service or a HUD-approved housing counseling agency to explore the specific options available to them under the Colorado CAMP Loan Modification Package. These professionals can guide homeowners through the application process and determine the most suitable modification plan based on their individual circumstances. It's crucial to provide all necessary documentation and meet the program's eligibility criteria to increase the chances of a successful loan modification.