Colorado Limited Liability Company LLC Agreement for New General Partner

Description

How to fill out Limited Liability Company LLC Agreement For New General Partner?

US Legal Forms - one of the largest libraries of authorized forms in the United States - delivers a variety of authorized document templates it is possible to download or produce. Making use of the site, you can find 1000s of forms for business and individual purposes, categorized by groups, states, or keywords and phrases.You will find the latest types of forms like the Colorado Limited Liability Company LLC Agreement for New General Partner within minutes.

If you already have a registration, log in and download Colorado Limited Liability Company LLC Agreement for New General Partner through the US Legal Forms library. The Download button can look on each type you see. You have access to all in the past delivered electronically forms inside the My Forms tab of your respective account.

If you would like use US Legal Forms initially, here are basic guidelines to get you started off:

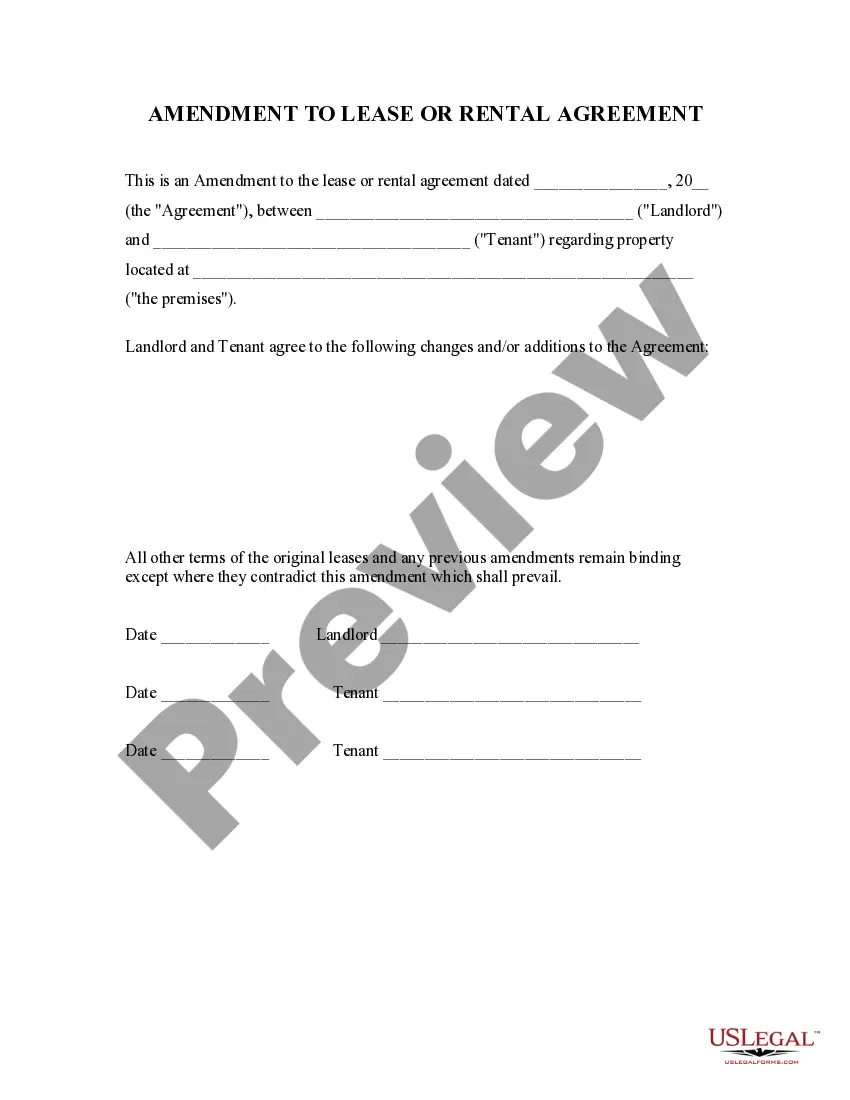

- Be sure to have picked the proper type for your personal area/state. Select the Preview button to analyze the form`s content material. Look at the type description to actually have chosen the appropriate type.

- If the type does not fit your specifications, take advantage of the Look for field at the top of the display to find the one which does.

- When you are satisfied with the form, validate your option by visiting the Acquire now button. Then, select the rates strategy you favor and supply your references to sign up to have an account.

- Process the purchase. Make use of bank card or PayPal account to accomplish the purchase.

- Select the format and download the form on your product.

- Make alterations. Load, revise and produce and signal the delivered electronically Colorado Limited Liability Company LLC Agreement for New General Partner.

Every single design you put into your bank account does not have an expiration particular date and is also yours permanently. So, if you want to download or produce yet another duplicate, just go to the My Forms segment and click about the type you will need.

Obtain access to the Colorado Limited Liability Company LLC Agreement for New General Partner with US Legal Forms, probably the most considerable library of authorized document templates. Use 1000s of specialist and status-distinct templates that fulfill your organization or individual requirements and specifications.

Form popularity

FAQ

Most businesses need an EIN, also called a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN). However, if your business is a single-member LLC and you do not have any employees, you can use your Social Security number instead.

A limited liability company (LLC) is a business entity type that can have more than one owner. These owners are referred to as ?members? and can include individuals, corporations, other LLCs, and foreign entities. Most states do not restrict LLC ownership, and there is generally no maximum number of members.

Under Colorado law, a general partnership is formed by ?the association of two or more persons to carry on, as co-owners, a business for profit . . . .? See C.R.S. § 7-64-202; C.R.S. § 7-60-106. Importantly, a partnership can be formed by oral or written agreement or inferred from the actions of the parties.

How do I amend my Colorado LLC operating agreement to add a member? Hold a meeting of all members. Draft a resolution (to add a member) Vote on the resolution. Pass the resolution (if a majority vote in favor) Keep the member resolution with your records.

How to form a Colorado General Partnership ? Step by Step Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Research license requirements. ... Step 6 ? Maintain your Partnership.

Converting a Single-Member LLC to a Multi-Member LLC If your LLC already has an employer identification number (EIN), you have to file Form 8832 with the IRS to elect partnership taxation and provide the names of the new members.

A person who is forming the limited liability company must be either an individual who is age 18 years or older or a business entity. If an individual is one of the persons forming the limited liability company, a last name and a first name must be provided.

Colorado does not require you to submit an Operating Agreement to form your LLC. However, it is important for every LLC to have an Operating Agreement, establishing the rules and structure of the business.