The non-employee director stock option prospectus explains the stock option plan to the non-employee directors. It addresses the director's right to exercise the option of buying common stock in the company, along with explaining the obligations of the non-employee director where taxes and capital gains are concerned.

Colorado Nonemployee Director Stock Option Prospectus

Description

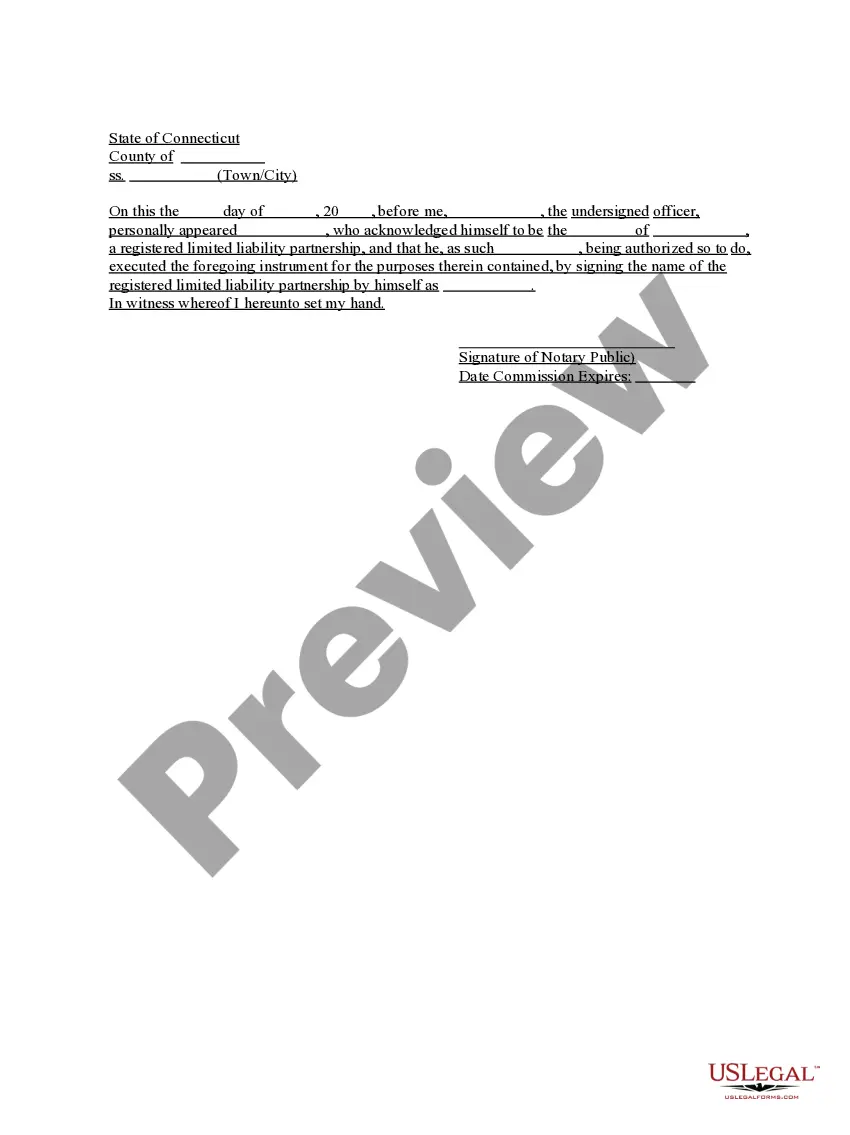

How to fill out Nonemployee Director Stock Option Prospectus?

US Legal Forms - one of several biggest libraries of legitimate kinds in the USA - offers a variety of legitimate papers templates it is possible to down load or printing. Using the website, you can get 1000s of kinds for enterprise and personal reasons, sorted by types, claims, or keywords and phrases.You can get the latest types of kinds like the Colorado Nonemployee Director Stock Option Prospectus within minutes.

If you currently have a subscription, log in and down load Colorado Nonemployee Director Stock Option Prospectus through the US Legal Forms local library. The Down load option can look on every develop you see. You gain access to all previously saved kinds within the My Forms tab of the profile.

In order to use US Legal Forms for the first time, listed here are simple instructions to help you started out:

- Be sure to have selected the best develop for your metropolis/county. Click the Preview option to review the form`s content material. Read the develop outline to ensure that you have selected the proper develop.

- In case the develop does not satisfy your requirements, utilize the Research area on top of the display screen to discover the one who does.

- If you are happy with the shape, validate your decision by clicking on the Get now option. Then, select the pricing program you want and provide your references to sign up on an profile.

- Process the purchase. Use your credit card or PayPal profile to finish the purchase.

- Pick the format and down load the shape on your device.

- Make adjustments. Fill up, revise and printing and indication the saved Colorado Nonemployee Director Stock Option Prospectus.

Each template you added to your bank account does not have an expiration particular date and is your own permanently. So, if you wish to down load or printing an additional backup, just check out the My Forms segment and click on the develop you want.

Gain access to the Colorado Nonemployee Director Stock Option Prospectus with US Legal Forms, by far the most extensive local library of legitimate papers templates. Use 1000s of professional and status-distinct templates that satisfy your organization or personal needs and requirements.

Form popularity

FAQ

Weighing your options Ultimately, it's best to remember that stock options are just that: Options. They don't compel anyone to do anything, but they can, in some cases, prove extremely valuable and help significantly increase an employee's wealth. If they're fortunate enough to be at a strong, growing company, that is.

These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

What is a Stock Option Agreement? A stock option agreement refers to a contract between a company and an employee, independent contractor, or a consultant. Employers use it as a form of employee compensation. Both parties submit to operate within the terms, conditions, and restrictions stipulated in the agreement.

A stock option is a contract between two parties that gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a specified time period. A seller of the stock option is called an option writer, where the seller is paid a premium from the contract purchased by the buyer.