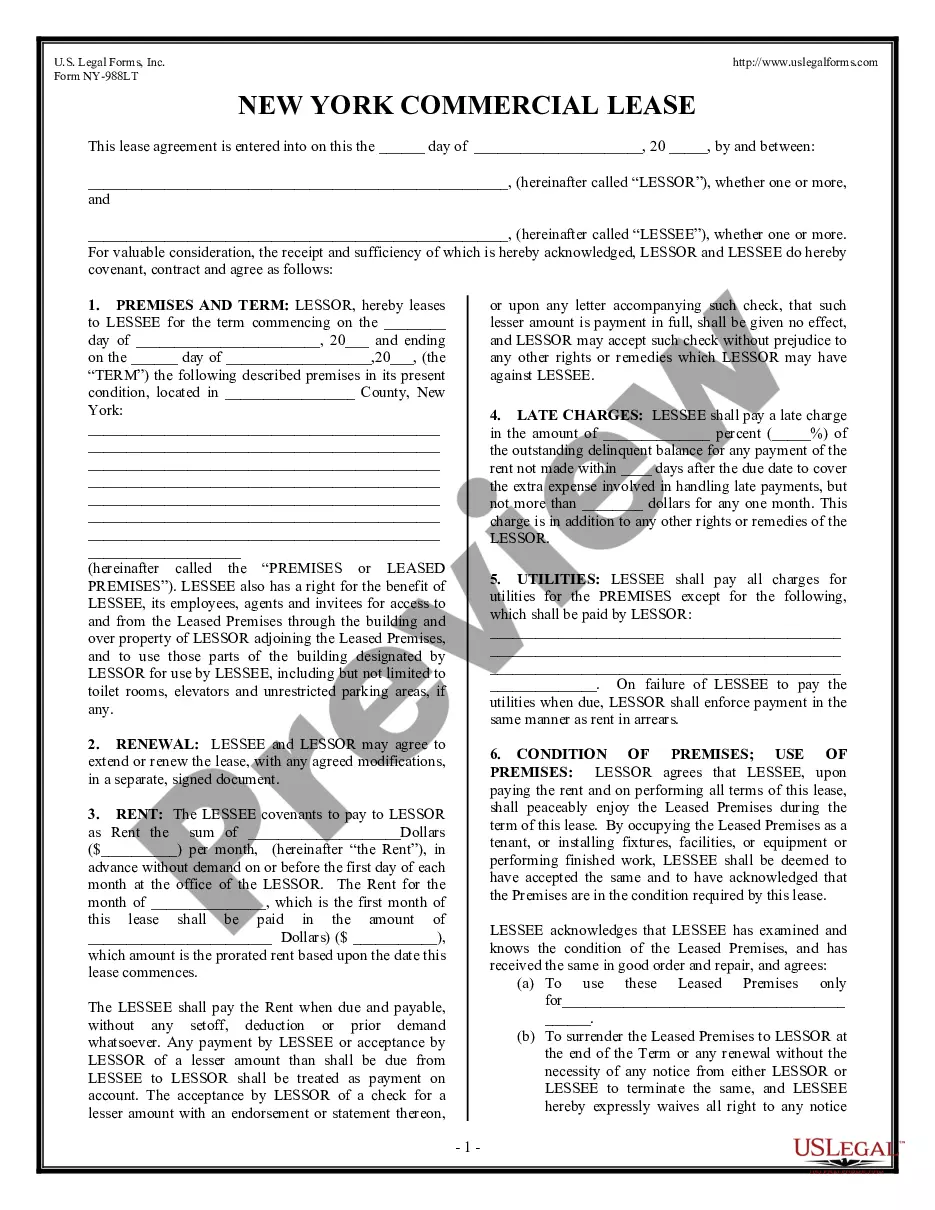

Deed of Trust - Assumable - Not Due on Transfer: This is an official Colorado Real Estate Commission form that complies with all applicable Colorado codes and statutes. USLF amends and updates all Colorado forms as is required by Colorado statutes and law.

Colorado Deed of Trust - Assumable - Not Due on Transfer

Description

How to fill out Colorado Deed Of Trust - Assumable - Not Due On Transfer?

The more documents you need to make - the more worried you are. You can get a huge number of Colorado Deed of Trust - Assumable - Not Due on Transfer blanks online, however, you don't know which of them to trust. Eliminate the hassle to make finding samples less complicated using US Legal Forms. Get accurately drafted documents that are created to meet state requirements.

If you already possess a US Legal Forms subscription, log in to the account, and you'll find the Download button on the Colorado Deed of Trust - Assumable - Not Due on Transfer’s webpage.

If you have never used our platform before, complete the sign up procedure using these directions:

- Check if the Colorado Deed of Trust - Assumable - Not Due on Transfer applies in your state.

- Re-check your option by reading through the description or by using the Preview function if they’re provided for the selected file.

- Simply click Buy Now to start the registration procedure and choose a rates plan that meets your preferences.

- Insert the requested information to create your profile and pay for the order with your PayPal or bank card.

- Select a handy document format and have your sample.

Find each file you get in the My Forms menu. Simply go there to produce a new version of your Colorado Deed of Trust - Assumable - Not Due on Transfer. Even when using professionally drafted forms, it’s nevertheless important that you think about asking the local legal representative to re-check completed form to be sure that your record is correctly filled in. Do much more for less with US Legal Forms!

Form popularity

FAQ

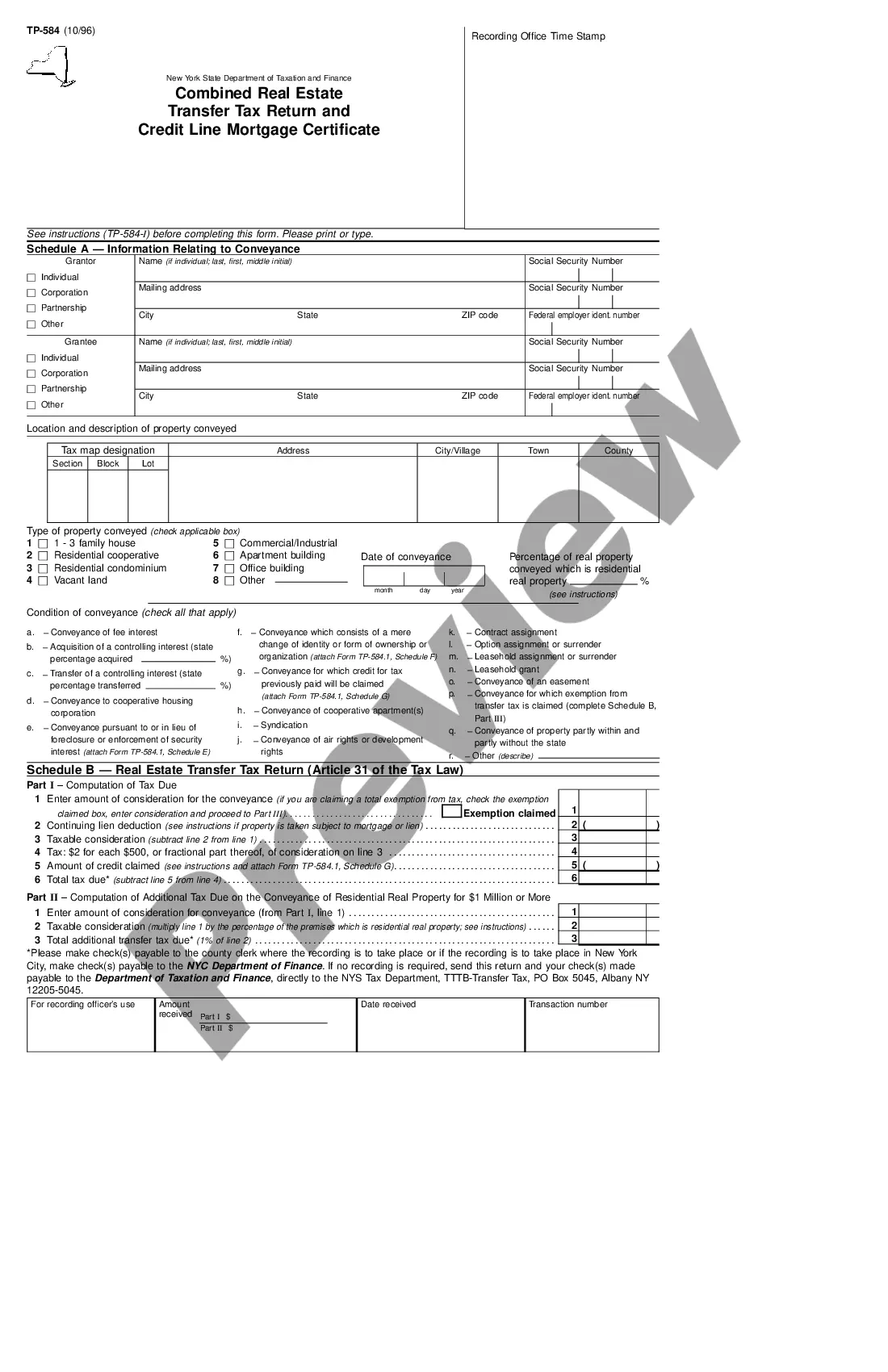

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

A deed conveys ownership; a deed of trust secures a loan.

Transferring a Property Subject to a Due-on-Sale Clause Perhaps the best way to avoid triggering a due-on-sale clause in a real estate deal is to obtain the lender's consent for a transfer.

A deed of trust expires can and will expire based upon one of two specific timelines. The deed can either expire at a designated point follow the maturity date or, in the absence of this information, exactly 35 years after the date on which the deed had been recorded.

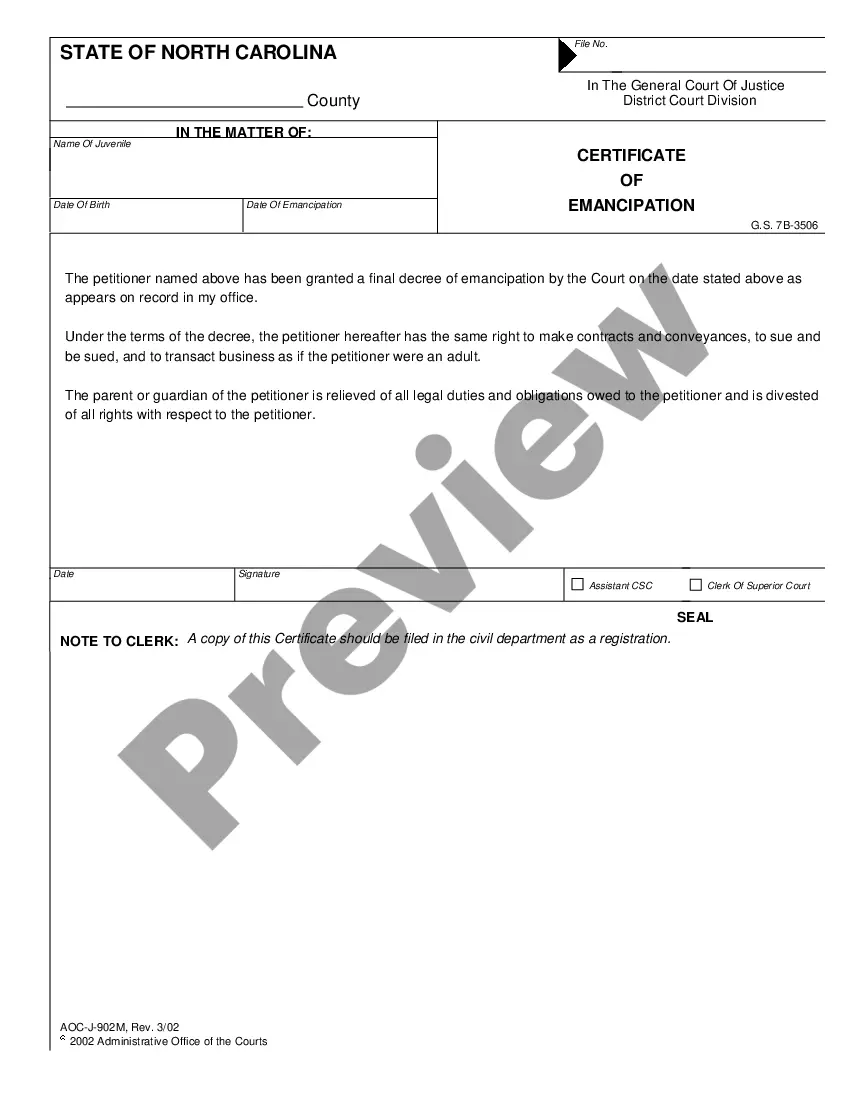

Property cannot be conveyed to a grantee who does not exist. Thus, a deed to a grantee who is dead at the time of delivery is void. For example, a deed recorded by the grantor is presumed to have been delivered.For example, a deed is voidable if it was obtained by fraud in the inducement.

Re-recording of the original document. With corrections made in the body of the original document. A cover sheet detailing the changes. Must be re-signed and re-acknowledged. Correction Deed. A new deed reflecting the corrections/changes. Must meet all recording requirements of a deed.

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.