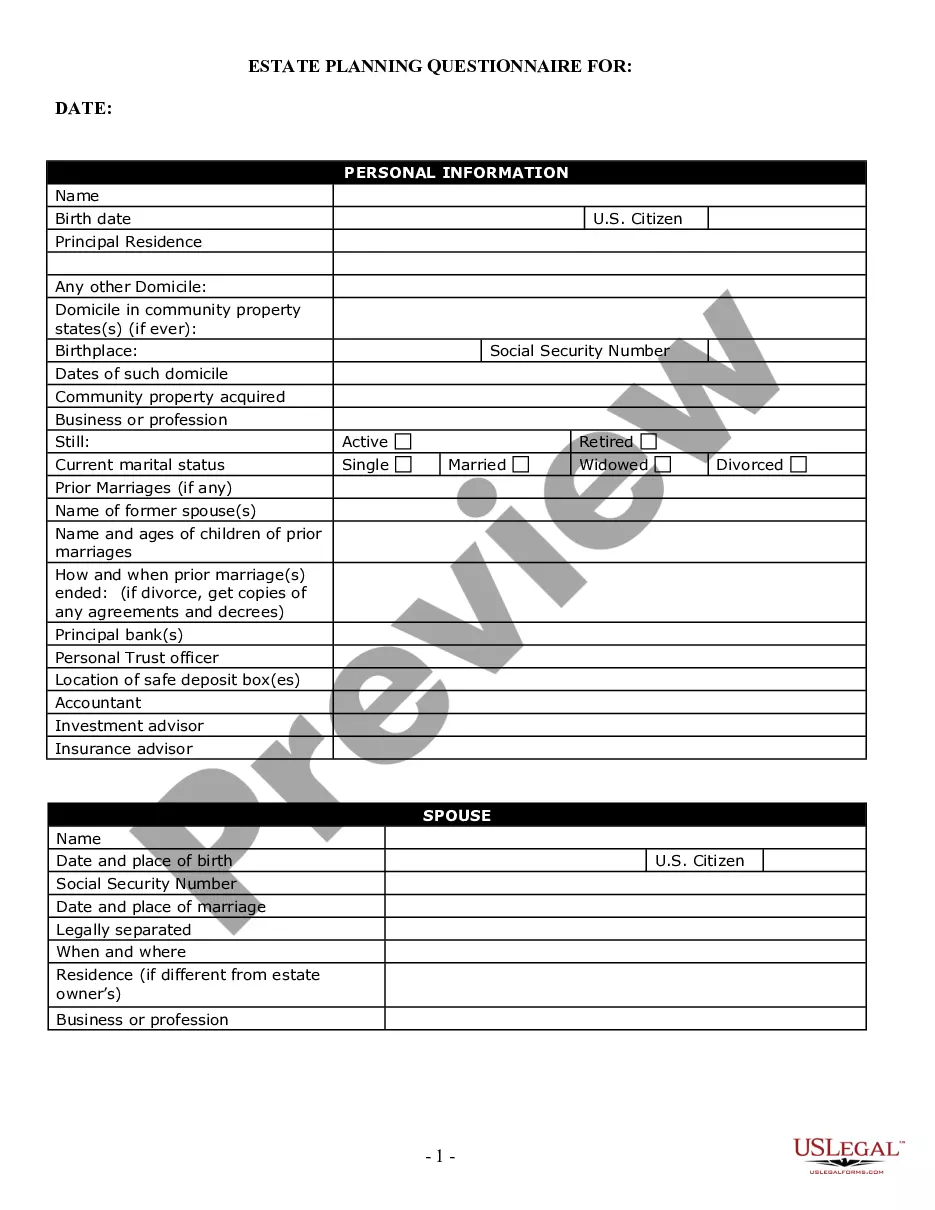

Colorado Estate Planning Questionnaire and Worksheets

Description

How to fill out Colorado Estate Planning Questionnaire And Worksheets?

The greater the number of documents you need to produce, the more anxious you become.

You can find numerous Colorado Estate Planning Questionnaire and Worksheets templates online, but you’re uncertain which ones to rely on.

Eliminate the frustration and simplify the process of obtaining samples by using US Legal Forms.

Click Buy Now to initiate the registration process and select a pricing option that fits your needs. Fill in the required information to create your account and complete the transaction using PayPal or credit card. Choose a preferred file format to download your document. You can find each sample you have downloaded in the My documents section. Just go there to generate a new version of the Colorado Estate Planning Questionnaire and Worksheets. Even with professionally prepared forms, it is still essential to consider asking your local attorney to verify the completed document to ensure that your submission is accurately filled out. Achieve more with less effort using US Legal Forms!

- Obtain precisely drafted documents that comply with state requirements.

- If you already have a subscription to US Legal Forms, Log In to your account, and you will find the Download button on the Colorado Estate Planning Questionnaire and Worksheets page.

- If you haven't used our site before, complete the registration process by following these steps.

- Verify that the Colorado Estate Planning Questionnaire and Worksheets applies in your state.

- Confirm your choice by reviewing the description or utilizing the Preview mode if available for the selected document.

Form popularity

FAQ

What Property Can Go in a Living Trust? Who Should Be My Trustee? Does a Living Trust Avoid Estate and Probate Taxes? What Are the Benefits of a Living Trust? What Are the Drawbacks of a Living Trust? Do I Still Need a Power of Attorney?

Step 1: Create a checklist of important documents (and their locations) Step 2: List the names and contact information of key associates. Step 3: Catalog your digital asset inventory. Step 4: Ensure all documents are organized and accessible.

Fill out your attorney's intake questionnaire. Gather your financial documents. Bring copies of your current estate plan documents. Divorce agreements, premarital agreements, and other relevant contracts. Choose your executors and health care agents.

Creating an estate plan is a lot like getting into better shape. Step 1: Sign a will. Step 2: Name beneficiaries. Step 3: Dodge estate taxes. Step 4: Leave a letter. Step 5: Draw up a durable power of attorney. Step 6: Create an advance health care directive.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

More Than a Last Will. Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Account. Update Your Insurance.