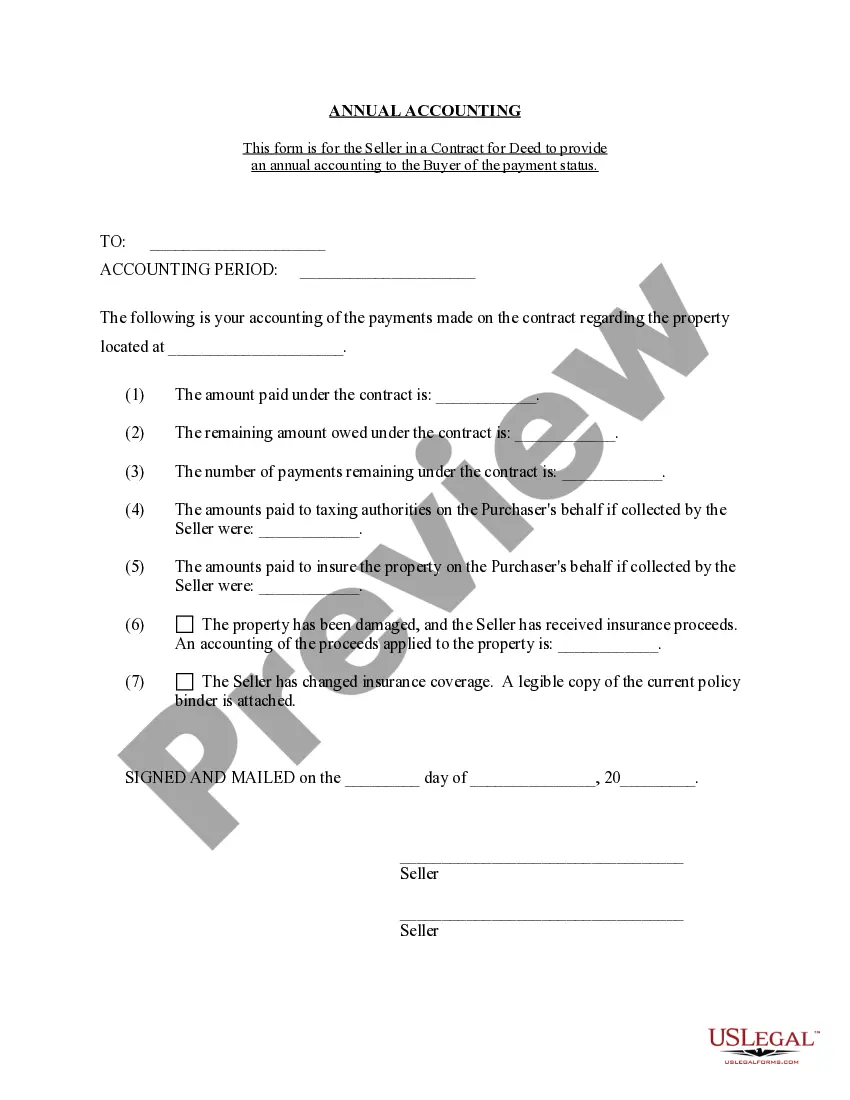

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Connecticut Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Connecticut Contract For Deed Seller's Annual Accounting Statement?

Utilize US Legal Forms to obtain a printable Connecticut Contract for Deed Seller's Annual Accounting Statement.

Our legally acceptable forms are created and frequently refreshed by proficient attorneys.

Ours is the most extensive library of forms on the internet and provides economical and precise samples for clients, legal experts, and small to medium-sized businesses.

Examine the form by reviewing the description and utilizing the Preview feature. If it's the document you seek, click Buy Now. Create your account and pay via PayPal or credit card. Download the template to your device and feel free to reuse it multiple times. If you need to find another document template, utilize the Search engine. US Legal Forms provides thousands of legal and tax samples and packages for both business and personal requirements, including the Connecticut Contract for Deed Seller's Annual Accounting Statement. Over three million users have successfully utilized our platform. Choose your subscription plan and acquire high-quality forms in just a few clicks.

- The documents are divided into state-specific categories.

- Several of them may be previewed before downloading.

- To download samples, users must hold a subscription and must Log In to their account.

- Click Download next to any template you require and locate it in My documents.

- For individuals without a subscription, follow the guidelines below to swiftly locate and download the Connecticut Contract for Deed Seller's Annual Accounting Statement.

- Ensure you have the correct form for the specific state required.

Form popularity

FAQ

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.

The State of Connecticut requires you to file an annual report for your LLC. Annual report forms or notifications are automatically sent to your LLC's mailing address. You can file your annual report online at the SOTS website. The annual report is due by the end of the anniversary month of your LLC's formation.

The amount that something can hold. Usually it means volume, such as milliliters (ml) or liters (l) in Metric, or pints or gallons in Imperial. Example: This glass has a capacity of 300 ml (but is actually holding only 160 ml)

The purpose of the annual report is to ensure the accuracy of the information on record regarding your business entity. The annual report does not require any financial information. The statutory filing fees for annual reports are as follows: ENTITY TYPE.

An annual report is a business's yearly report required by the states for which entities are registered to do business.Filing an annual report in a timely manner ensures your good standing with state government.

Annual reports inform all interested parties about the financial success (or failure) of a public entity, private corporation, non-profit organization, or other business formation.Some types of businesses must prepare and file an annual report by law with the Secretary of State where the company operates.

Authorized Capacity means the number of children that a licensed child care center or day care home is able to have in care at any one time including overlap. Sample 1.

How much does it cost to form an LLC in Connecticut? The Connecticut Secretary of State charges a $120 fee to file the Articles of Organization. It will cost $60 to file a name reservation application, if you wish to reserve your LLC name prior to filing the Articles of Organization.