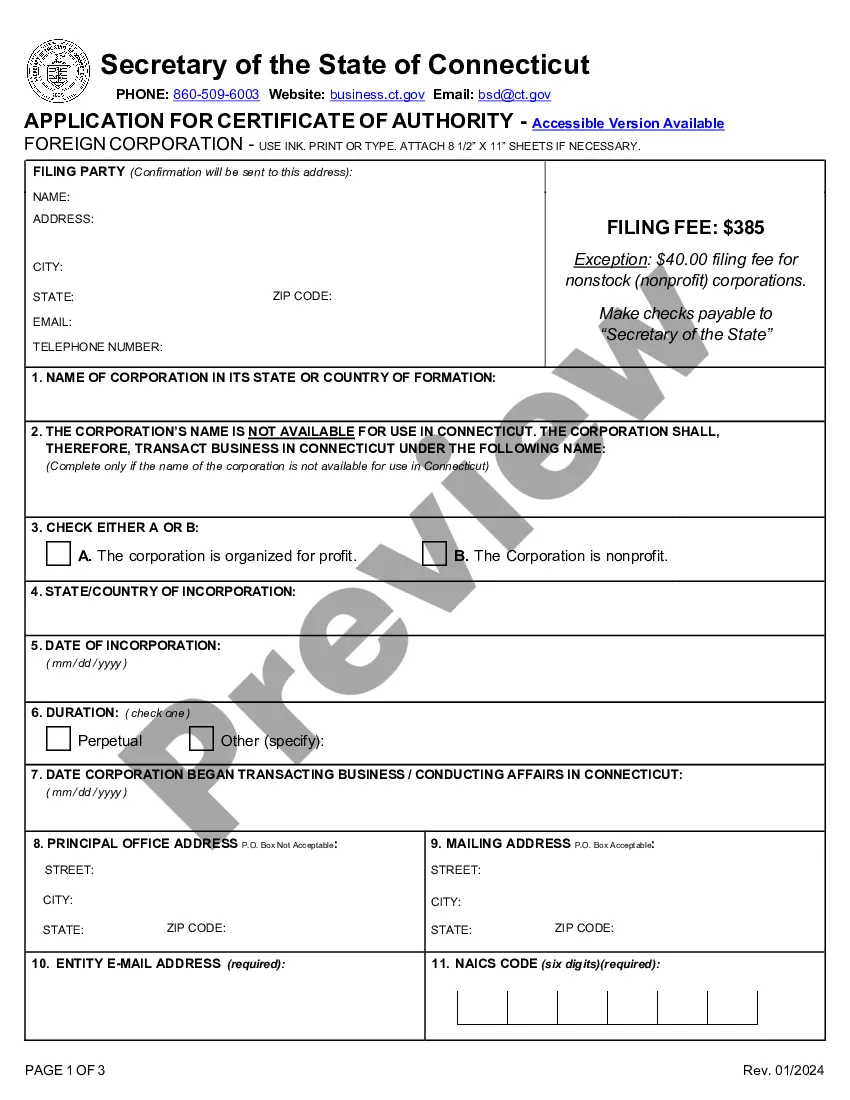

Connecticut Registration of Foreign Corporation

Description

How to fill out Connecticut Registration Of Foreign Corporation?

The larger quantity of documents you ought to compile - the more anxious you feel.

You can find countless Connecticut Registration of Foreign Corporation templates online, yet, you are unsure which ones to trust.

Eliminate the inconvenience and make searching for samples significantly simpler by using US Legal Forms. Obtain precisely formulated documents that are designed to fulfill state standards.

Provide the necessary information to establish your account and pay for the order using your PayPal or credit card. Choose a suitable document format and download your sample. Access each document you acquire in the My documents section. Simply navigate there to create a new version of the Connecticut Registration of Foreign Corporation. Even when possessing expertly crafted templates, it’s still important to consider consulting your local attorney to verify that your document is completed correctly. Achieve more for less with US Legal Forms!

- If you already possess a US Legal Forms subscription, Log In to your account, and you will see the Download option on the Connecticut Registration of Foreign Corporation’s page.

- If this is your first time using our service, follow these instructions to complete the registration process.

- Ensure that the Connecticut Registration of Foreign Corporation is applicable in your resident state.

- Verify your selection by reviewing the description or by utilizing the Preview option if available for the selected document.

- Click Buy Now to initiate the registration process and select a pricing plan that meets your needs.

Form popularity

FAQ

Decide Upon and Set Up the Legal Structure of the Business. Name Selection. Register for a Federal Tax Number (referred to as an EIN, Employer Identification Number, FEIN or Federal Employer Identification Number) Obtain a State Tax Registration Number/ID from DRS (the Connecticut Department of Revenue Services)

When opening a Connecticut business, the first thing you need to do is register your entity through the Department of Revenue and apply for a Connecticut State Tax ID number. You will need to use Form REG-1 if you make the application via mail or apply online.

To start an LLC in Connecticut you will need to file a Certificate of Organization with the Connecticut Secretary of State, which costs $120. You can apply online, by mail, or in person. The Certificate of Organization is the legal document that officially creates your Connecticut limited liability company.

Online using the Taxpayer Service Center. In person by visiting any of our Offices.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

If you own a business that was created in a state other than Connecticut, you will need to qualify or register that business in Connecticut if you want to do business there. Here is an overview of the rules on how to qualify your foreign (non-Connecticut) limited liability company (LLC) to do business in Connecticut.

2) Business LicensesConnecticut's requires new businesses to obtain permits and licenses that correspond to their available services. The cost of the license or permit will depend on the trade or occupation.

Foreign Entity - Any business organization that transacts business outside of its state of formation is recognized as foreign in the states in which it obtains a certificate of authority. Foreign Qualification - Refers to registering your business or nonprofit outside its state of formation.