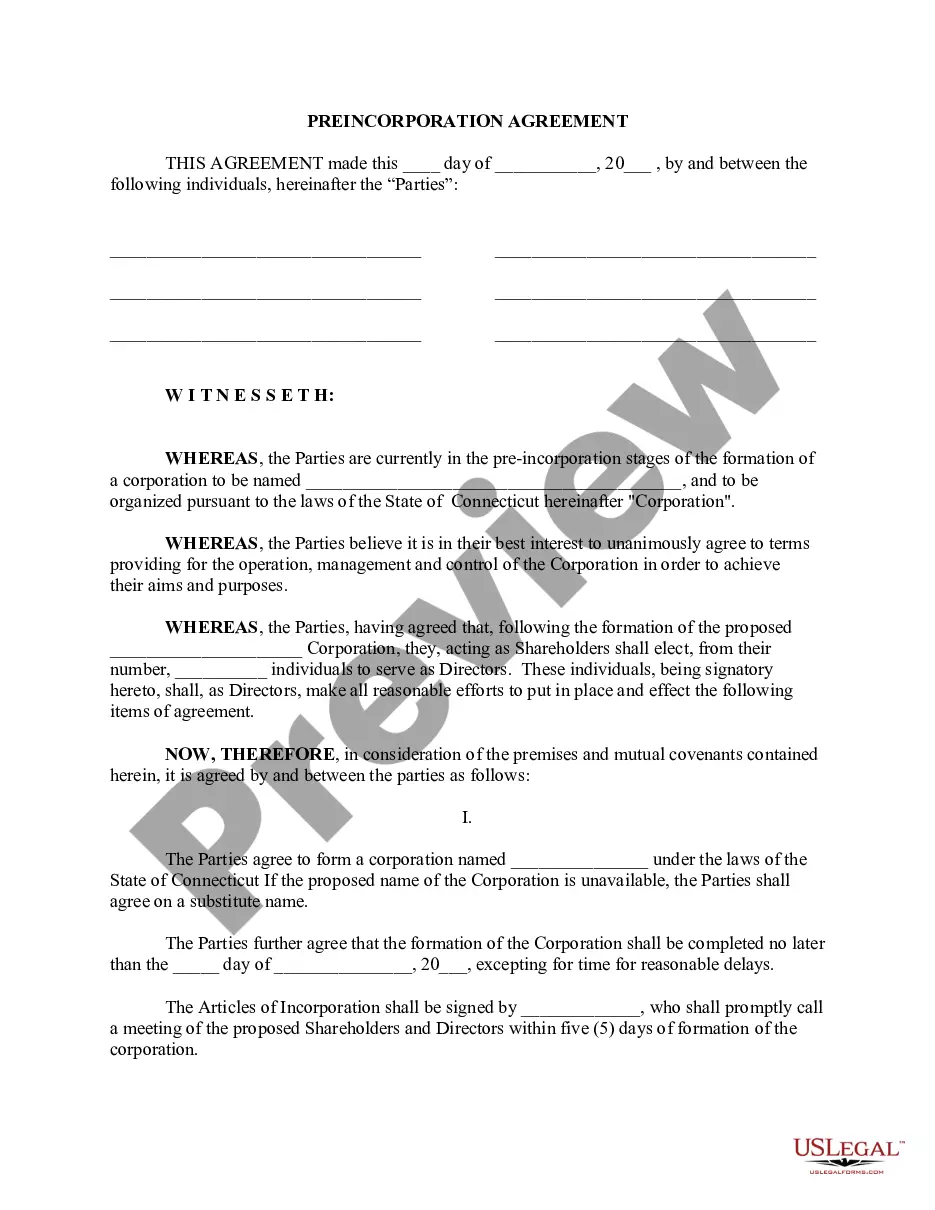

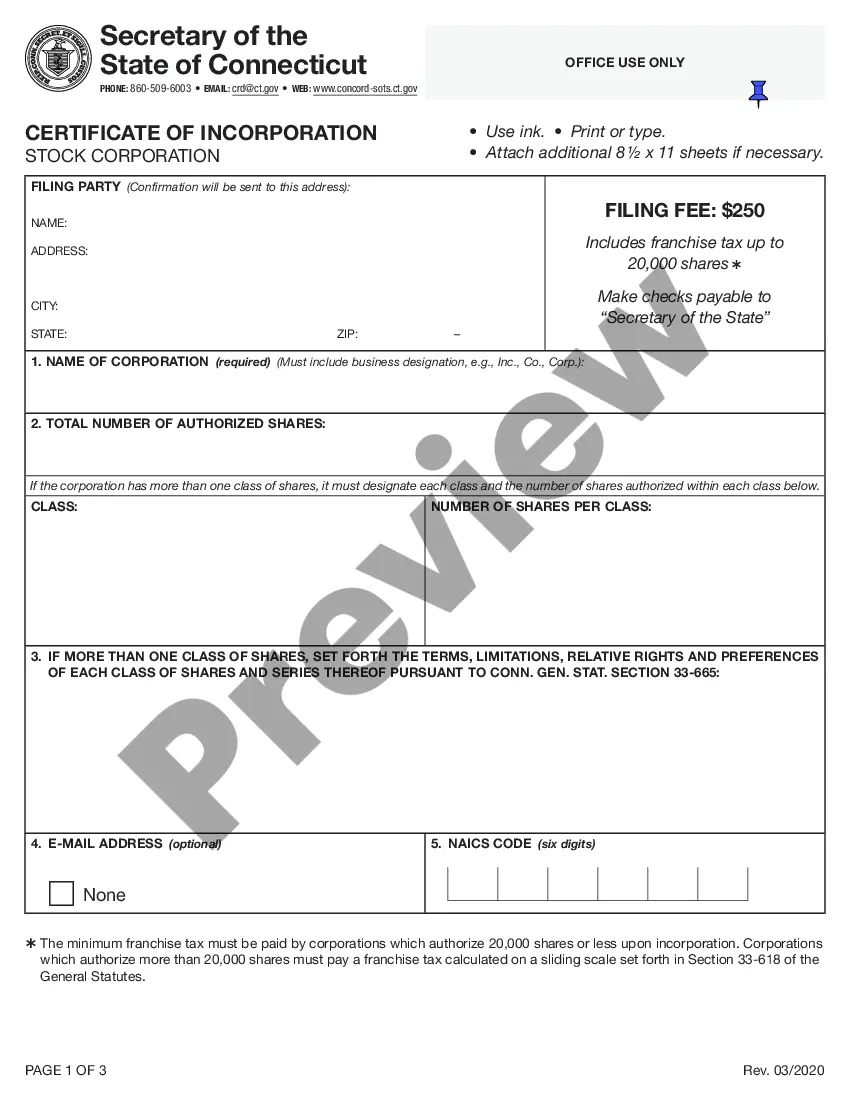

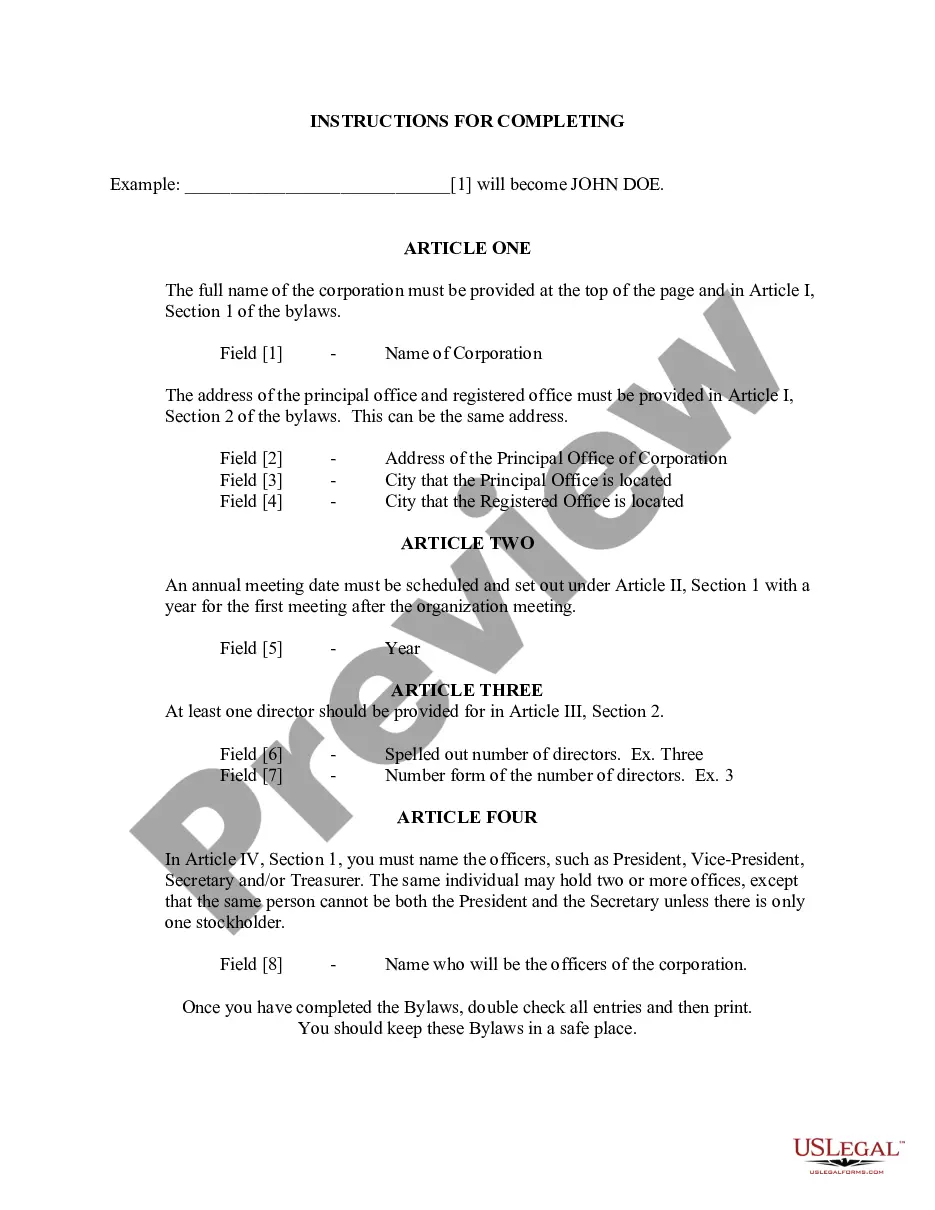

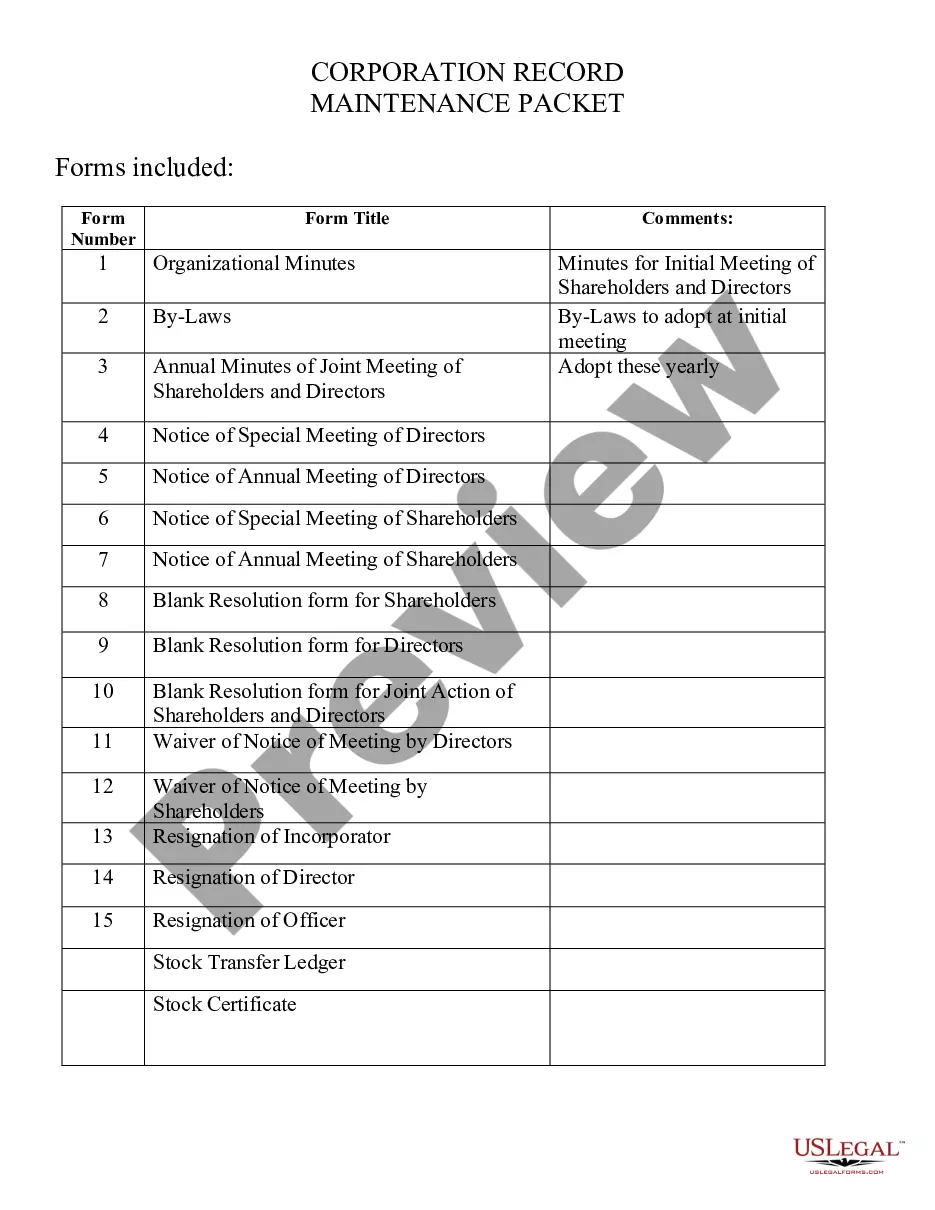

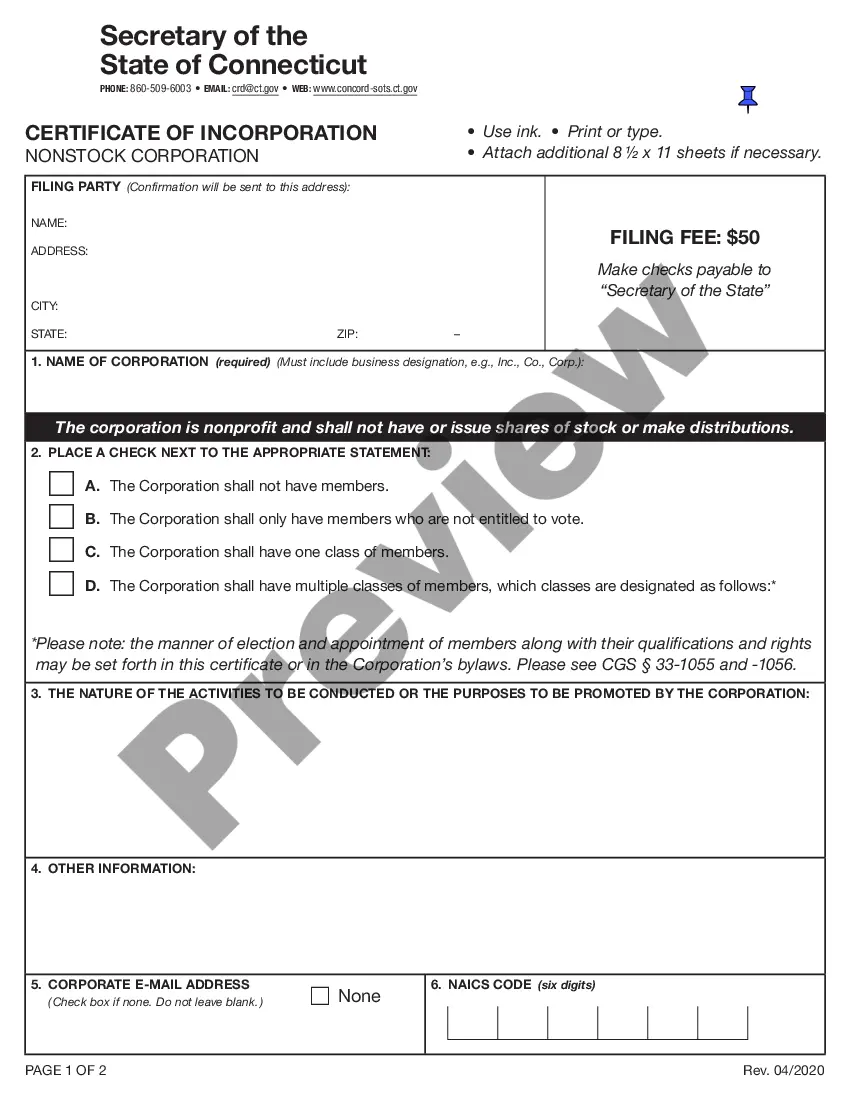

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Connecticut Business Incorporation Package to Incorporate Corporation

Description

How to fill out Connecticut Business Incorporation Package To Incorporate Corporation?

The larger quantity of documentation you need to produce - the more nervous you become.

You can access a vast array of Connecticut Business Incorporation Package to Incorporate Corporation templates online, however, you remain uncertain about which ones to trust.

Eliminate the frustration of finding samples by utilizing US Legal Forms. Obtain professionally designed documents that adhere to state regulations.

Provide the required information to create your account and process your payment using PayPal or a credit card. Choose a convenient file format and download your template. Locate every document you download in the My documents section. Simply go there to prepare a new copy of your Connecticut Business Incorporation Package to Incorporate Corporation. Even when utilizing professionally crafted templates, it remains crucial to consider consulting a local attorney to review the completed form to ensure that your document is accurately filled. Achieve more for less with US Legal Forms!

- If you are currently subscribed to US Legal Forms, Log In to your account, and you will find the Download option on the Connecticut Business Incorporation Package to Incorporate Corporation page.

- If you have never utilized our platform before, complete the registration process by following these steps.

- Confirm that the Connecticut Business Incorporation Package to Incorporate Corporation is applicable in your state.

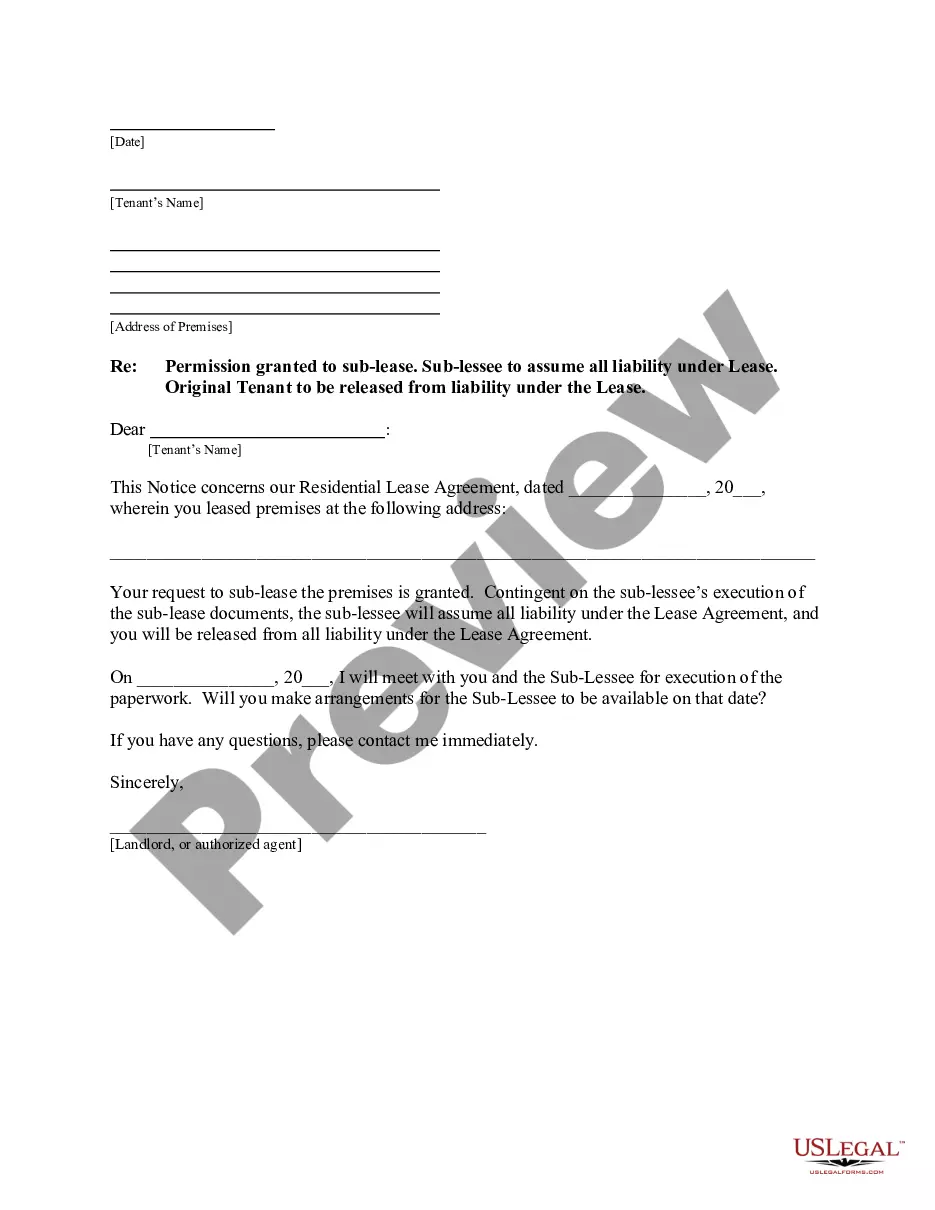

- Verify your selection by reading the description or using the Preview feature if available for the chosen document.

- Click Buy Now to initiate the registration process and choose a pricing plan that fits your needs.

Form popularity

FAQ

Decide Upon and Set Up the Legal Structure of the Business. Name Selection. Register for a Federal Tax Number (referred to as an EIN, Employer Identification Number, FEIN or Federal Employer Identification Number) Obtain a State Tax Registration Number/ID from DRS (the Connecticut Department of Revenue Services)

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

To start an LLC in Connecticut you will need to file a Certificate of Organization with the Connecticut Secretary of State, which costs $120. You can apply online, by mail, or in person. The Certificate of Organization is the legal document that officially creates your Connecticut limited liability company.

Inc. is the abbreviation for incorporated. An incorporated company, or corporation, is a separate legal entity from the person or people forming it. Directors and officers purchase shares in the business and have responsibility for its operation. Incorporation limits an individual's liability in case of a lawsuit.

Registered Office. Business Activity. Director's Details. Shareholders' Details. Shareholders' Details. Secretary Details (Not Compulsory) Person with Significant Control (PSC) Details Where the person is not a director, shareholder or secretary.

How much does it cost to form an LLC in Connecticut? The Connecticut Secretary of State charges a $120 fee to file the Articles of Organization. It will cost $60 to file a name reservation application, if you wish to reserve your LLC name prior to filing the Articles of Organization.

Do I need to incorporate my small business? Whether your team is composed of two people or 10, all businesses can benefit from incorporating. Advantages of forming a corporation or limited liability company (LLC) include: Personal asset protection.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

Choose a Corporate Name. File Certificate of Incorporation. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Initial Directors and Hold First Board Meeting. File an Annual Report. Obtain an EIN.