This form package provides the forms necessary to form a professional corporation for the practice of a state-licensed profession in Connecticut. You fill in the name of your profession in the blanks provided.

Professional Corporation Package for Connecticut

Description Business Entity Search Connecticut

How to fill out Professional Corporation Package For Connecticut?

Amid numerous paid and complimentary templates available on the internet, one cannot guarantee their precision. For instance, who created them or if they possess adequate expertise to fulfill your specific needs.

Stay calm and utilize US Legal Forms! Obtain the Professional Corporation Package for Connecticut templates crafted by proficient attorneys and sidestep the expensive and time-consuming task of searching for a lawyer and subsequently compensating them to draft a document that you can easily acquire yourself.

If you hold a subscription, Log In to your account and locate the Download button adjacent to the file you seek. You will also gain access to all your previously saved samples in the My documents section.

Once you have registered and purchased your subscription, you can utilize your Professional Corporation Package for Connecticut as frequently as you require or for as long as it is valid in your area. Modify it with your chosen online or offline editor, complete it, sign it, and create a physical copy. Achieve more for less with US Legal Forms!

- Ensure that the file you find is applicable in your location.

- Examine the template by checking the description using the Preview feature.

- Hit Buy Now to initiate the purchasing process or search for another template using the Search box in the header.

- Select a pricing option and set up an account.

- Make the payment for the subscription using your credit/debit card or Paypal.

- Download the document in the desired file format.

Business Entity Search Ct Form popularity

Connecticut Business Entity Search Other Form Names

FAQ

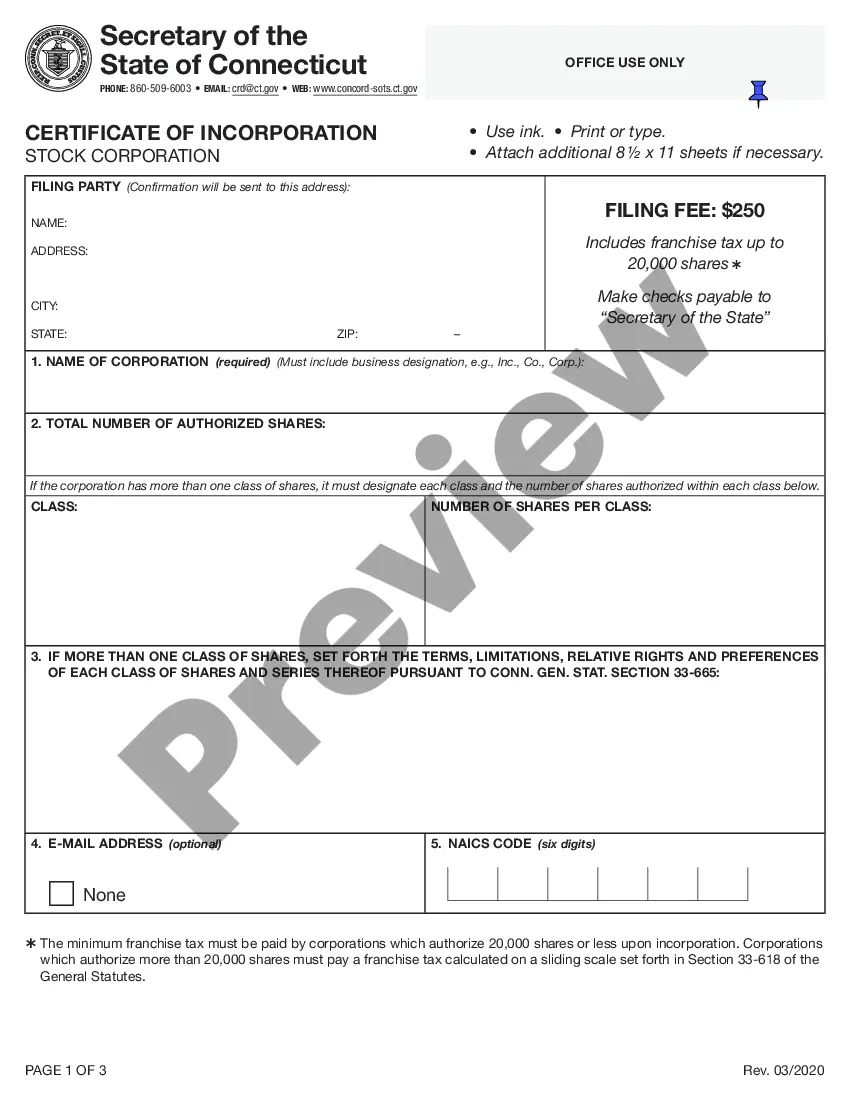

About the Connecticut Corporate Tax Rate At 9 percent, Connecticut currently has the sixth highest corporate income tax rate in the United States. Even if your business makes no money, the state requires a minimum payment of $250 annually when filing the state business tax return.

Step 1- Navigate to this webpage on the Secretary of the State government website and find the field that asks for the name of the company you'd like information on. Step 2- A list of relevant entities will appear displaying the business name, address, filing number and status of each.

CT Secretary of the State Business ID: The Secretary of the State issues a 7-digit "Business ID" number to each domestic and foreign business entity that is registered with the Secretary of the State.

All business entities registered in Connecticut are available to search on Connecticut's Secretary of State's website. Enter the name for which you are searching into the search bar, then click search. A list of entities will appear showing the status, filing number, address, and business name.

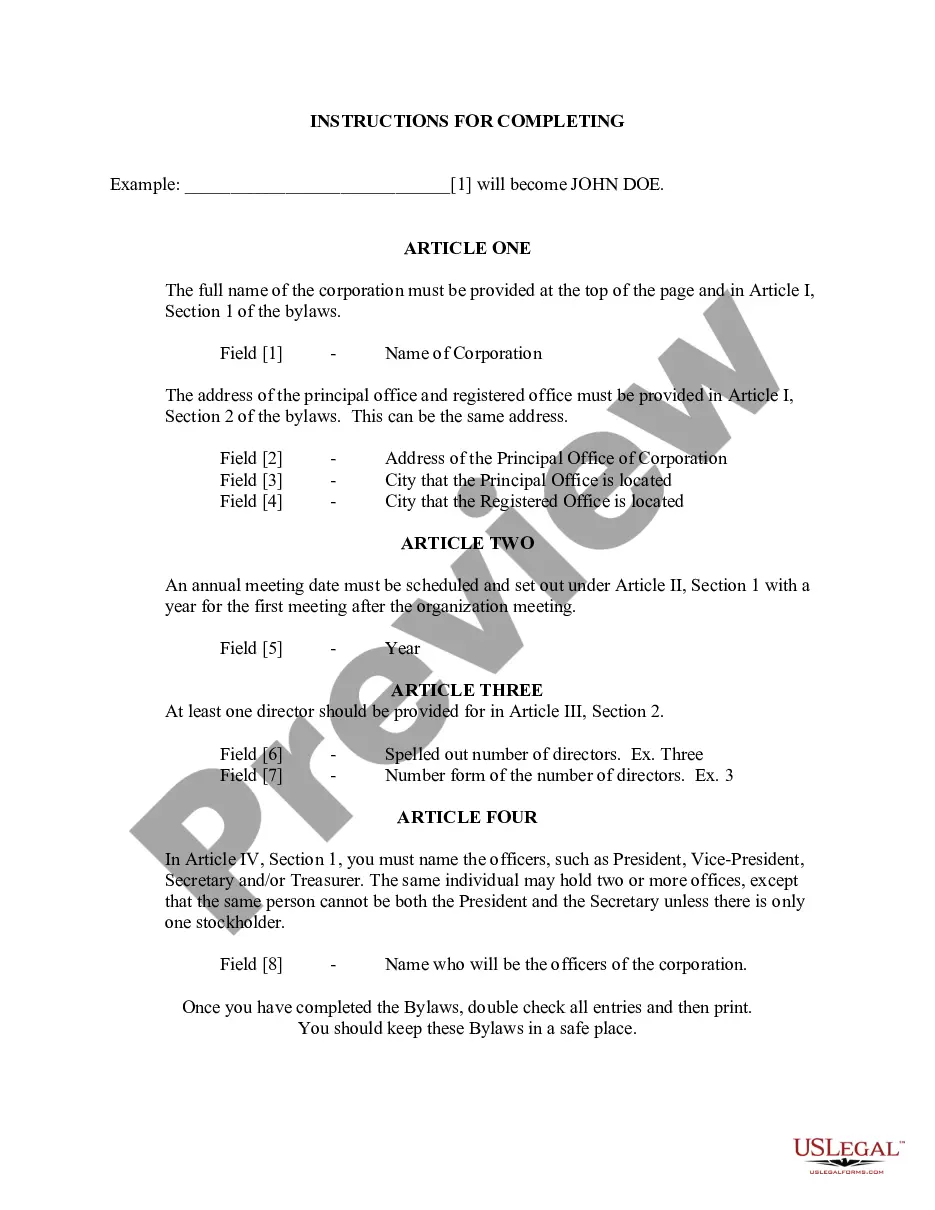

Choose a Corporate Name. File Certificate of Incorporation. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Initial Directors and Hold First Board Meeting. File an Annual Report. Obtain an EIN.

Just go to the business name search tool and enter your proposed business name. You can search the register of the Connecticut Secretary of State, which will tell you if there are any CT corporations or LLCs with that name.

PHONE: 860-509-6002. WEBSITE: www.concord-sots.ct.gov. FAX: 860-509-6057.

Choose a Business Name. Check Availability of Name. Register a DBA Name. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholders' Agreement. Hold Initial Board of Directors Meeting.

Locate your eleven-digit (XXXXXXXX XXX) registration number on any previously filed state tax return (Form CT-941) or correspondence from CT Department of Revenue Services. Call the Department of Revenue Services: 860-297-5962.