Certificate of Incorporation for a Connecticut Professional Corporation.

Connecticut Certificate of Incorporation for Professional Corporation

Description

How to fill out Connecticut Certificate Of Incorporation For Professional Corporation?

The larger quantity of documents you ought to produce - the more anxious you become.

You can discover a vast amount of Connecticut Certificate of Incorporation for Professional Corporation templates online, however, you are uncertain which ones to trust.

Eliminate the stress and make finding samples simpler with US Legal Forms. Obtain professionally crafted documents that are designed to meet state regulations.

Provide the requested information to create your profile and pay for the order with your PayPal or credit card. Choose a convenient file format and download your copy. Locate each template you receive in the My documents section. Just go there to complete a new version of the Connecticut Certificate of Incorporation for Professional Corporation. Even when using well-drafted documents, it’s still crucial to consider consulting a local attorney to verify that your submission is correctly filled out. Achieve more for less with US Legal Forms!

- If you have a US Legal Forms subscription, Log In to your account, and you'll see the Download button on the Connecticut Certificate of Incorporation for Professional Corporation’s page.

- If you’ve never utilized our platform before, complete the sign-up process by following these steps.

- Ensure the Connecticut Certificate of Incorporation for Professional Corporation is valid in your state.

- Verify your choice by reviewing the description or by using the Preview feature if available for the selected document.

- Click Buy Now to initiate the sign-up process and select a pricing plan that meets your needs.

Form popularity

FAQ

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

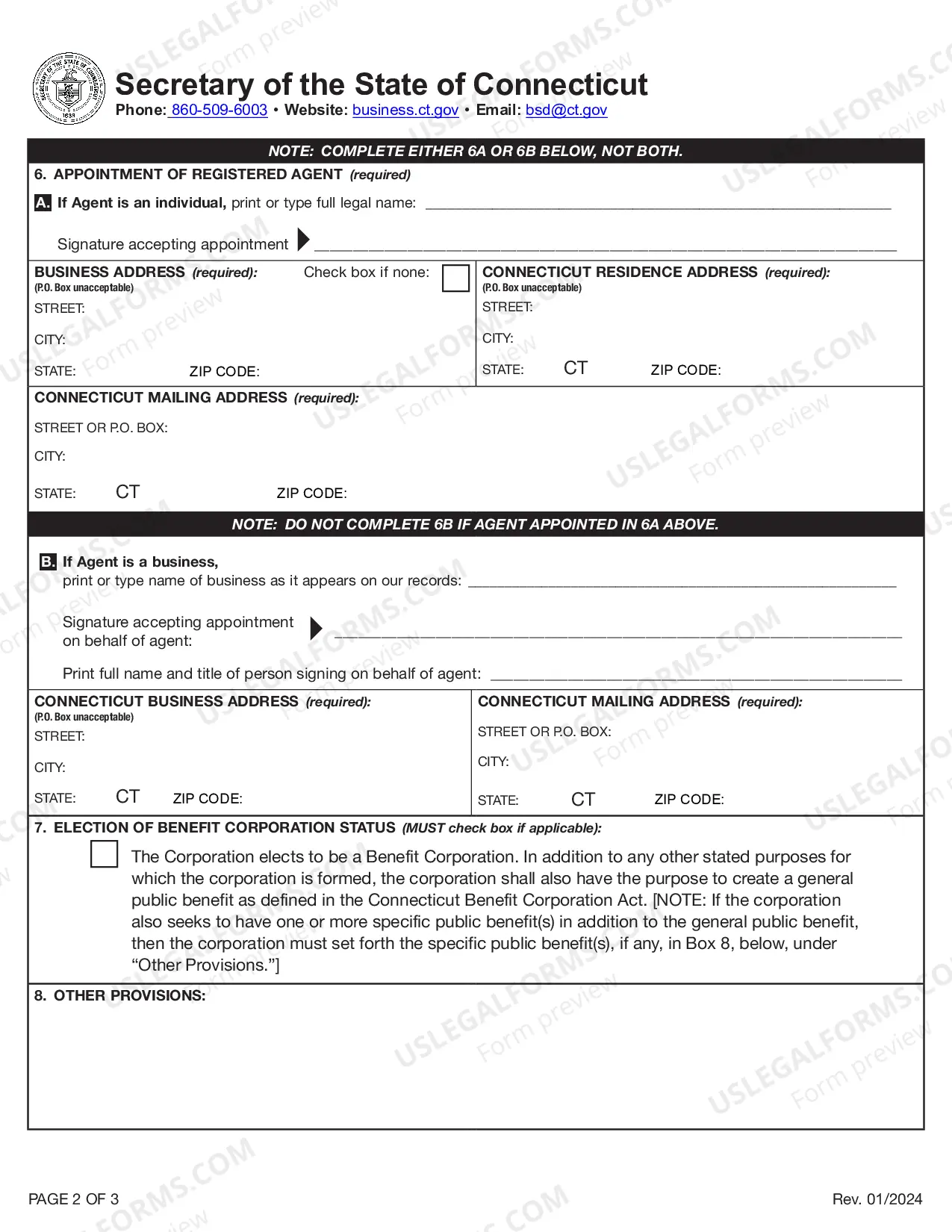

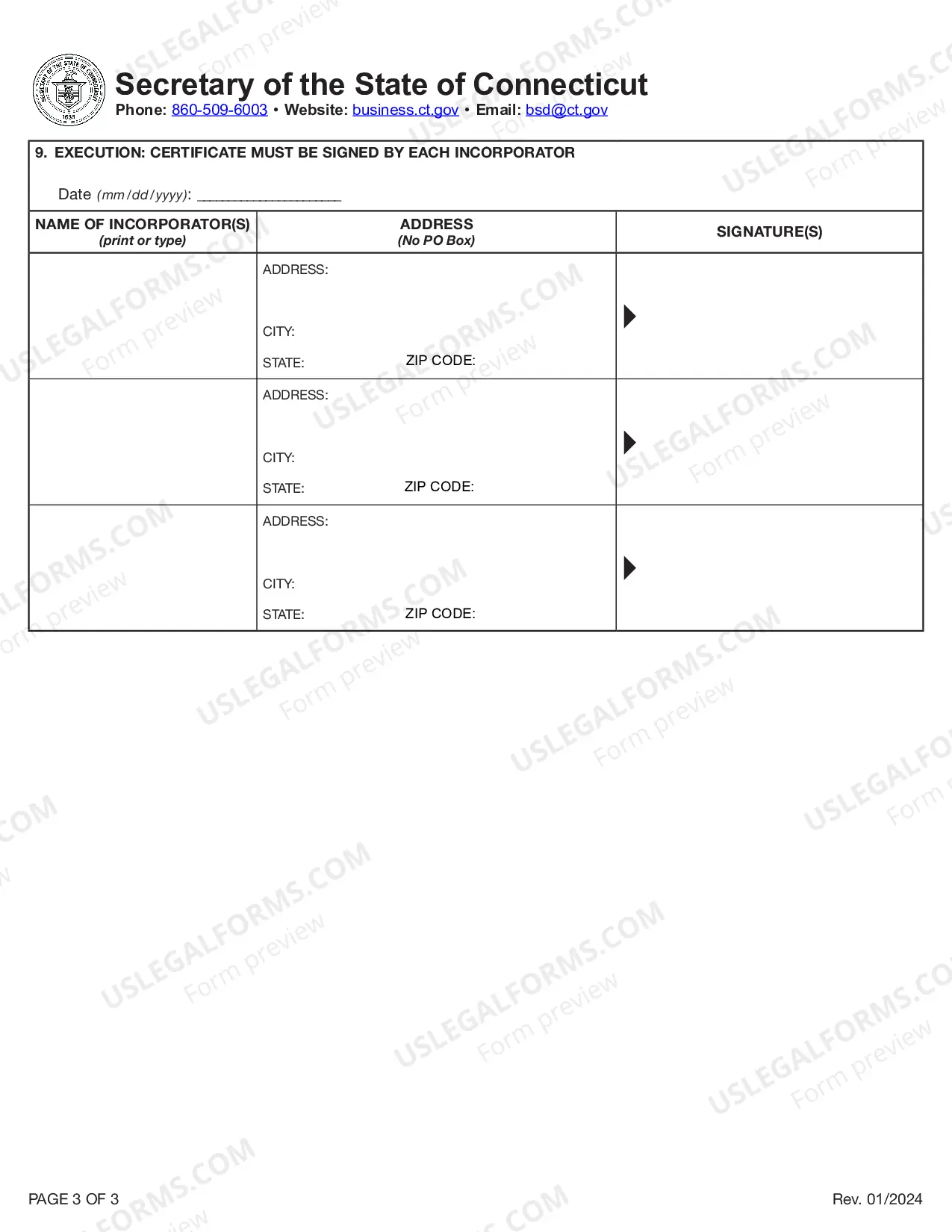

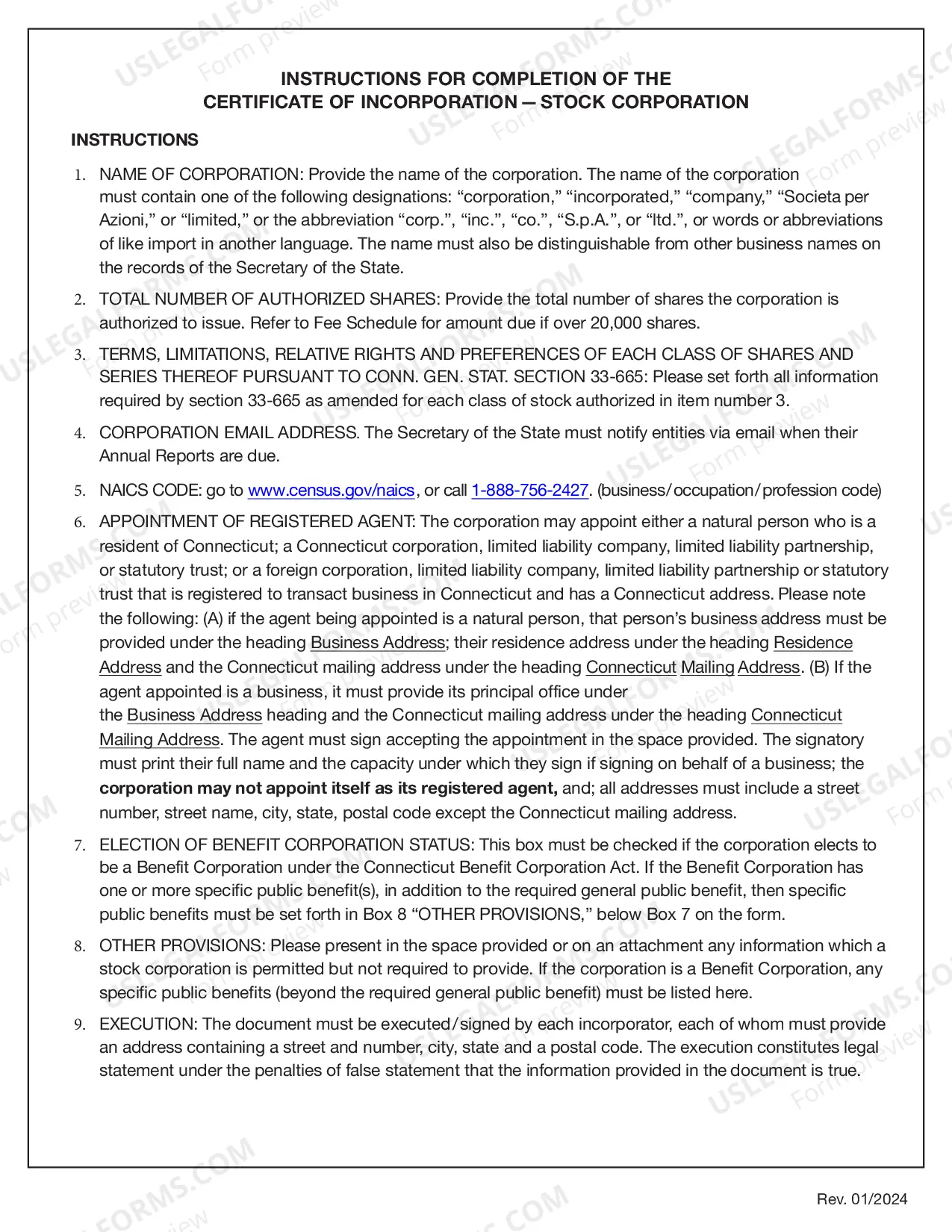

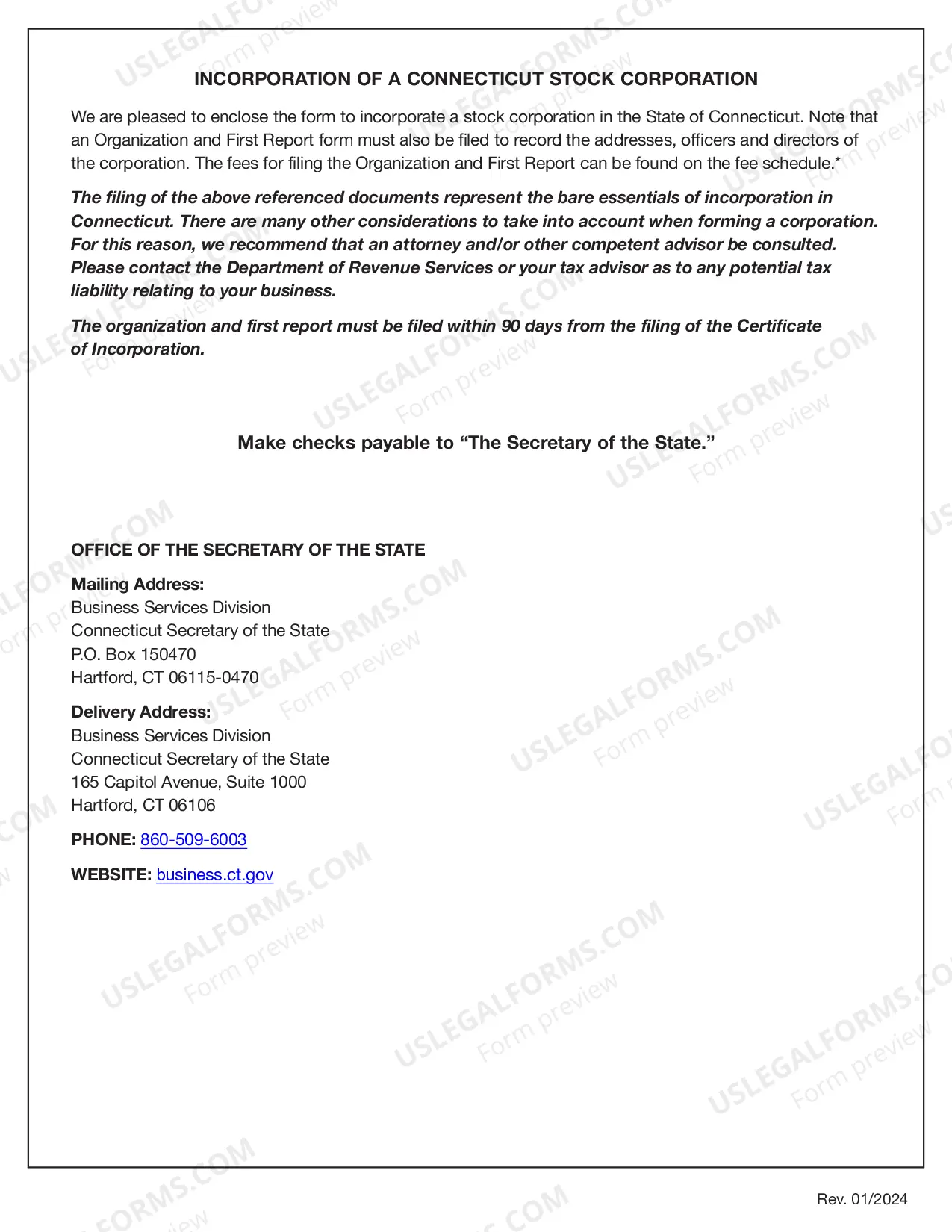

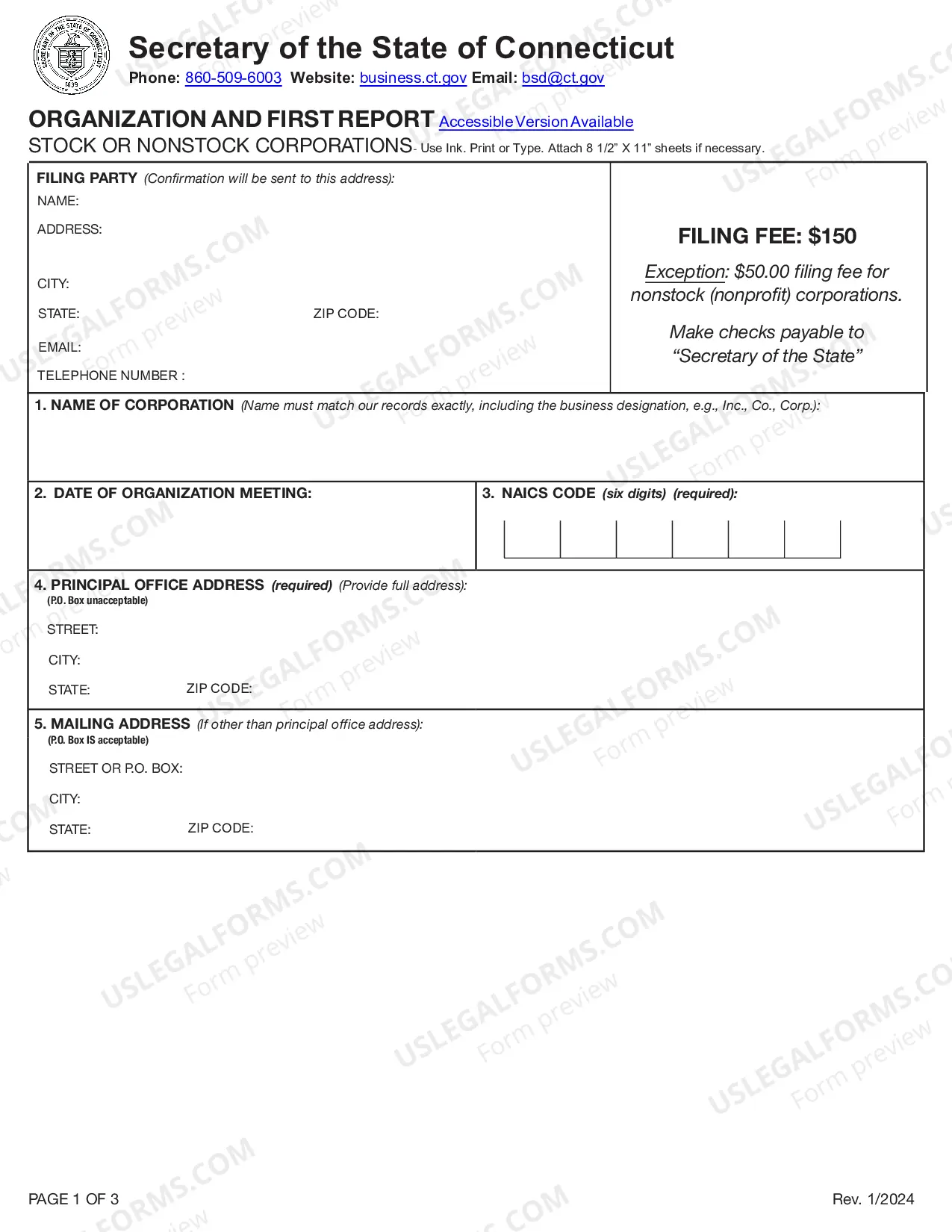

Choose a Corporate Name. File Certificate of Incorporation. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Initial Directors and Hold First Board Meeting. File an Annual Report. Obtain an EIN.

A professional corporation (PC) is a corporation of professionals, organized (incorporated) under the laws of a specific state.A professional corporation must form a corporation within a state. It is not an LLC or a partnership, and it is taxed as a corporation.

"Professionals," Frederick W.Dailey explained in his book Tax Savvy for Small Business, "are treated as small businesses under the tax code. Most of them operate as sole proprietorships or partnerships, and are subject to the same tax rules as other similar businesses.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.

Most professional corporations are classified as "personal service corporations" by the IRS and must file a professional corporation tax return. As of 2018, all professional corporations pay a flat tax rate of 21%.

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

A: A corporation is the business entity itself. Incorporation is the act of starting a corporate business entity.This means they have filed their corporate charter, the founding document, with the state of incorporation.